Romi's (BVMF:ROMI3) Weak Earnings May Only Reveal A Part Of The Whole Picture

The subdued market reaction suggests that Romi S.A.'s (BVMF:ROMI3) recent earnings didn't contain any surprises. However, we believe that investors should be aware of some underlying factors which may be of concern.

View our latest analysis for Romi

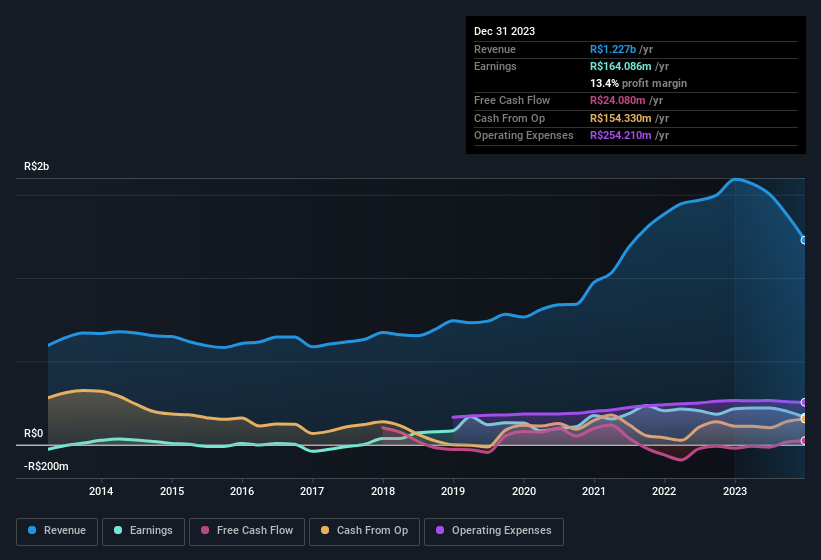

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Romi's profit received a boost of R$65m in unusual items, over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. We can see that Romi's positive unusual items were quite significant relative to its profit in the year to December 2023. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Romi.

Our Take On Romi's Profit Performance

As we discussed above, we think the significant positive unusual item makes Romi's earnings a poor guide to its underlying profitability. As a result, we think it may well be the case that Romi's underlying earnings power is lower than its statutory profit. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So while earnings quality is important, it's equally important to consider the risks facing Romi at this point in time. To help with this, we've discovered 3 warning signs (1 is a bit unpleasant!) that you ought to be aware of before buying any shares in Romi.

Today we've zoomed in on a single data point to better understand the nature of Romi's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ROMI3

Romi

Develops, manufactures, and sells machine tools, plastic processing machines, and cast parts.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026