- Brazil

- /

- Hospitality

- /

- BOVESPA:CVCB3

CVC Brasil Operadora e Agência de Viagens S.A.'s (BVMF:CVCB3) 33% Share Price Plunge Could Signal Some Risk

CVC Brasil Operadora e Agência de Viagens S.A. (BVMF:CVCB3) shares have had a horrible month, losing 33% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

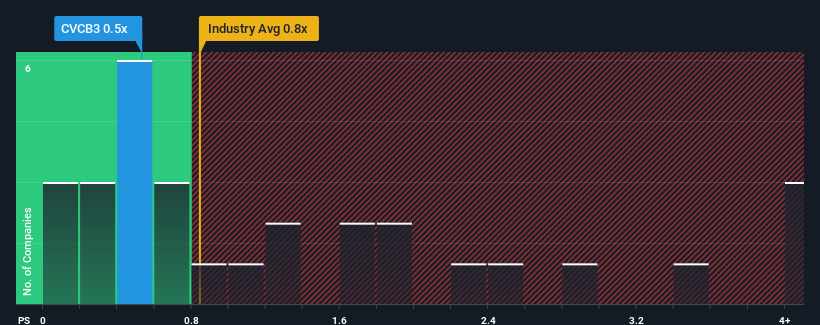

In spite of the heavy fall in price, it's still not a stretch to say that CVC Brasil Operadora e Agência de Viagens' price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Hospitality industry in Brazil, where the median P/S ratio is around 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for CVC Brasil Operadora e Agência de Viagens

How Has CVC Brasil Operadora e Agência de Viagens Performed Recently?

Recent times have been advantageous for CVC Brasil Operadora e Agência de Viagens as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on CVC Brasil Operadora e Agência de Viagens will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

CVC Brasil Operadora e Agência de Viagens' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 128% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 2.7% each year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 15% each year, which is noticeably more attractive.

In light of this, it's curious that CVC Brasil Operadora e Agência de Viagens' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

With its share price dropping off a cliff, the P/S for CVC Brasil Operadora e Agência de Viagens looks to be in line with the rest of the Hospitality industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that CVC Brasil Operadora e Agência de Viagens' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about this 1 warning sign we've spotted with CVC Brasil Operadora e Agência de Viagens.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CVCB3

CVC Brasil Operadora e Agência de Viagens

Provides tourism services in Brazil and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives