- Brazil

- /

- Metals and Mining

- /

- BOVESPA:CSNA3

Companhia Siderúrgica Nacional (BVMF:CSNA3) Is Looking To Continue Growing Its Returns On Capital

If you're looking for a multi-bagger, there's a few things to keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. With that in mind, we've noticed some promising trends at Companhia Siderúrgica Nacional (BVMF:CSNA3) so let's look a bit deeper.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Companhia Siderúrgica Nacional is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.19 = R$10b ÷ (R$70b - R$17b) (Based on the trailing twelve months to March 2021).

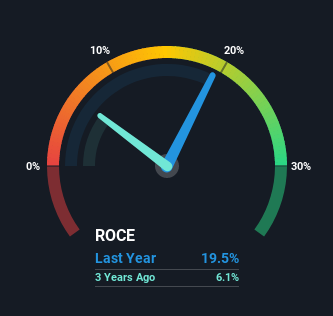

Therefore, Companhia Siderúrgica Nacional has an ROCE of 19%. On its own, that's a standard return, however it's much better than the 15% generated by the Metals and Mining industry.

View our latest analysis for Companhia Siderúrgica Nacional

In the above chart we have measured Companhia Siderúrgica Nacional's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

How Are Returns Trending?

Companhia Siderúrgica Nacional is displaying some positive trends. The data shows that returns on capital have increased substantially over the last five years to 19%. Basically the business is earning more per dollar of capital invested and in addition to that, 32% more capital is being employed now too. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. Essentially the business now has suppliers or short-term creditors funding about 24% of its operations, which isn't ideal. Keep an eye out for future increases because when the ratio of current liabilities to total assets gets particularly high, this can introduce some new risks for the business.

What We Can Learn From Companhia Siderúrgica Nacional's ROCE

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what Companhia Siderúrgica Nacional has. And a remarkable 464% total return over the last five years tells us that investors are expecting more good things to come in the future. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

Companhia Siderúrgica Nacional does come with some risks though, we found 4 warning signs in our investment analysis, and 1 of those can't be ignored...

While Companhia Siderúrgica Nacional may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:CSNA3

Companhia Siderúrgica Nacional

Operates as an integrated steel producer in Brazil and Latin America.

Undervalued with moderate growth potential.