- Belgium

- /

- Retail REITs

- /

- ENXTBR:VASTB

3 European Growth Companies With Insider Ownership Up To 22%

Reviewed by Simply Wall St

As the European market continues to navigate mixed economic signals, with inflation concerns and varying GDP growth across major economies, investors are increasingly focusing on companies that demonstrate resilience and potential for growth. In this context, stocks with high insider ownership can be particularly attractive as they often indicate strong internal confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| TF Bank (OM:TFBANK) | 15.6% | 20% |

| Elicera Therapeutics (OM:ELIC) | 27.8% | 97.2% |

| Vow (OB:VOW) | 12.9% | 120.9% |

| Pharma Mar (BME:PHM) | 11.9% | 40.1% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| XTPL (WSE:XTP) | 27.9% | 118% |

| Ortoma (OM:ORT B) | 27.7% | 73.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 89.9% |

| Circus (XTRA:CA1) | 26% | 51.4% |

Here's a peek at a few of the choices from the screener.

Vastned Belgium (ENXTBR:VASTB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vastned Belgium is a public regulated real estate company (RREC) listed on Euronext Brussels, with a market capitalization of €545.13 million.

Operations: Vastned Belgium focuses on managing and investing in retail properties across prime locations, generating revenue through leasing activities.

Insider Ownership: 18.9%

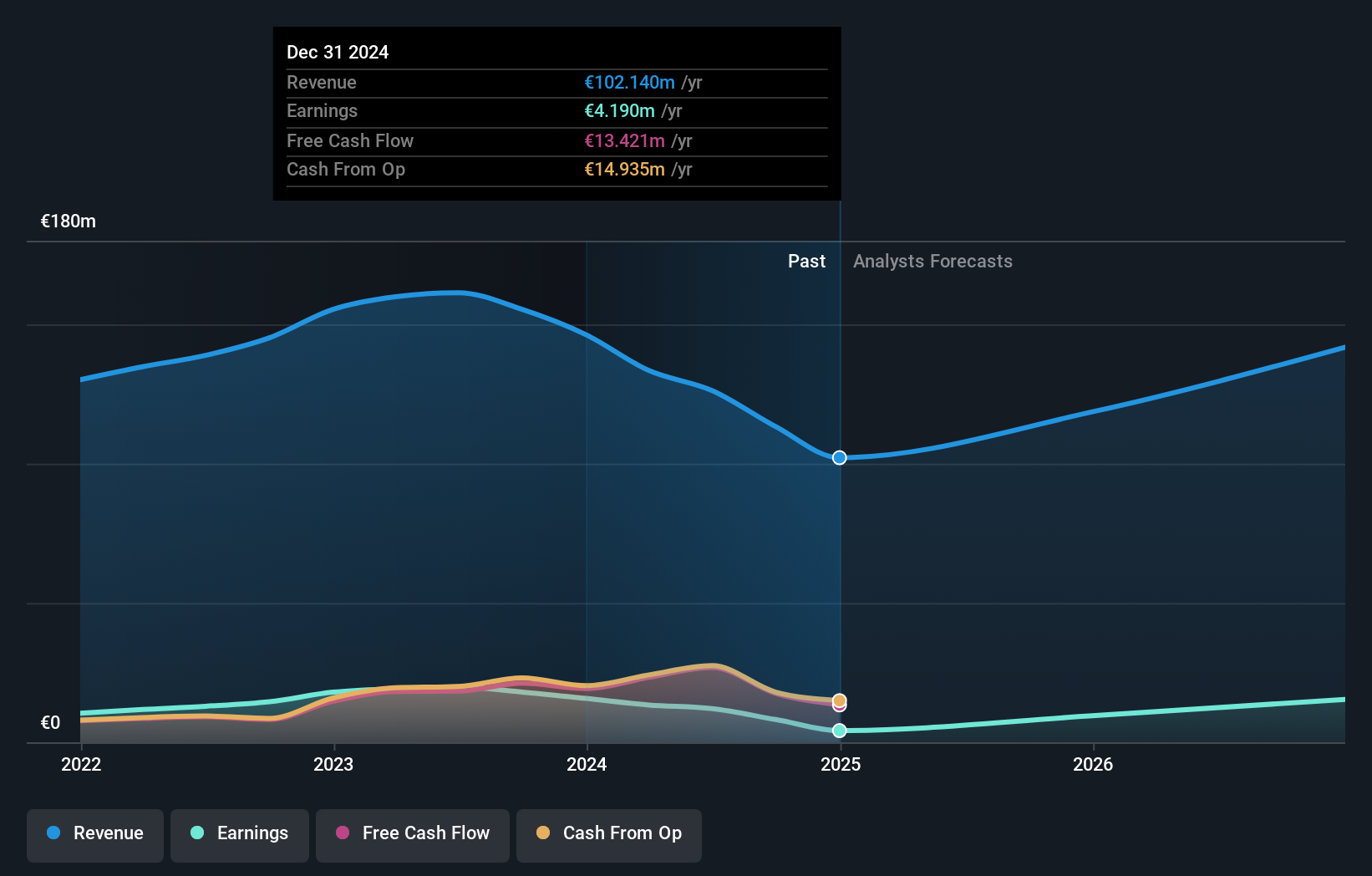

Vastned Belgium shows promising growth potential, with earnings and revenue forecasted to grow significantly at 50.7% and 46.9% per year, respectively, outpacing the Belgian market averages. Despite recent declines in sales and net income for 2024, the company remains a strong contender in its sector with inclusion in the ASCX AMS Small Cap Index. However, its dividend sustainability is questionable due to insufficient free cash flow coverage and debt not well covered by operating cash flow.

