These 4 Measures Indicate That Camil Alimentos (BVMF:CAML3) Is Using Debt Reasonably Well

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Camil Alimentos S.A. (BVMF:CAML3) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Camil Alimentos

What Is Camil Alimentos's Net Debt?

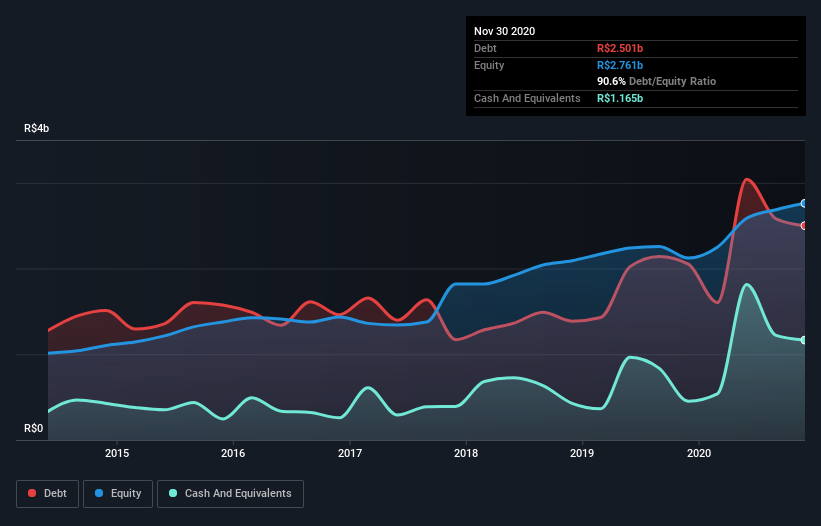

As you can see below, at the end of November 2020, Camil Alimentos had R$2.50b of debt, up from R$2.05b a year ago. Click the image for more detail. On the flip side, it has R$1.17b in cash leading to net debt of about R$1.34b.

A Look At Camil Alimentos' Liabilities

We can see from the most recent balance sheet that Camil Alimentos had liabilities of R$1.74b falling due within a year, and liabilities of R$2.10b due beyond that. Offsetting this, it had R$1.17b in cash and R$1.18b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by R$1.49b.

This deficit isn't so bad because Camil Alimentos is worth R$3.76b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Camil Alimentos's net debt to EBITDA ratio of about 1.8 suggests only moderate use of debt. And its strong interest cover of 10.6 times, makes us even more comfortable. Notably, Camil Alimentos's EBIT launched higher than Elon Musk, gaining a whopping 120% on last year. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Camil Alimentos can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent three years, Camil Alimentos recorded free cash flow of 34% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Camil Alimentos's EBIT growth rate suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. All these things considered, it appears that Camil Alimentos can comfortably handle its current debt levels. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Camil Alimentos is showing 3 warning signs in our investment analysis , and 1 of those is potentially serious...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Camil Alimentos or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:CAML3

Camil Alimentos

Engages in processing, production, packaging, and marketing of food products.

Undervalued with slight risk.

Market Insights

Community Narratives