Shareholders Will Probably Not Have Any Issues With UCB SA's (EBR:UCB) CEO Compensation

Key Insights

- UCB will host its Annual General Meeting on 25th of April

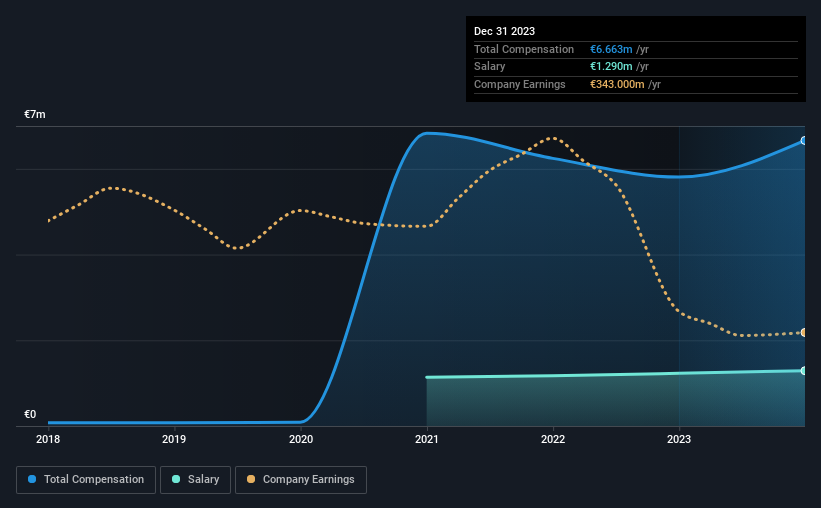

- Salary of €1.29m is part of CEO Jean-Christophe Tellier's total remuneration

- The overall pay is 37% below the industry average

- UCB's EPS declined by 22% over the past three years while total shareholder return over the past three years was 48%

Shareholders may be wondering what CEO Jean-Christophe Tellier plans to do to improve the less than great performance at UCB SA (EBR:UCB) recently. At the next AGM coming up on 25th of April, they can influence managerial decision making through voting on resolutions, including executive remuneration. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for UCB

Comparing UCB SA's CEO Compensation With The Industry

Our data indicates that UCB SA has a market capitalization of €23b, and total annual CEO compensation was reported as €6.7m for the year to December 2023. Notably, that's an increase of 15% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at €1.3m.

In comparison with other companies in the Belgium Pharmaceuticals industry with market capitalizations over €7.5b, the reported median total CEO compensation was €11m. In other words, UCB pays its CEO lower than the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €1.3m | €1.2m | 19% |

| Other | €5.4m | €4.6m | 81% |

| Total Compensation | €6.7m | €5.8m | 100% |

On an industry level, around 60% of total compensation represents salary and 40% is other remuneration. It's interesting to note that UCB allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at UCB SA's Growth Numbers

Over the last three years, UCB SA has shrunk its earnings per share by 22% per year. It saw its revenue drop 4.9% over the last year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has UCB SA Been A Good Investment?

We think that the total shareholder return of 48%, over three years, would leave most UCB SA shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean these strong returns may not continue. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling UCB (free visualization of insider trades).

Switching gears from UCB, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:UCB

UCB

A biopharmaceutical company, develops products and solutions for people with neurology and immunology diseases worldwide.

Reasonable growth potential with adequate balance sheet.