- Brazil

- /

- Consumer Durables

- /

- BOVESPA:DIRR3

Direcional Engenharia S.A. (BVMF:DIRR3) Stock Goes Ex-Dividend In Just Three Days

Direcional Engenharia S.A. (BVMF:DIRR3) is about to trade ex-dividend in the next three days. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Meaning, you will need to purchase Direcional Engenharia's shares before the 17th of December to receive the dividend, which will be paid on the 23rd of December.

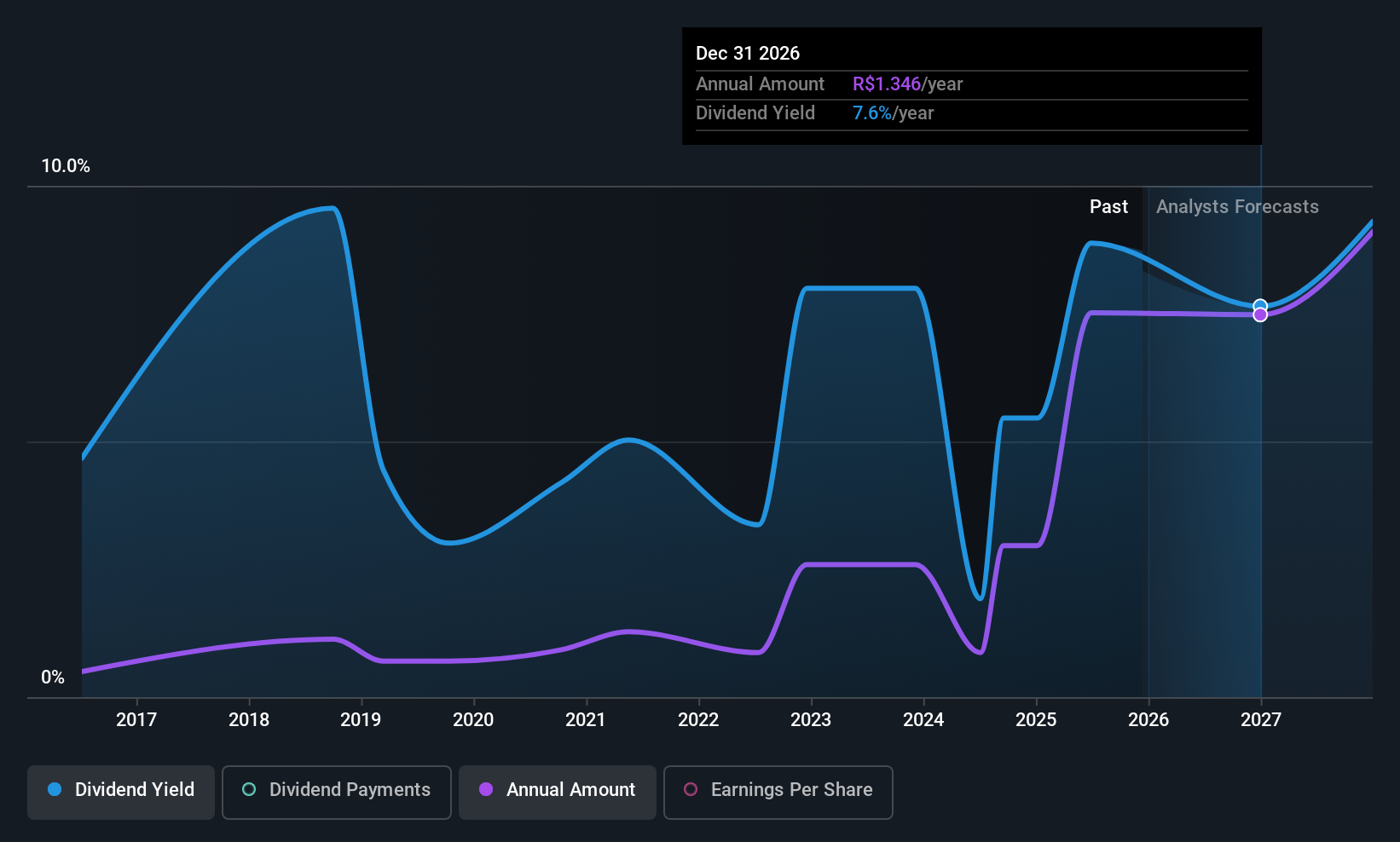

The company's next dividend payment will be R$1.55 per share. Last year, in total, the company distributed R$1.35 to shareholders. Calculating the last year's worth of payments shows that Direcional Engenharia has a trailing yield of 7.7% on the current share price of R$17.61. If you buy this business for its dividend, you should have an idea of whether Direcional Engenharia's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fortunately Direcional Engenharia's payout ratio is modest, at just 29% of profit. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Over the last year, it paid out dividends equivalent to 351% of what it generated in free cash flow, a disturbingly high percentage. It's pretty hard to pay out more than you earn, so we wonder how Direcional Engenharia intends to continue funding this dividend, or if it could be forced to cut the payment.

Direcional Engenharia paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Cash is king, as they say, and were Direcional Engenharia to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Check out our latest analysis for Direcional Engenharia

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings fall far enough, the company could be forced to cut its dividend. It's encouraging to see Direcional Engenharia has grown its earnings rapidly, up 45% a year for the past five years. Earnings have been growing quickly, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, 10 years ago, Direcional Engenharia has lifted its dividend by approximately 27% a year on average. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

The Bottom Line

From a dividend perspective, should investors buy or avoid Direcional Engenharia? We like that Direcional Engenharia has been successfully growing its earnings per share at a nice rate and reinvesting most of its profits in the business. However, we note the high cashflow payout ratio with some concern. Overall we're not hugely bearish on the stock, but there are likely better dividend investments out there.

While it's tempting to invest in Direcional Engenharia for the dividends alone, you should always be mindful of the risks involved. Be aware that Direcional Engenharia is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us...

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:DIRR3

Direcional Engenharia

Engages in the development and construction of real estate properties in Brazil.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)