- Brazil

- /

- Trade Distributors

- /

- BOVESPA:ARML3

Armac Locação Logística e Serviços (BVMF:ARML3) Seems To Be Using A Lot Of Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Armac Locação, Logística e Serviços S.A. (BVMF:ARML3) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Armac Locação Logística e Serviços's Net Debt?

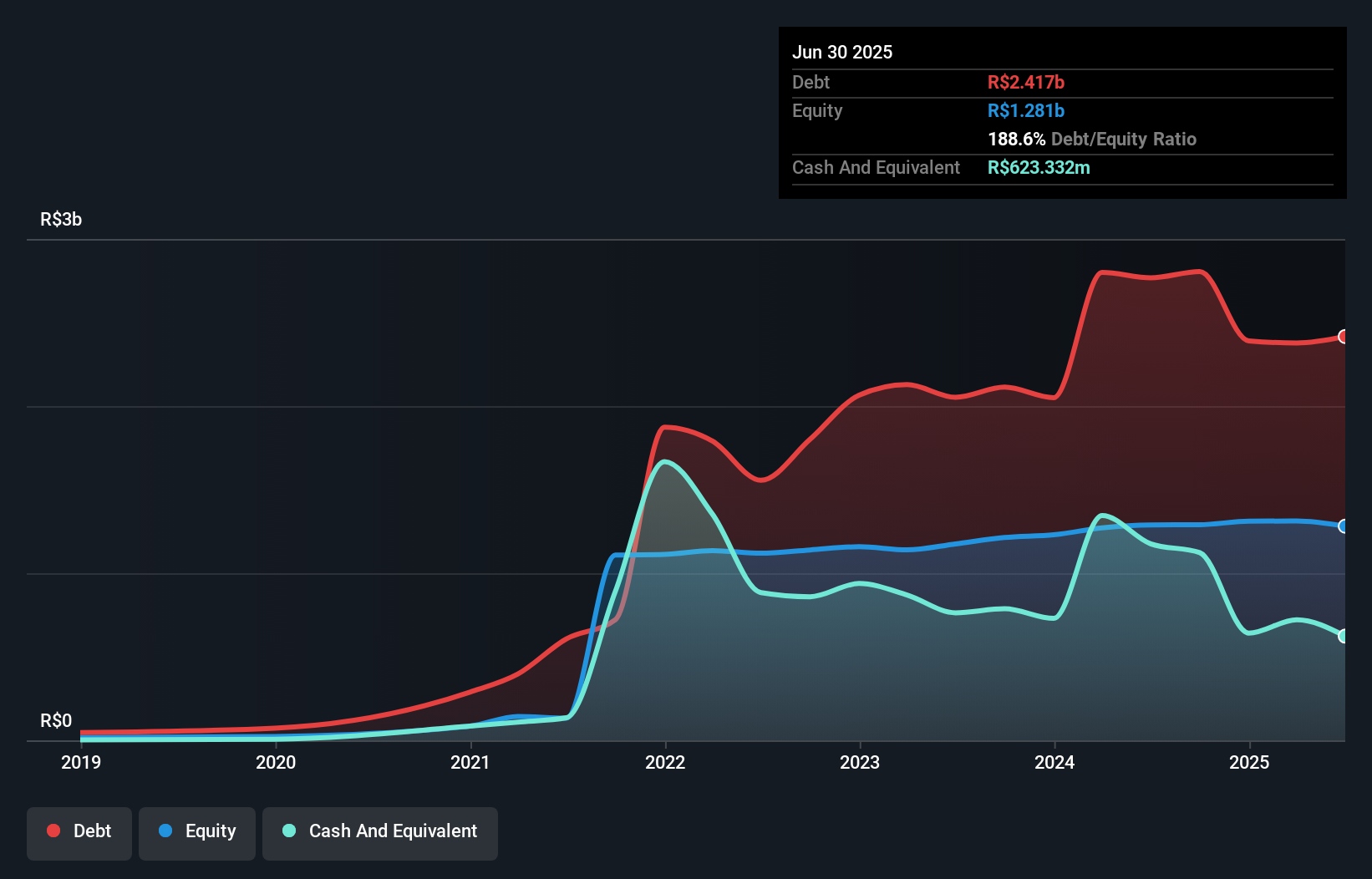

As you can see below, Armac Locação Logística e Serviços had R$2.42b of debt at June 2025, down from R$2.77b a year prior. However, because it has a cash reserve of R$623.3m, its net debt is less, at about R$1.79b.

A Look At Armac Locação Logística e Serviços' Liabilities

Zooming in on the latest balance sheet data, we can see that Armac Locação Logística e Serviços had liabilities of R$605.6m due within 12 months and liabilities of R$2.70b due beyond that. Offsetting this, it had R$623.3m in cash and R$426.2m in receivables that were due within 12 months. So it has liabilities totalling R$2.25b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the R$1.12b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Armac Locação Logística e Serviços would probably need a major re-capitalization if its creditors were to demand repayment.

See our latest analysis for Armac Locação Logística e Serviços

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Armac Locação Logística e Serviços's debt to EBITDA ratio (2.8) suggests that it uses some debt, its interest cover is very weak, at 1.3, suggesting high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Another concern for investors might be that Armac Locação Logística e Serviços's EBIT fell 17% in the last year. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Armac Locação Logística e Serviços can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Armac Locação Logística e Serviços created free cash flow amounting to 9.6% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

To be frank both Armac Locação Logística e Serviços's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. Considering all the factors previously mentioned, we think that Armac Locação Logística e Serviços really is carrying too much debt. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Armac Locação Logística e Serviços you should be aware of, and 1 of them shouldn't be ignored.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ARML3

Armac Locação Logística e Serviços

Engages in leasing machines, equipment, and services in Brazil.

Reasonable growth potential with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)