- Brazil

- /

- Hospitality

- /

- BOVESPA:MEAL3

Is International Meal Company Alimentação (BVMF:MEAL3) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that International Meal Company Alimentação S.A. (BVMF:MEAL3) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for International Meal Company Alimentação

What Is International Meal Company Alimentação's Net Debt?

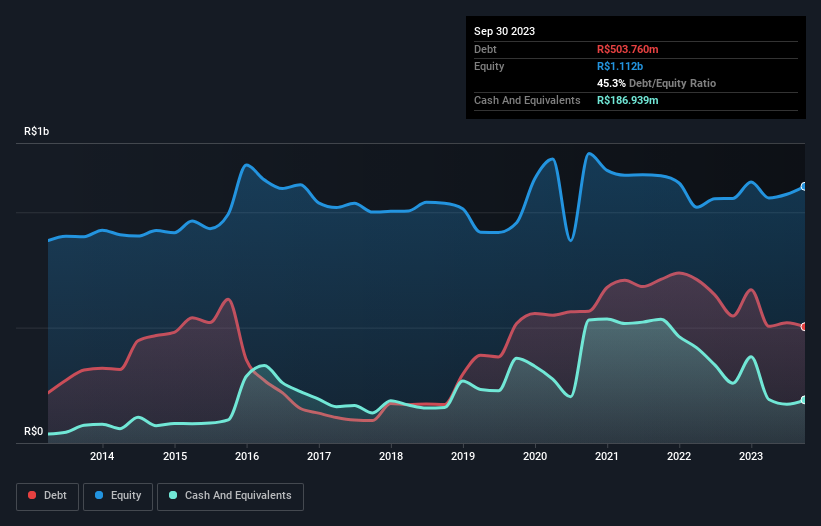

As you can see below, International Meal Company Alimentação had R$503.8m of debt at September 2023, down from R$550.4m a year prior. However, it also had R$186.9m in cash, and so its net debt is R$316.8m.

How Healthy Is International Meal Company Alimentação's Balance Sheet?

We can see from the most recent balance sheet that International Meal Company Alimentação had liabilities of R$570.5m falling due within a year, and liabilities of R$1.07b due beyond that. On the other hand, it had cash of R$186.9m and R$166.9m worth of receivables due within a year. So its liabilities total R$1.29b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the R$525.2m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, International Meal Company Alimentação would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Even though International Meal Company Alimentação's debt is only 1.9, its interest cover is really very low at 0.66. The main reason for this is that it has such high depreciation and amortisation. These charges may be non-cash, so they could be excluded when it comes to paying down debt. But the accounting charges are there for a reason -- some assets are seen to be losing value. Either way there's no doubt the stock is using meaningful leverage. Notably, International Meal Company Alimentação's EBIT launched higher than Elon Musk, gaining a whopping 538% on last year. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if International Meal Company Alimentação can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last two years, International Meal Company Alimentação burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, International Meal Company Alimentação's conversion of EBIT to free cash flow left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Overall, it seems to us that International Meal Company Alimentação's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for International Meal Company Alimentação that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MEAL3

International Meal Company Alimentação

Operates restaurants, bars, and cafes that offers food and beverages in Brazil, Colombia, and the United States.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives