- Brazil

- /

- Hospitality

- /

- BOVESPA:SMFT3

Smartfit Escola de Ginástica e Dança S.A.'s (BVMF:SMFT3) Popularity With Investors Is Clear

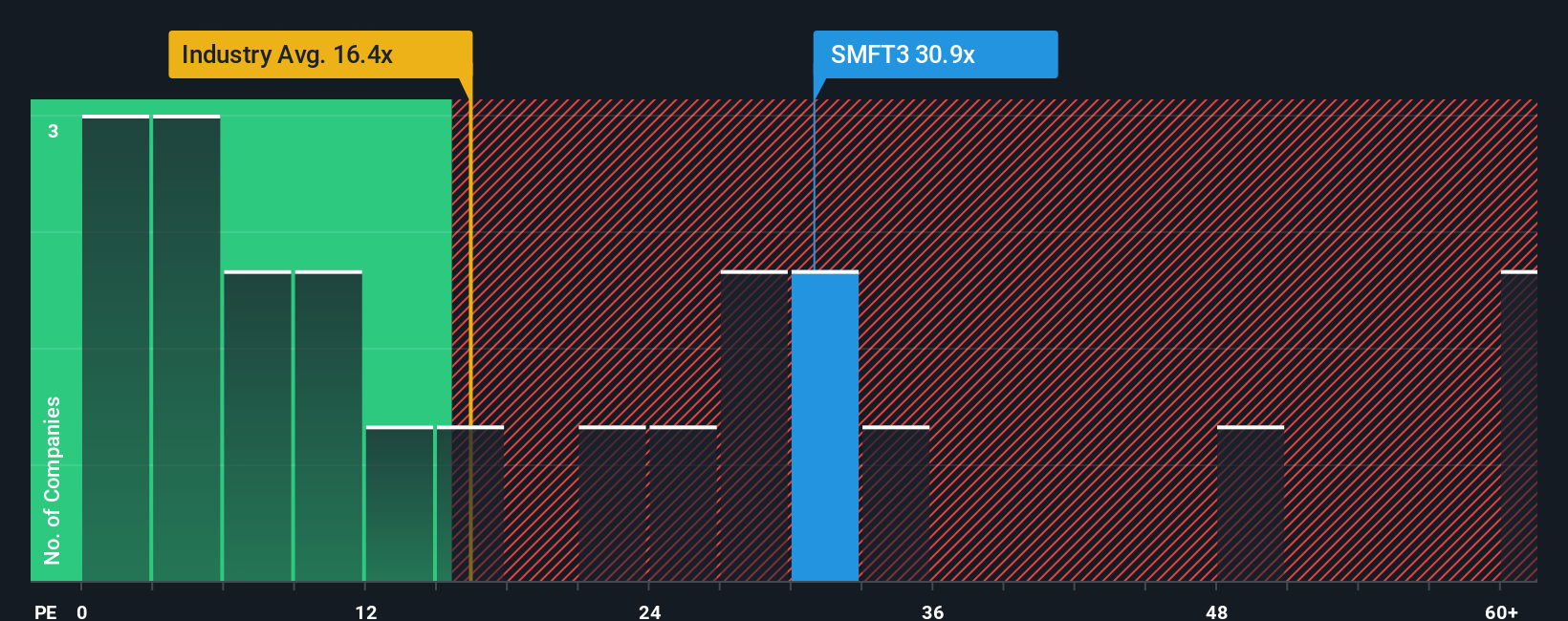

With a price-to-earnings (or "P/E") ratio of 30.9x Smartfit Escola de Ginástica e Dança S.A. (BVMF:SMFT3) may be sending very bearish signals at the moment, given that almost half of all companies in Brazil have P/E ratios under 9x and even P/E's lower than 6x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Smartfit Escola de Ginástica e Dança could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Smartfit Escola de Ginástica e Dança

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Smartfit Escola de Ginástica e Dança's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 56%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 43% per year as estimated by the twelve analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 13% per year, which is noticeably less attractive.

In light of this, it's understandable that Smartfit Escola de Ginástica e Dança's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Smartfit Escola de Ginástica e Dança's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Smartfit Escola de Ginástica e Dança maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Smartfit Escola de Ginástica e Dança is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

Of course, you might also be able to find a better stock than Smartfit Escola de Ginástica e Dança. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:SMFT3

Smartfit Escola de Ginástica e Dança

Smartfit Escola de Ginástica e Dança S.A.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026