- Brazil

- /

- Consumer Durables

- /

- BOVESPA:TEND3

Even With A 36% Surge, Cautious Investors Are Not Rewarding Construtora Tenda S.A.'s (BVMF:TEND3) Performance Completely

The Construtora Tenda S.A. (BVMF:TEND3) share price has done very well over the last month, posting an excellent gain of 36%. The last 30 days bring the annual gain to a very sharp 59%.

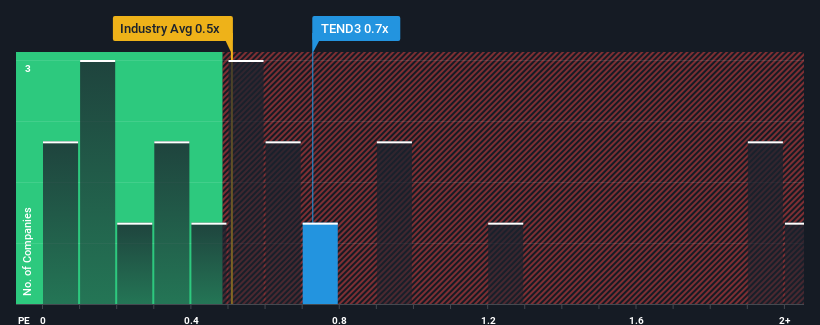

Even after such a large jump in price, it's still not a stretch to say that Construtora Tenda's price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Consumer Durables industry in Brazil, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We've discovered 1 warning sign about Construtora Tenda. View them for free.See our latest analysis for Construtora Tenda

What Does Construtora Tenda's Recent Performance Look Like?

Recent times haven't been great for Construtora Tenda as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Construtora Tenda will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Construtora Tenda?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Construtora Tenda's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. The solid recent performance means it was also able to grow revenue by 29% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 26% per year during the coming three years according to the nine analysts following the company. With the industry only predicted to deliver 15% per year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Construtora Tenda's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Construtora Tenda appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Construtora Tenda's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Plus, you should also learn about this 1 warning sign we've spotted with Construtora Tenda.

If you're unsure about the strength of Construtora Tenda's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:TEND3

Exceptional growth potential with outstanding track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026