- Brazil

- /

- Hospitality

- /

- BOVESPA:MEAL3

International Meal Company Alimentação S.A.'s (BVMF:MEAL3) Shares Climb 30% But Its Business Is Yet to Catch Up

Those holding International Meal Company Alimentação S.A. (BVMF:MEAL3) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

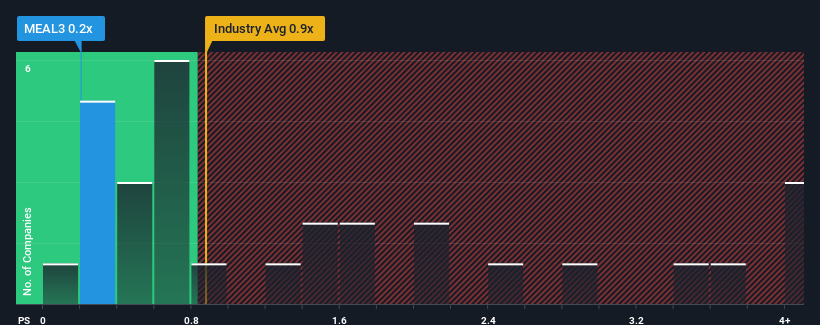

Even after such a large jump in price, it's still not a stretch to say that International Meal Company Alimentação's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Hospitality industry in Brazil, where the median P/S ratio is around 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for International Meal Company Alimentação

What Does International Meal Company Alimentação's P/S Mean For Shareholders?

Recent times haven't been great for International Meal Company Alimentação as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on International Meal Company Alimentação will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For International Meal Company Alimentação?

There's an inherent assumption that a company should be matching the industry for P/S ratios like International Meal Company Alimentação's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 5.0%. This was backed up an excellent period prior to see revenue up by 102% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 12% each year over the next three years. That's shaping up to be materially lower than the 16% per annum growth forecast for the broader industry.

With this in mind, we find it intriguing that International Meal Company Alimentação's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From International Meal Company Alimentação's P/S?

International Meal Company Alimentação's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that International Meal Company Alimentação's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It is also worth noting that we have found 1 warning sign for International Meal Company Alimentação that you need to take into consideration.

If you're unsure about the strength of International Meal Company Alimentação's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade International Meal Company Alimentação, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:MEAL3

International Meal Company Alimentação

Operates restaurants, bars, and cafes that offers food and beverages in Brazil, Colombia, and the United States.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives