- Brazil

- /

- Consumer Durables

- /

- BOVESPA:RDNI3

Is RNI Negócios Imobiliários' (BVMF:RDNI3) Share Price Gain Of 139% Well Earned?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. Long term RNI Negócios Imobiliários S.A. (BVMF:RDNI3) shareholders would be well aware of this, since the stock is up 139% in five years. In the last week the share price is up 4.6%.

Check out our latest analysis for RNI Negócios Imobiliários

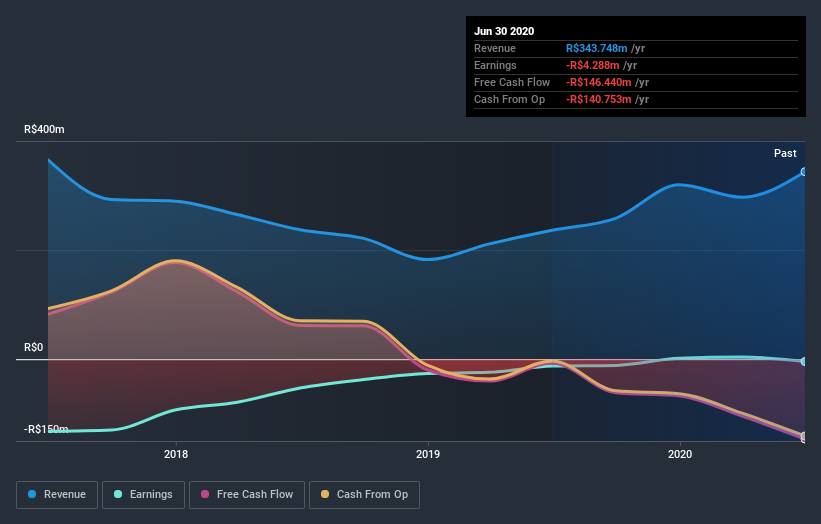

Because RNI Negócios Imobiliários made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last half decade RNI Negócios Imobiliários' revenue has actually been trending down at about 19% per year. Given that scenario, we wouldn't have expected the share price to rise 19% per year, but that's what it did. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, this situation makes us a little wary of the stock.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling RNI Negócios Imobiliários stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between RNI Negócios Imobiliários' total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that RNI Negócios Imobiliários' TSR of 150% over the last 5 years is better than the share price return.

A Different Perspective

Investors in RNI Negócios Imobiliários had a tough year, with a total loss of 19%, against a market gain of about 3.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 20%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that RNI Negócios Imobiliários is showing 3 warning signs in our investment analysis , and 2 of those don't sit too well with us...

Of course RNI Negócios Imobiliários may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you decide to trade RNI Negócios Imobiliários, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BOVESPA:RDNI3

Slight and slightly overvalued.

Market Insights

Community Narratives