- Brazil

- /

- Metals and Mining

- /

- BOVESPA:CSNA3

Shareholders Should Be Pleased With Companhia Siderúrgica Nacional's (BVMF:CSNA3) Price

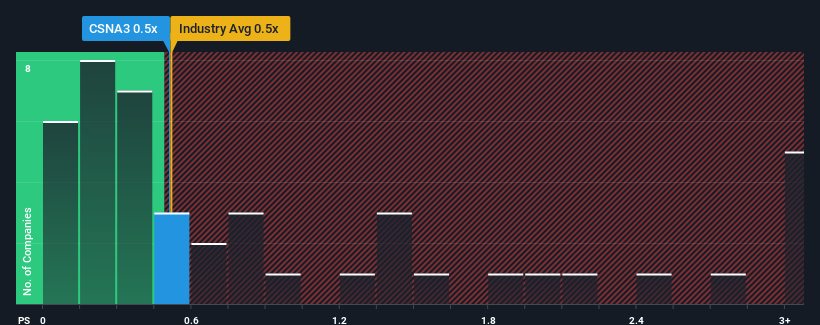

It's not a stretch to say that Companhia Siderúrgica Nacional's (BVMF:CSNA3) price-to-sales (or "P/S") ratio of 0.5x seems quite "middle-of-the-road" for Metals and Mining companies in Brazil, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Companhia Siderúrgica Nacional

What Does Companhia Siderúrgica Nacional's Recent Performance Look Like?

Companhia Siderúrgica Nacional certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. Those who are bullish on Companhia Siderúrgica Nacional will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Companhia Siderúrgica Nacional's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Companhia Siderúrgica Nacional?

The only time you'd be comfortable seeing a P/S like Companhia Siderúrgica Nacional's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 66% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 0.9% per year as estimated by the ten analysts watching the company. Although, this is simply shaping up to be in line with the broader industry, which is also set to decline 0.08% each year.

In light of this, it's understandable that Companhia Siderúrgica Nacional's P/S sits in line with the majority of other companies. Nonetheless, with revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

What We Can Learn From Companhia Siderúrgica Nacional's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our findings align with our suspicions - a closer look at Companhia Siderúrgica Nacional's analyst forecasts shows that the company's similarly unstable outlook compared to the industry is keeping its price-to-sales ratio in line with the industry's average. Right now, shareholders are comfortable with the P/S as they have faith that future revenue will not uncover any unpleasant surprises. However, we're slightly cautious about the company's ability to resist further pain to its business from the broader industry turmoil. For now though, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You always need to take note of risks, for example - Companhia Siderúrgica Nacional has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Companhia Siderúrgica Nacional, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Companhia Siderúrgica Nacional, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CSNA3

Companhia Siderúrgica Nacional

Operates as an integrated steel producer in Brazil and Latin America.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives