- Brazil

- /

- Consumer Services

- /

- BOVESPA:YDUQ3

Yduqs Participações S.A.'s (BVMF:YDUQ3) Popularity With Investors Is Clear

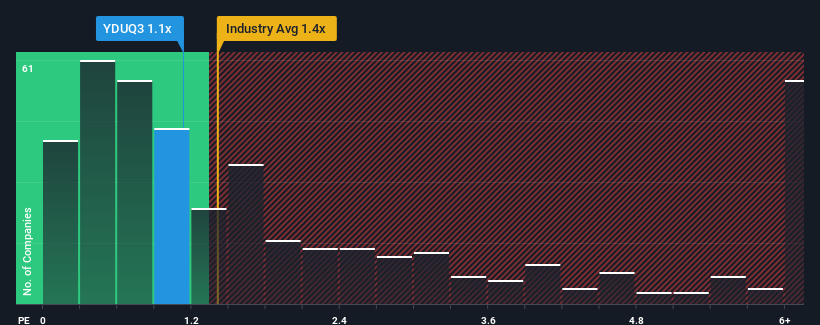

It's not a stretch to say that Yduqs Participações S.A.'s (BVMF:YDUQ3) price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" for companies in the Consumer Services industry in Brazil, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Yduqs Participações

How Yduqs Participações Has Been Performing

Yduqs Participações' revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Yduqs Participações.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Yduqs Participações would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. This was backed up an excellent period prior to see revenue up by 34% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 9.9% during the coming year according to the eight analysts following the company. With the industry predicted to deliver 11% growth , the company is positioned for a comparable revenue result.

With this information, we can see why Yduqs Participações is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Yduqs Participações' P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Yduqs Participações maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Yduqs Participações (1 makes us a bit uncomfortable!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:YDUQ3

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026