- Brazil

- /

- Electrical

- /

- BOVESPA:AERI3

Aeris Indústria e Comércio de Equipamentos para Geração de Energia S.A.'s (BVMF:AERI3) Share Price Is Still Matching Investor Opinion Despite 25% Slump

The Aeris Indústria e Comércio de Equipamentos para Geração de Energia S.A. (BVMF:AERI3) share price has fared very poorly over the last month, falling by a substantial 25%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

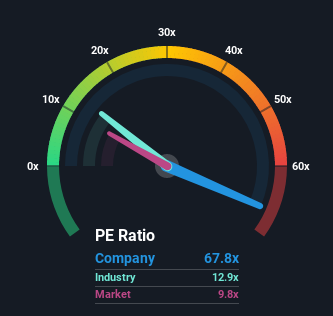

In spite of the heavy fall in price, given close to half the companies in Brazil have price-to-earnings ratios (or "P/E's") below 9x, you may still consider Aeris Indústria e Comércio de Equipamentos para Geração de Energia as a stock to avoid entirely with its 67.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Aeris Indústria e Comércio de Equipamentos para Geração de Energia's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Aeris Indústria e Comércio de Equipamentos para Geração de Energia

How Is Aeris Indústria e Comércio de Equipamentos para Geração de Energia's Growth Trending?

In order to justify its P/E ratio, Aeris Indústria e Comércio de Equipamentos para Geração de Energia would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 66%. The last three years don't look nice either as the company has shrunk EPS by 54% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 124% as estimated by the five analysts watching the company. With the market only predicted to deliver 12%, the company is positioned for a stronger earnings result.

With this information, we can see why Aeris Indústria e Comércio de Equipamentos para Geração de Energia is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Aeris Indústria e Comércio de Equipamentos para Geração de Energia's P/E?

A significant share price dive has done very little to deflate Aeris Indústria e Comércio de Equipamentos para Geração de Energia's very lofty P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Aeris Indústria e Comércio de Equipamentos para Geração de Energia maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Aeris Indústria e Comércio de Equipamentos para Geração de Energia (of which 2 are a bit concerning!) you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AERI3

Aeris Indústria e Comércio de Equipamentos para Geração de Energia

Aeris Indústria e Comércio de Equipamentos para Geração de Energia S.A.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives