- Brazil

- /

- Commercial Services

- /

- BOVESPA:AMBP3

More Unpleasant Surprises Could Be In Store For Ambipar Participações e Empreendimentos S.A.'s (BVMF:AMBP3) Shares After Tumbling 27%

Ambipar Participações e Empreendimentos S.A. (BVMF:AMBP3) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

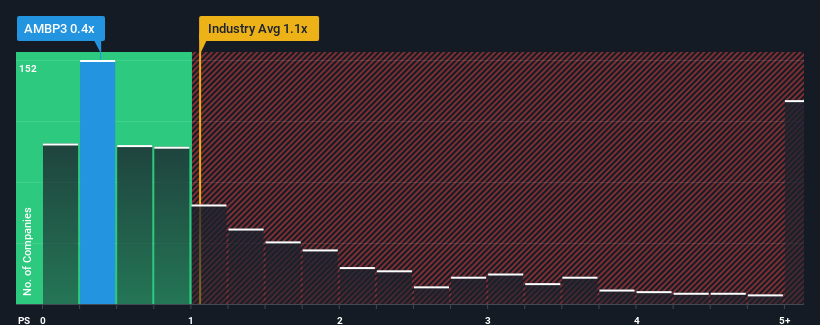

In spite of the heavy fall in price, it's still not a stretch to say that Ambipar Participações e Empreendimentos' price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Commercial Services industry in Brazil, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Ambipar Participações e Empreendimentos

How Ambipar Participações e Empreendimentos Has Been Performing

Ambipar Participações e Empreendimentos certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ambipar Participações e Empreendimentos.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ambipar Participações e Empreendimentos' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 8.5% during the coming year according to the three analysts following the company. That's shaping up to be materially lower than the 27% growth forecast for the broader industry.

In light of this, it's curious that Ambipar Participações e Empreendimentos' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Following Ambipar Participações e Empreendimentos' share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of Ambipar Participações e Empreendimentos' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Ambipar Participações e Empreendimentos (1 doesn't sit too well with us!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AMBP3

Ambipar Participações e Empreendimentos

Ambipar Participações e Empreendimentos S.A.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives