Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Lupatech S.A. (BVMF:LUPA3) does carry debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Lupatech

What Is Lupatech's Net Debt?

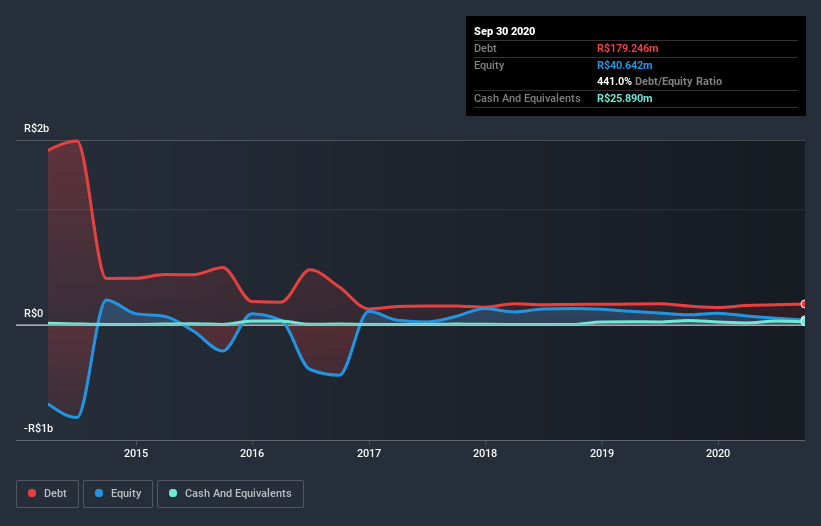

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Lupatech had R$179.2m of debt, an increase on R$161.0m, over one year. On the flip side, it has R$25.9m in cash leading to net debt of about R$153.4m.

How Strong Is Lupatech's Balance Sheet?

We can see from the most recent balance sheet that Lupatech had liabilities of R$80.3m falling due within a year, and liabilities of R$382.3m due beyond that. Offsetting this, it had R$25.9m in cash and R$45.5m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by R$391.2m.

This deficit casts a shadow over the R$55.0m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Lupatech would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Lupatech's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Lupatech wasn't profitable at an EBIT level, but managed to grow its revenue by 36%, to R$45m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though Lupatech managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Indeed, it lost a very considerable R$30m at the EBIT level. When you combine this with the very significant balance sheet liabilities mentioned above, we are so wary of it that we are basically at a loss for the right words. Sure, the company might have a nice story about how they are going on to a brighter future. But the reality is that it is low on liquid assets relative to liabilities, and it lost R$130m in the last year. So we're not very excited about owning this stock. Its too risky for us. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Lupatech has 2 warning signs (and 1 which is potentially serious) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Lupatech, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:LUPA3

Slightly overvalued with worrying balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion