Here's Why We Think Vulcabras (BVMF:VULC3) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Vulcabras (BVMF:VULC3). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Vulcabras with the means to add long-term value to shareholders.

See our latest analysis for Vulcabras

Vulcabras' Improving Profits

In the last three years Vulcabras' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Vulcabras' EPS skyrocketed from R$1.37 to R$2.29, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 67%.

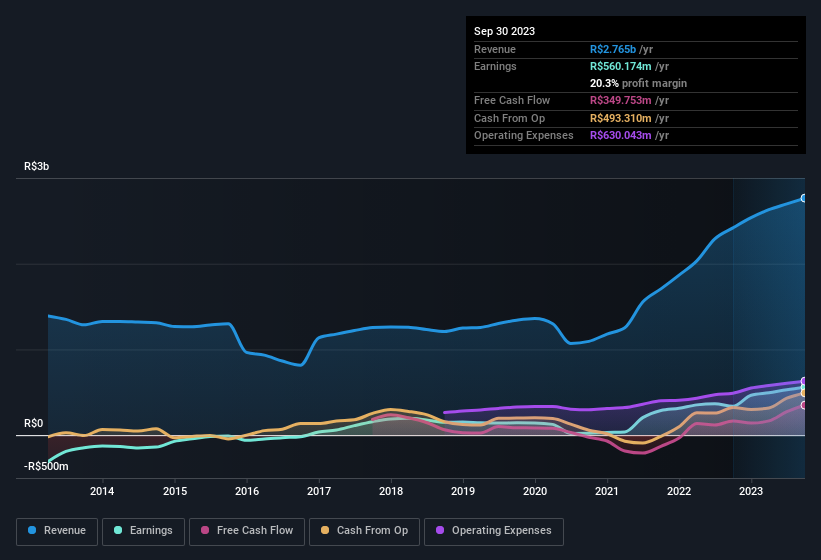

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Vulcabras shareholders is that EBIT margins have grown from 16% to 20% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Vulcabras.

Are Vulcabras Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Vulcabras shares worth a considerable sum. We note that their impressive stake in the company is worth R$658m. Coming in at 14% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

Does Vulcabras Deserve A Spot On Your Watchlist?

For growth investors, Vulcabras' raw rate of earnings growth is a beacon in the night. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Vulcabras , and understanding this should be part of your investment process.

Although Vulcabras certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Brazilian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:VULC3

Vulcabras

Through its subsidiaries, operates as a footwear company in Brazil and internationally.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026