- Unlock comprehensive insights into our analysis of Vastned Belgium stock in this growth report.

- Our valuation report unveils the possibility Vastned Belgium's shares may be trading at a premium.

Stemmer Imaging (HMSE:S9I)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stemmer Imaging AG offers machine vision technology for various applications globally, with a market cap of €357.50 million.

Operations: The company generates revenue primarily from its machine vision technology segment, amounting to €113.27 million.

Insider Ownership: 15.6%

Stemmer Imaging's earnings are forecast to grow significantly at 41% annually, surpassing the German market average. However, its revenue growth of 11.2% per year trails behind the ideal high-growth threshold but still exceeds the market rate. Despite a decline in profit margins from 11.6% to 7.2%, there is no substantial insider trading activity reported recently, indicating stability in insider sentiment amidst these mixed performance metrics.

- Delve into the full analysis future growth report here for a deeper understanding of Stemmer Imaging.

- Upon reviewing our latest valuation report, Stemmer Imaging's share price might be too optimistic.

COLTENE Holding (SWX:CLTN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: COLTENE Holding AG is a company that develops, manufactures, and sells dental disposables, tools, and equipment across various regions including Europe, the Middle East, Africa, North America, Latin America, and Asia/Oceania with a market cap of CHF316.69 million.

Operations: The company's revenue is derived from selling dental disposables, tools, and equipment, totaling CHF238.80 million.

Insider Ownership: 22.2%

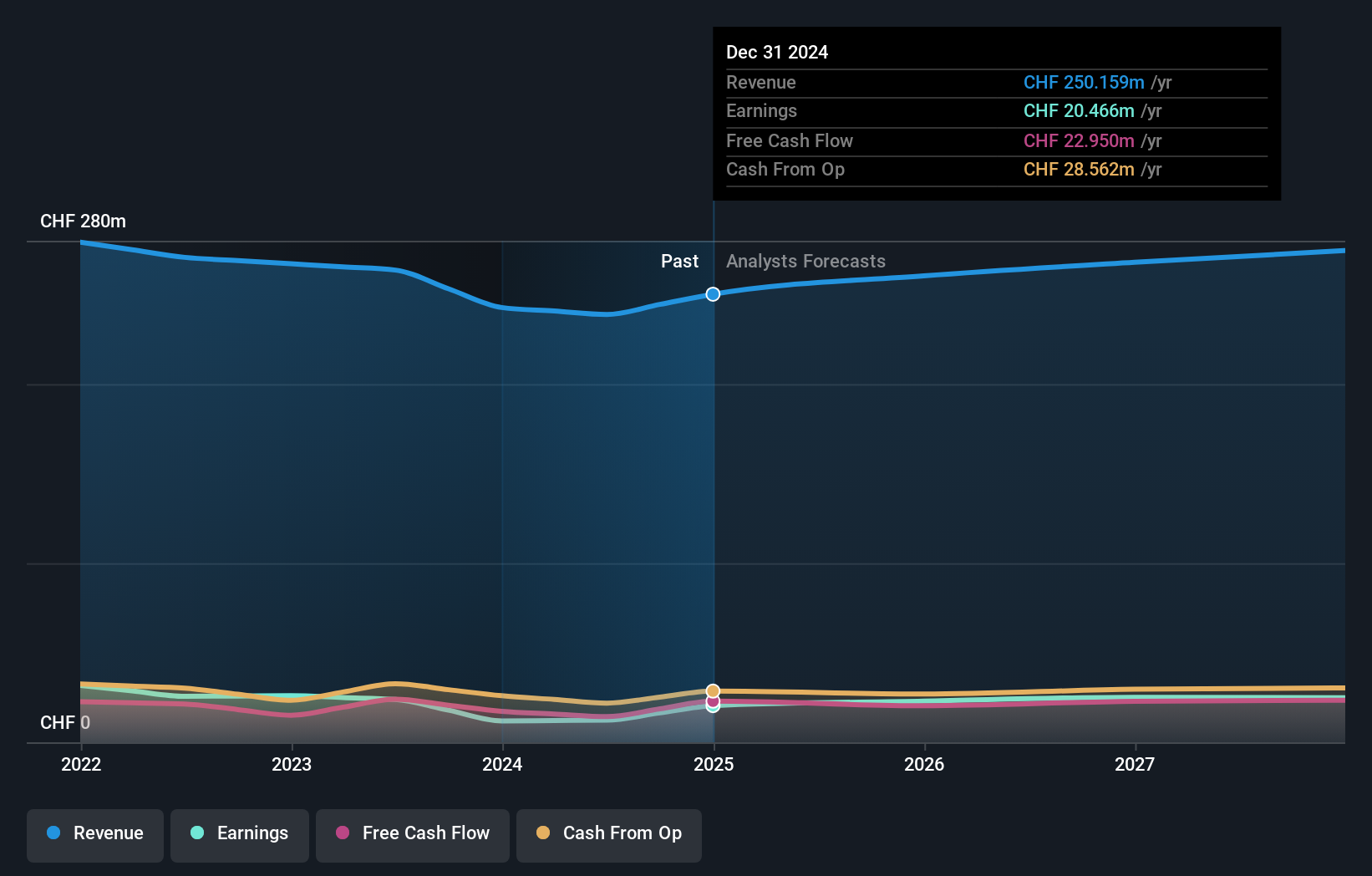

COLTENE Holding is trading at a substantial discount, 39.4% below its estimated fair value, suggesting good relative value compared to peers. While revenue growth of 3.3% annually lags behind the Swiss market, earnings are expected to grow significantly at 24.2%, outpacing the market average. Despite declining profit margins from 9.1% to 5.2%, no recent insider trading activity suggests stable insider sentiment amidst these mixed metrics, though dividend coverage remains weak at a rate of 3.77%.

- Navigate through the intricacies of COLTENE Holding with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of COLTENE Holding shares in the market.

Turning Ideas Into Actions

- Reveal the 222 hidden gems among our Fast Growing European Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:VASTB

Vastned Belgium

Vastned Belgium is a public regulated real estate company (RREC), the shares of which are listed on Euronext Brussels (VASTB).

High growth potential average dividend payer.