- Brazil

- /

- Consumer Services

- /

- BOVESPA:COGN3

Does Cogna Educação (BVMF:COGN3) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Cogna Educação S.A. (BVMF:COGN3) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Cogna Educação

What Is Cogna Educação's Debt?

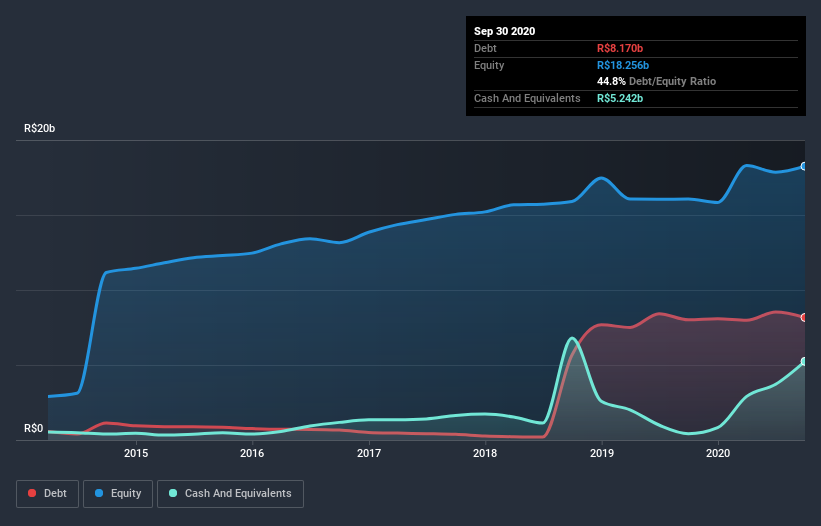

The chart below, which you can click on for greater detail, shows that Cogna Educação had R$8.17b in debt in September 2020; about the same as the year before. On the flip side, it has R$5.24b in cash leading to net debt of about R$2.93b.

How Strong Is Cogna Educação's Balance Sheet?

The latest balance sheet data shows that Cogna Educação had liabilities of R$4.32b due within a year, and liabilities of R$13.5b falling due after that. Offsetting these obligations, it had cash of R$5.24b as well as receivables valued at R$2.63b due within 12 months. So its liabilities total R$9.95b more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's R$8.90b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Cogna Educação can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Cogna Educação made a loss at the EBIT level, and saw its revenue drop to R$6.2b, which is a fall of 12%. That's not what we would hope to see.

Caveat Emptor

Not only did Cogna Educação's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). To be specific the EBIT loss came in at R$58m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. For example, we would not want to see a repeat of last year's loss of R$2.0b. And until that time we think this is a risky stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Cogna Educação (at least 1 which is significant) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Cogna Educação, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:COGN3

Cogna Educação

Operates as a private educational organization in Brazil and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives