Unpleasant Surprises Could Be In Store For Caixa Seguridade Participações S.A.'s (BVMF:CXSE3) Shares

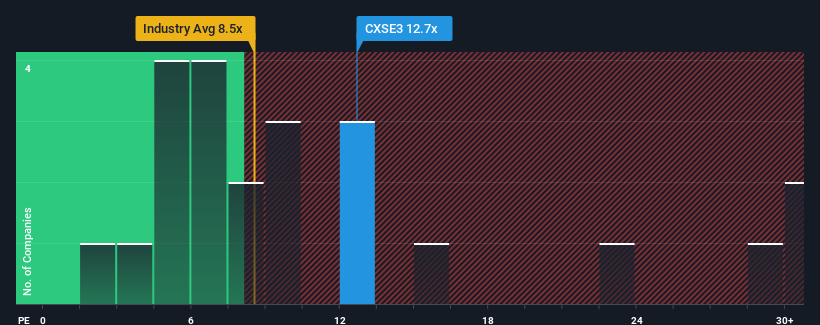

With a price-to-earnings (or "P/E") ratio of 12.7x Caixa Seguridade Participações S.A. (BVMF:CXSE3) may be sending bearish signals at the moment, given that almost half of all companies in Brazil have P/E ratios under 9x and even P/E's lower than 6x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Caixa Seguridade Participações could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Caixa Seguridade Participações

How Is Caixa Seguridade Participações' Growth Trending?

In order to justify its P/E ratio, Caixa Seguridade Participações would need to produce impressive growth in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.2%. Even so, admirably EPS has lifted 87% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 11% each year during the coming three years according to the eleven analysts following the company. Meanwhile, the rest of the market is forecast to expand by 17% per year, which is noticeably more attractive.

With this information, we find it concerning that Caixa Seguridade Participações is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Caixa Seguridade Participações currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 1 warning sign for Caixa Seguridade Participações that we have uncovered.

If these risks are making you reconsider your opinion on Caixa Seguridade Participações, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CXSE3

Caixa Seguridade Participações

Provides various life and non-life insurance products in Brazil.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives