Is It Smart To Buy Camil Alimentos S.A. (BVMF:CAML3) Before It Goes Ex-Dividend?

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Camil Alimentos S.A. (BVMF:CAML3) is about to go ex-dividend in just four days. Investors can purchase shares before the 23rd of March in order to be eligible for this dividend, which will be paid on the 31st of March.

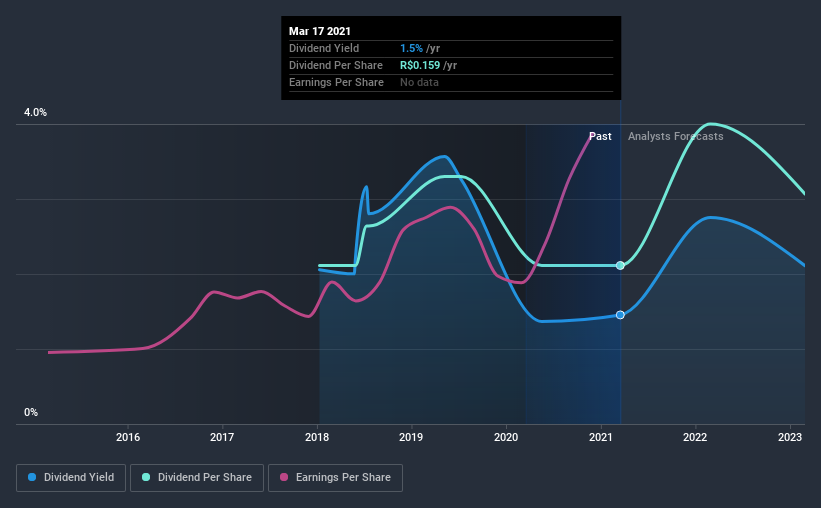

Camil Alimentos's next dividend payment will be R$0.055 per share, on the back of last year when the company paid a total of R$0.16 to shareholders. Last year's total dividend payments show that Camil Alimentos has a trailing yield of 1.5% on the current share price of R$10.9. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Camil Alimentos

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Camil Alimentos paid out a comfortable 42% of its profit last year.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. It's encouraging to see Camil Alimentos has grown its earnings rapidly, up 32% a year for the past five years. Earnings per share have been growing very quickly, and the company is paying out a relatively low percentage of its profit and cash flow. This is a very favourable combination that can often lead to the dividend multiplying over the long term, if earnings grow and the company pays out a higher percentage of its earnings.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. It looks like the Camil Alimentos dividends are largely the same as they were three years ago.

The Bottom Line

Is Camil Alimentos worth buying for its dividend? When companies are growing rapidly and retaining a majority of the profits within the business, it's usually a sign that reinvesting earnings creates more value than paying dividends to shareholders. This strategy can add significant value to shareholders over the long term - as long as it's done without issuing too many new shares. Camil Alimentos ticks a lot of boxes for us from a dividend perspective, and we think these characteristics should mark the company as deserving of further attention.

In light of that, while Camil Alimentos has an appealing dividend, it's worth knowing the risks involved with this stock. Our analysis shows 3 warning signs for Camil Alimentos that we strongly recommend you have a look at before investing in the company.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Camil Alimentos, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:CAML3

Camil Alimentos

Engages in processing, production, packaging, and marketing of food products.

Slight risk and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion