- Brazil

- /

- Hospitality

- /

- BOVESPA:ZAMP3

BK Brasil Operação e Assessoria a Restaurantes' (BVMF:BKBR3) Shareholders Are Down 39% On Their Shares

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term BK Brasil Operação e Assessoria a Restaurantes S.A. (BVMF:BKBR3) shareholders have had that experience, with the share price dropping 39% in three years, versus a market return of about 63%. And more recent buyers are having a tough time too, with a drop of 38% in the last year.

See our latest analysis for BK Brasil Operação e Assessoria a Restaurantes

BK Brasil Operação e Assessoria a Restaurantes wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, BK Brasil Operação e Assessoria a Restaurantes grew revenue at 14% per year. That's a pretty good rate of top-line growth. Shareholders have seen the share price fall at 12% per year, for three years. So the market has definitely lost some love for the stock. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

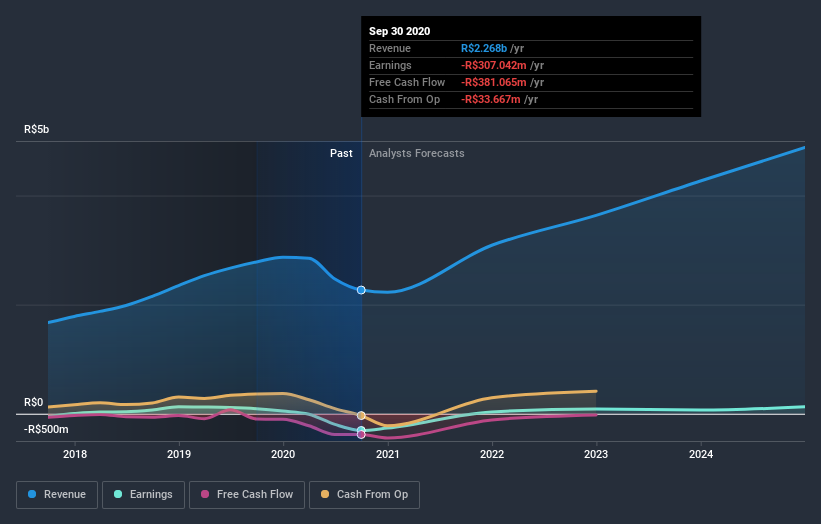

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

The last twelve months weren't great for BK Brasil Operação e Assessoria a Restaurantes shares, which cost holders 38%, while the market was up about 4.7%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 11% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for BK Brasil Operação e Assessoria a Restaurantes that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you’re looking to trade BK Brasil Operação e Assessoria a Restaurantes, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zamp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:ZAMP3

Zamp

Engages in the developing, operating, and franchising restaurants under the Burger King and Popeyes brand names in Brazil.

Reasonable growth potential and fair value.

Market Insights

Community Narratives