Does Favorable TK2d Study Data Signal a New Era for UCB's Rare Disease Innovation (ENXTBR:UCB)?

Reviewed by Sasha Jovanovic

- On October 13, 2025, UCB announced that Neurology had published favorable results from a multicenter retrospective chart review study of its investigational pyrimidine nucleoside and/or nucleotide therapy in patients with thymidine kinase 2 deficiency (TK2d), showing that 29% (6 out of 21) of treated individuals experienced reduced need for ventilatory support and most adverse events were mild.

- An interesting aspect of the study is the potential clinical impact on this rare neuromuscular disorder, as well as the challenge of interpreting results due to small patient numbers and variability in data collection.

- We'll look at how these newly published study results for TK2d therapy may shape UCB's investment narrative, especially around innovation in rare diseases.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

UCB Investment Narrative Recap

UCB’s long-term story relies on sustained leadership in neurology and immunology by advancing innovative therapies, such as BIMZELX, amid challenging pricing and biosimilar risks. The favorable TK2d data adds to UCB’s reputation for rare disease innovation, but given small patient numbers and the investigational status, it is unlikely to materially impact short-term performance drivers or mitigate the present risk of pricing erosion in core assets.

One recent announcement with more immediate relevance is the three-year data on BIMZELX in hidradenitis suppurativa, underscoring the importance of expanding indications for cornerstone assets. Progress with BIMZELX in broader patient populations remains a key short-term catalyst, while market pressures on pricing and margins persist.

By contrast, investors should be mindful that current optimism may be tempered if pricing pressure in the US market accelerates beyond expectations, especially if...

Read the full narrative on UCB (it's free!)

UCB's narrative projects €9.4 billion in revenue and €2.1 billion in earnings by 2028. This requires 11.3% yearly revenue growth and a €0.8 billion earnings increase from €1.3 billion today.

Uncover how UCB's forecasts yield a €240.28 fair value, a 5% downside to its current price.

Exploring Other Perspectives

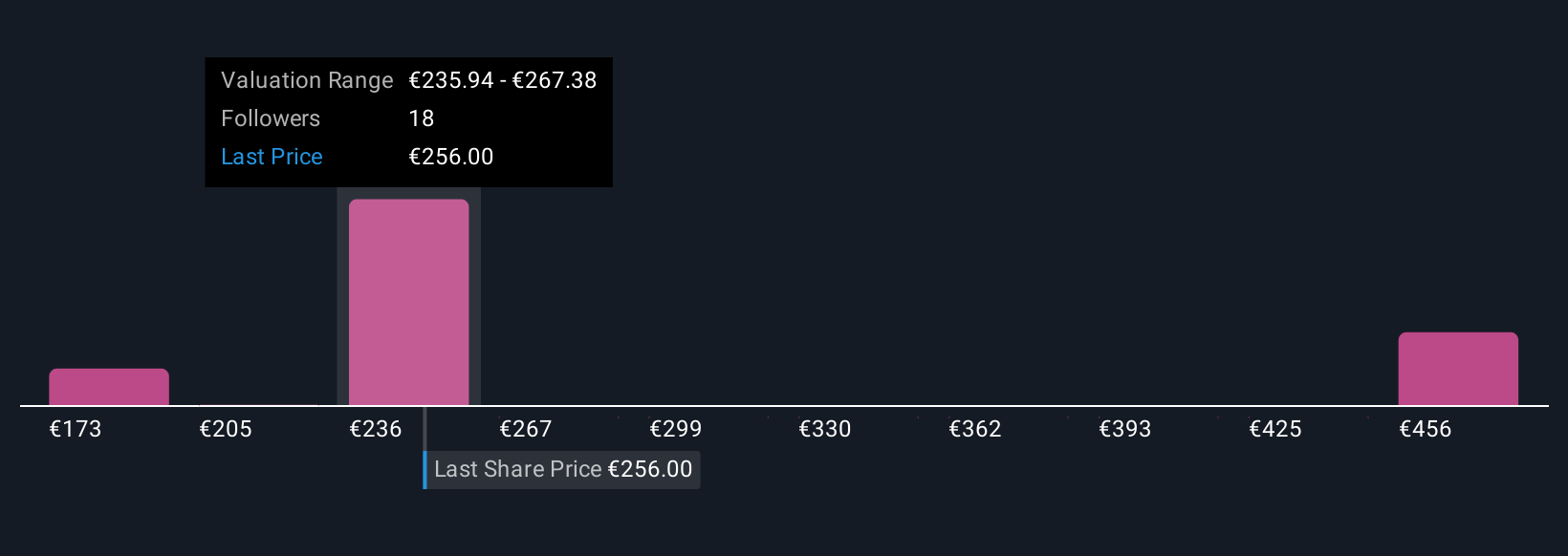

Six members of the Simply Wall St Community currently estimate UCB’s fair value between €173 and €506. While many focus on future innovation and expanding indications, broad consensus remains elusive given the significant risk that further US market pricing pressure could weigh on margins and growth. Consider exploring these diverse valuation perspectives to inform your outlook.

Explore 6 other fair value estimates on UCB - why the stock might be worth as much as 100% more than the current price!

Build Your Own UCB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UCB research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free UCB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UCB's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:UCB

UCB

A biopharmaceutical company, develops products and solutions for people with neurology and immunology diseases worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives