- Brazil

- /

- Healthcare Services

- /

- BOVESPA:VVEO3

Why Investors Shouldn't Be Surprised By CM Hospitalar S/A's (BVMF:VVEO3) 28% Share Price Plunge

To the annoyance of some shareholders, CM Hospitalar S/A (BVMF:VVEO3) shares are down a considerable 28% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 61% share price decline.

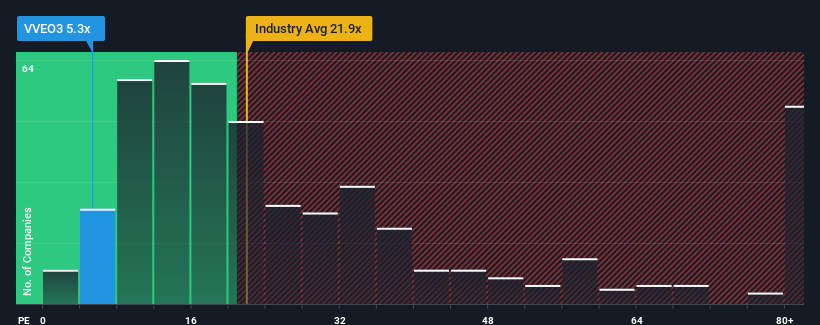

Following the heavy fall in price, given about half the companies in Brazil have price-to-earnings ratios (or "P/E's") above 11x, you may consider CM Hospitalar S/A as an attractive investment with its 5.3x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for CM Hospitalar S/A as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for CM Hospitalar S/A

Is There Any Growth For CM Hospitalar S/A?

The only time you'd be truly comfortable seeing a P/E as low as CM Hospitalar S/A's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 31%. Pleasingly, EPS has also lifted 108% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings growth is heading into negative territory, declining 13% over the next year. With the market predicted to deliver 21% growth , that's a disappointing outcome.

In light of this, it's understandable that CM Hospitalar S/A's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

The softening of CM Hospitalar S/A's shares means its P/E is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of CM Hospitalar S/A's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 5 warning signs for CM Hospitalar S/A (2 are a bit concerning!) that we have uncovered.

You might be able to find a better investment than CM Hospitalar S/A. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:VVEO3

CM Hospitalar S/A

Engages in the distribution of hospital materials, medicines, and nutrition products in Brazil.

Undervalued slight.

Market Insights

Community Narratives