Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Fras-le S.A. (BVMF:FRAS3) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Our analysis indicates that FRAS3 is potentially overvalued!

How Much Debt Does Fras-le Carry?

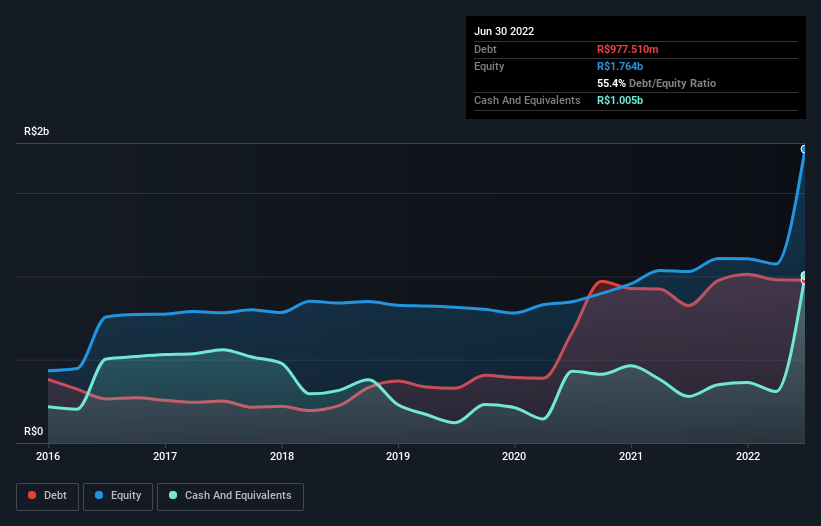

The image below, which you can click on for greater detail, shows that at June 2022 Fras-le had debt of R$977.5m, up from R$824.6m in one year. However, it does have R$1.00b in cash offsetting this, leading to net cash of R$27.3m.

How Healthy Is Fras-le's Balance Sheet?

The latest balance sheet data shows that Fras-le had liabilities of R$785.0m due within a year, and liabilities of R$1.17b falling due after that. Offsetting this, it had R$1.00b in cash and R$505.3m in receivables that were due within 12 months. So its liabilities total R$446.2m more than the combination of its cash and short-term receivables.

Since publicly traded Fras-le shares are worth a total of R$3.60b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Fras-le also has more cash than debt, so we're pretty confident it can manage its debt safely.

We saw Fras-le grow its EBIT by 8.0% in the last twelve months. That's far from incredible but it is a good thing, when it comes to paying off debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Fras-le's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Fras-le may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Looking at the most recent three years, Fras-le recorded free cash flow of 24% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Summing Up

Although Fras-le's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of R$27.3m. And it also grew its EBIT by 8.0% over the last year. So we don't have any problem with Fras-le's use of debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Fras-le that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:FRAS3

Fras-le

Provides friction materials for braking systems and other products in Brazil, England, Argentina, the United States, China, India, Uruguay, Holland, Chile, Colombia, Germany, South America, and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026