- Brazil

- /

- Energy Services

- /

- BOVESPA:LUPA3

Beyond Lackluster Earnings: Potential Concerns For Lupatech's (BVMF:LUPA3) Shareholders

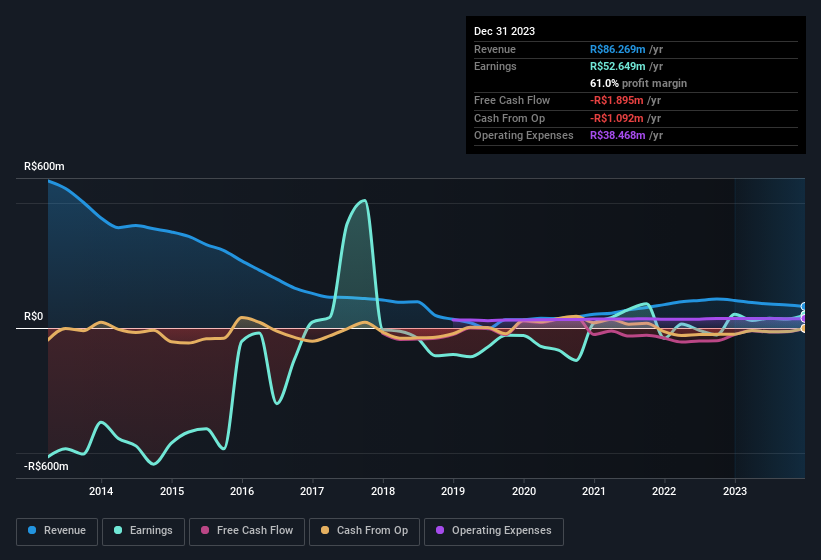

Lupatech S.A.'s (BVMF:LUPA3) stock wasn't much affected by its recent lackluster earnings numbers. We did some digging, and we believe that investors are missing some worrying factors underlying the profit figures.

Check out our latest analysis for Lupatech

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Lupatech increased the number of shares on issue by 32% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Lupatech's EPS by clicking here.

A Look At The Impact Of Lupatech's Dilution On Its Earnings Per Share (EPS)

We don't have any data on the company's profits from three years ago. And even focusing only on the last twelve months, we see profit is down 4.0%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 29% in the same period. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

In the long term, if Lupatech's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Lupatech.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that Lupatech's profit was boosted by unusual items worth R$32m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. Lupatech had a rather significant contribution from unusual items relative to its profit to December 2023. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Lupatech's Profit Performance

To sum it all up, Lupatech got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. For the reasons mentioned above, we think that a perfunctory glance at Lupatech's statutory profits might make it look better than it really is on an underlying level. If you'd like to know more about Lupatech as a business, it's important to be aware of any risks it's facing. For example, we've found that Lupatech has 5 warning signs (1 doesn't sit too well with us!) that deserve your attention before going any further with your analysis.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:LUPA3

Overvalued with worrying balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026