- Brazil

- /

- Electrical

- /

- BOVESPA:AERI3

Lacklustre Performance Is Driving Aeris Indústria e Comércio de Equipamentos para Geração de Energia S.A.'s (BVMF:AERI3) 26% Price Drop

To the annoyance of some shareholders, Aeris Indústria e Comércio de Equipamentos para Geração de Energia S.A. (BVMF:AERI3) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 72% loss during that time.

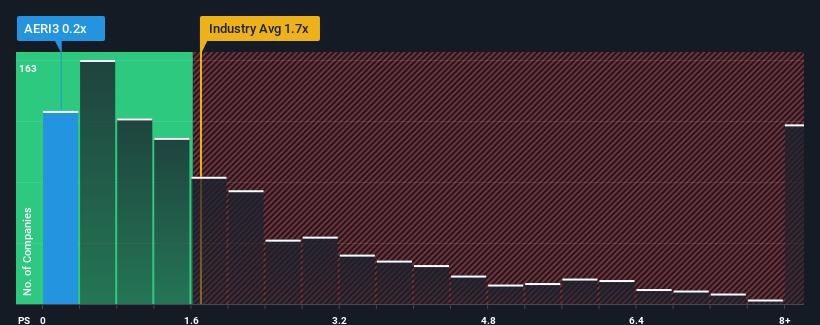

Following the heavy fall in price, Aeris Indústria e Comércio de Equipamentos para Geração de Energia may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Electrical industry in Brazil have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Aeris Indústria e Comércio de Equipamentos para Geração de Energia

What Does Aeris Indústria e Comércio de Equipamentos para Geração de Energia's Recent Performance Look Like?

Aeris Indústria e Comércio de Equipamentos para Geração de Energia hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Aeris Indústria e Comércio de Equipamentos para Geração de Energia will help you uncover what's on the horizon.How Is Aeris Indústria e Comércio de Equipamentos para Geração de Energia's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Aeris Indústria e Comércio de Equipamentos para Geração de Energia's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 27% during the coming year according to the dual analysts following the company. Meanwhile, the broader industry is forecast to expand by 16%, which paints a poor picture.

In light of this, it's understandable that Aeris Indústria e Comércio de Equipamentos para Geração de Energia's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Aeris Indústria e Comércio de Equipamentos para Geração de Energia's P/S

The southerly movements of Aeris Indústria e Comércio de Equipamentos para Geração de Energia's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Aeris Indústria e Comércio de Equipamentos para Geração de Energia maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 4 warning signs for Aeris Indústria e Comércio de Equipamentos para Geração de Energia you should be aware of, and 2 of them don't sit too well with us.

If you're unsure about the strength of Aeris Indústria e Comércio de Equipamentos para Geração de Energia's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AERI3

Aeris Indústria e Comércio de Equipamentos para Geração de Energia

Aeris Indústria e Comércio de Equipamentos para Geração de Energia S.A.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives