- Brazil

- /

- Personal Products

- /

- BOVESPA:NTCO3

Natura &Co Holding S.A. (BVMF:NTCO3) Might Not Be As Mispriced As It Looks After Plunging 29%

The Natura &Co Holding S.A. (BVMF:NTCO3) share price has fared very poorly over the last month, falling by a substantial 29%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 48% in that time.

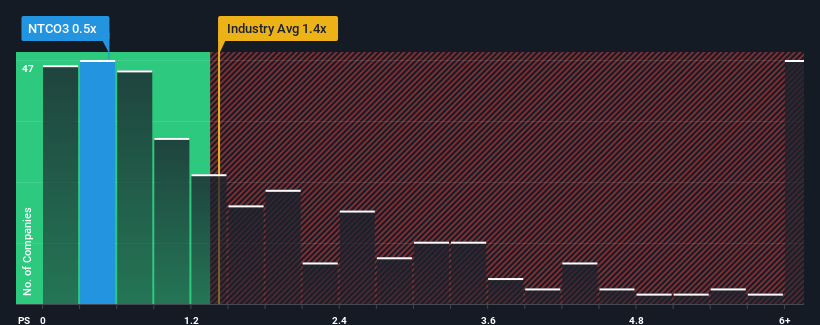

Following the heavy fall in price, Natura &Co Holding's price-to-sales (or "P/S") ratio of 0.5x might make it look like a buy right now compared to the Personal Products industry in Brazil, where around half of the companies have P/S ratios above 1.4x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Natura &Co Holding

How Has Natura &Co Holding Performed Recently?

Natura &Co Holding certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Natura &Co Holding.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Natura &Co Holding would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 21%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 40% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 11% per annum as estimated by the analysts watching the company. With the industry only predicted to deliver 5.6% each year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Natura &Co Holding is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Natura &Co Holding's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at Natura &Co Holding's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Having said that, be aware Natura &Co Holding is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Natura &Co Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Natura &Co Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Natura &Co Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:NTCO3

Natura &Co Holding

Engages in the manufacturing, distribution, and sale of cosmetics, fragrances, and personal care products in Brazil, Asia, Europe, North America, South America, the Middle East, Africa, and Oceania.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives