- Belgium

- /

- Retail REITs

- /

- ENXTBR:RET

We Think The Compensation For Retail Estates N.V.'s (EBR:RET) CEO Looks About Right

Despite Retail Estates N.V.'s (EBR:RET) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. The upcoming AGM on 19 July 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for Retail Estates

Comparing Retail Estates N.V.'s CEO Compensation With the industry

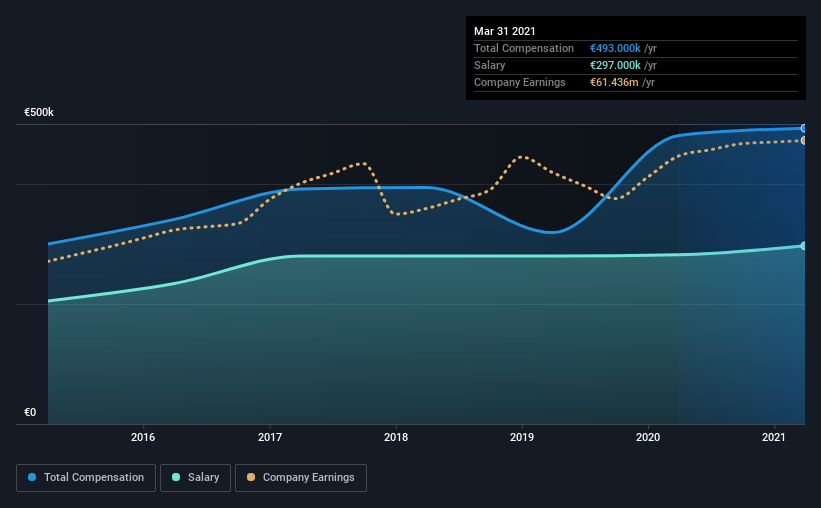

According to our data, Retail Estates N.V. has a market capitalization of €955m, and paid its CEO total annual compensation worth €493k over the year to March 2021. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is €297.0k, represents most of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from €337m to €1.3b, we found that the median CEO total compensation was €476k. From this we gather that Jan De Nys is paid around the median for CEOs in the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | €297k | €282k | 60% |

| Other | €196k | €199k | 40% |

| Total Compensation | €493k | €481k | 100% |

On an industry level, roughly 60% of total compensation represents salary and 40% is other remuneration. Although there is a difference in how total compensation is set, Retail Estates more or less reflects the market in terms of setting the salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Retail Estates N.V.'s Growth Numbers

Over the last three years, Retail Estates N.V. has not seen its earnings per share change much, though they have deteriorated slightly. Its revenue is down 5.2% over the previous year.

Its a bit disappointing to see that the company has failed to grow its EPS. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Retail Estates N.V. Been A Good Investment?

Retail Estates N.V. has not done too badly by shareholders, with a total return of 9.8%, over three years. It would be nice to see that metric improve in the future. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for Retail Estates that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Retail Estates, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTBR:RET

Retail Estates

The Belgian public real estate investment trust Retail Estates nv is a niche player specialised in making out-of town retail properties located on the periphery of residential areas or along main access roads to urban centres available to users.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives