- Belgium

- /

- Health Care REITs

- /

- ENXTBR:AED

How Raised 2025 Guidance and Solid Results at Aedifica (ENXTBR:AED) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Aedifica announced in late October that it has raised its 2025 earnings guidance and reported solid nine-month results, with sales reaching €271.79 million and net income of €194.12 million.

- A key highlight is the 3.1% like-for-like rental income growth, reflecting improved operational momentum alongside continued asset rotation and new investment initiatives.

- We'll explore how the uplifted earnings forecast reinforces Aedifica's investment narrative and signals continued operating momentum in its core markets.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Aedifica/SA's Investment Narrative?

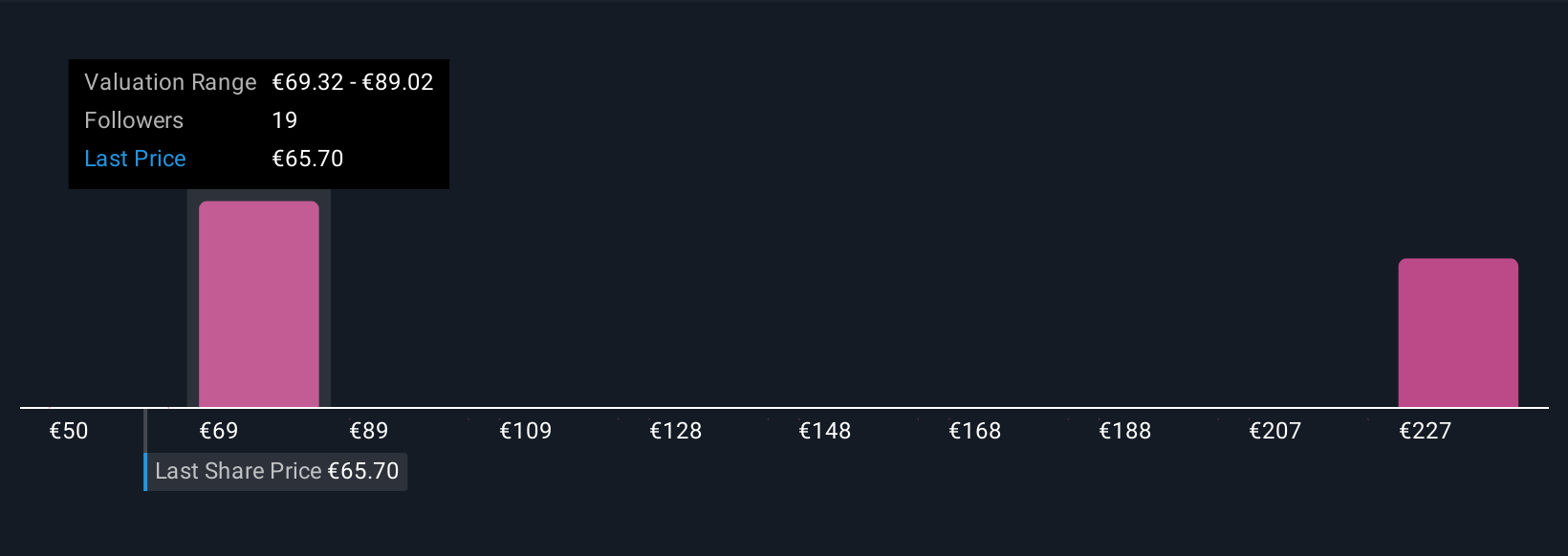

Aedifica’s updated 2025 earnings forecast and strong nine-month results reinforce the investment story for those who back the company’s specialised healthcare real estate approach. For shareholders, the big picture rests on trust in Aedifica’s ability to reliably grow rental income through asset rotation, expansion in core European markets and disciplined management. The raised guidance signals that the operational momentum expected by many is materialising, with like-for-like rental growth and further acquisitions underpinning short-term upside catalysts such as renewed investor confidence and dividend stability. Still, investors cannot ignore key risks, particularly Aedifica’s comparatively high debt and the challenge of keeping revenue growth in line with broader market trends. Regulatory uncertainties, like the pending Belgian Competition Authority decision, could also shift the near-term outlook if outcomes differ from expectations. Longer-term, the balance between earnings growth, access to capital and interest rate sensitivity remains a core risk profile that’s worth monitoring closely as market conditions evolve.

However, beneath these strong numbers, the company’s debt coverage remains a key issue investors should watch.

Exploring Other Perspectives

Explore 8 other fair value estimates on Aedifica/SA - why the stock might be worth 23% less than the current price!

Build Your Own Aedifica/SA Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aedifica/SA research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Aedifica/SA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aedifica/SA's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:AED

Aedifica/SA

Aedifica is a Regulated Real Estate Company under Belgian law specialised in European healthcare real estate, particularly in elderly care.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion