- Brazil

- /

- Oil and Gas

- /

- BOVESPA:BRAV3

Time To Worry? Analysts Just Downgraded Their 3R Petroleum Óleo e Gás S.A. (BVMF:RRRP3) Outlook

Today is shaping up negative for 3R Petroleum Óleo e Gás S.A. (BVMF:RRRP3) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting analysts have soured majorly on the business.

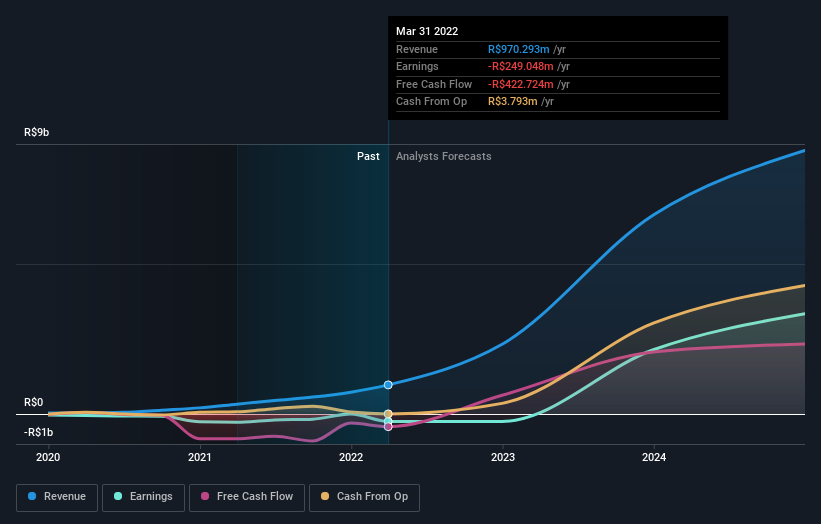

After this downgrade, 3R Petroleum Óleo e Gás' three analysts are now forecasting revenues of R$2.3b in 2022. This would be a major 139% improvement in sales compared to the last 12 months. Losses are forecast to hold steady at around R$1.23. Before this latest update, the analysts had been forecasting revenues of R$2.7b and earnings per share (EPS) of R$6.40 in 2022. There looks to have been a major change in sentiment regarding 3R Petroleum Óleo e Gás' prospects, with a substantial drop in revenues and the analysts now forecasting a loss instead of a profit.

View our latest analysis for 3R Petroleum Óleo e Gás

There was no major change to the consensus price target of R$82.88, signalling that the business is performing roughly in line with expectations, despite lower earnings per share forecasts. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic 3R Petroleum Óleo e Gás analyst has a price target of R$111 per share, while the most pessimistic values it at R$61.00. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of 3R Petroleum Óleo e Gás'historical trends, as the 220% annualised revenue growth to the end of 2022 is roughly in line with the 195% annual revenue growth over the past year. Compare this with the broader industry (in aggregate), which analyst estimates suggest will see revenues fall 1.2% per year. So it's clear that not only is revenue growth expected to be maintained, but 3R Petroleum Óleo e Gás is expected to grow meaningfully faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts are expecting 3R Petroleum Óleo e Gás to become unprofitable this year. Unfortunately, they also downgraded their revenue estimates, and our data indicates sales are expected to outperform the wider market. Even so, earnings per share are more important to the intrinsic value of the business. We're also surprised to see that the price target went unchanged. Still, deteriorating business conditions (assuming accurate forecasts!) can be a leading indicator for the stock price, so we wouldn't blame investors for being more cautious on 3R Petroleum Óleo e Gás after the downgrade.

There might be good reason for analyst bearishness towards 3R Petroleum Óleo e Gás, like major dilution from new stock issuance in the past year. Learn more, and discover the 1 other risk we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Brava Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:BRAV3

Brava Energia

Engages in the exploration and production of oil and natural gas in Brazil.

Good value with moderate growth potential.

Market Insights

Community Narratives