- Poland

- /

- Entertainment

- /

- WSE:CDR

High Growth Tech Stocks In Europe To Watch March 2025

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index continues its longest streak of weekly gains since August 2012, driven by positive company results and resilience in defense stocks amid global trade uncertainties, the European tech sector remains a focal point for investors seeking growth opportunities. In this dynamic landscape, identifying promising high-growth tech stocks involves looking at companies that demonstrate strong innovation capabilities and adaptability to evolving market conditions.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Pharma Mar | 23.58% | 40.13% | ★★★★★★ |

| Yubico | 21.27% | 26.82% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Bonesupport Holding | 30.50% | 48.59% | ★★★★★★ |

| Xbrane Biopharma | 73.73% | 139.21% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

| Elliptic Laboratories | 49.89% | 89.90% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Kinepolis Group (ENXTBR:KIN)

Simply Wall St Growth Rating: ★★★★☆☆

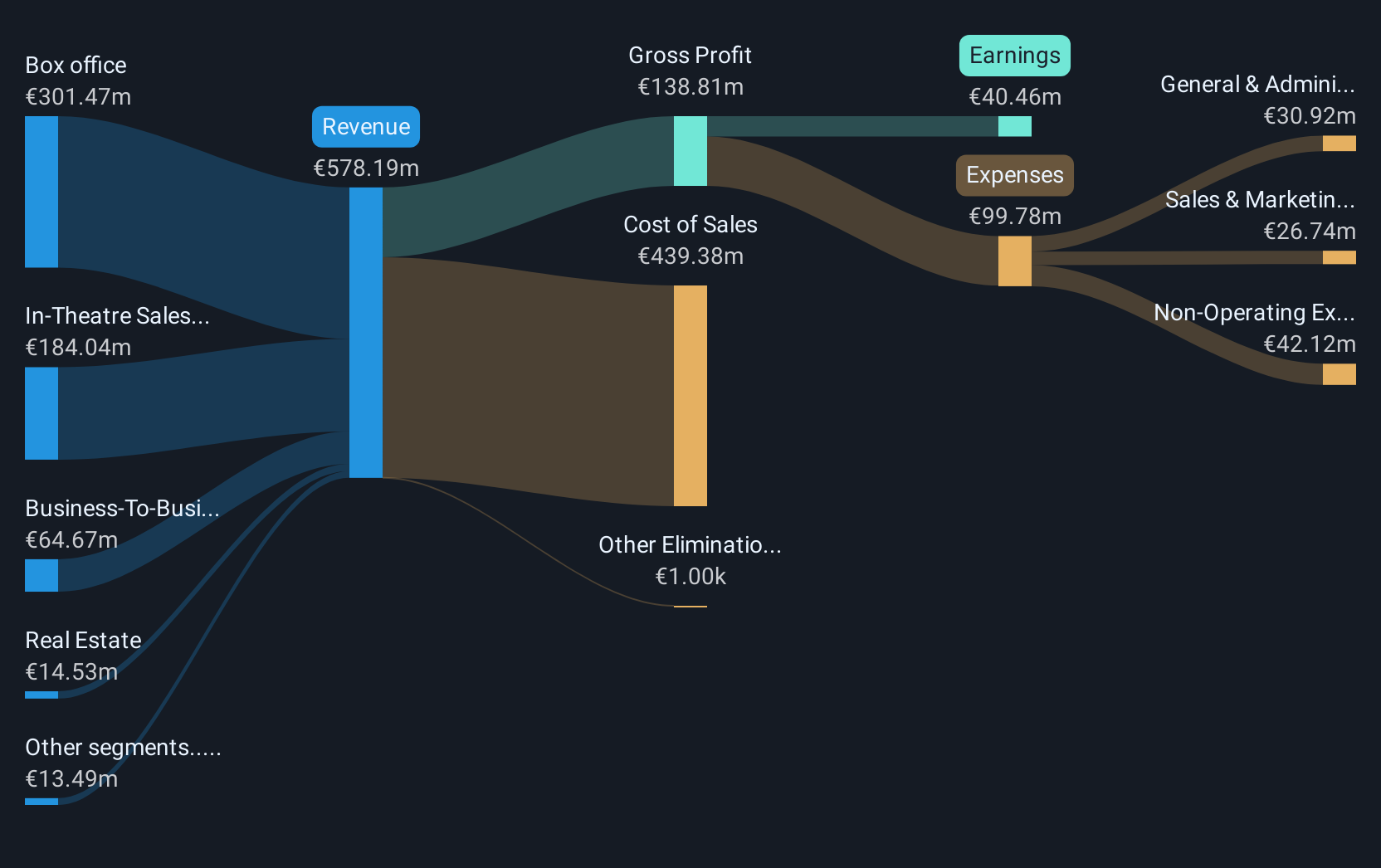

Overview: Kinepolis Group NV operates cinema complexes across several countries, including Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States with a market cap of €906.08 million.

Operations: Kinepolis Group generates revenue primarily through its box office sales (€294.05 million) and in-theatre sales (€177.61 million), with additional contributions from real estate and film distribution activities.

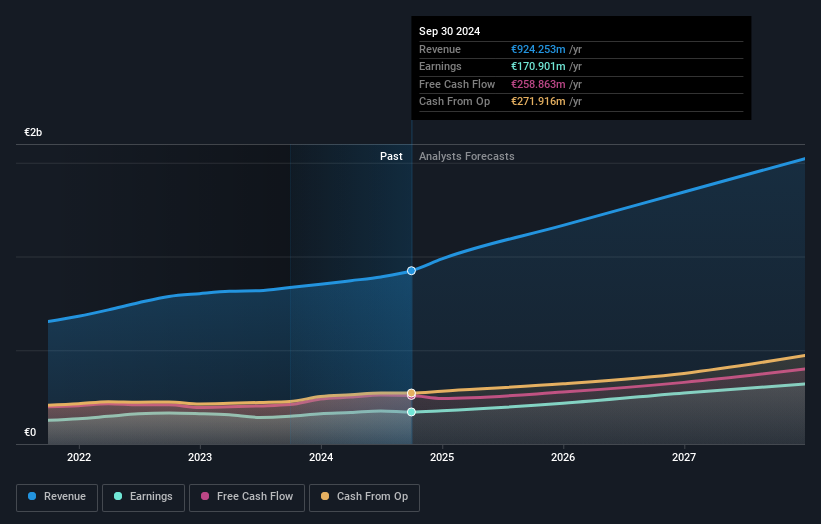

Kinepolis Group, navigating a challenging entertainment landscape, shows potential with its robust earnings forecast to grow by 26% annually, outpacing the Belgian market's average of 16.5%. Despite a recent dip in earnings growth by 9.8% over the past year against an industry average of 21.6%, Kinepolis maintains high-quality earnings and is poised for significant advancement with an expected Return on Equity of 23.8% in three years. The company's revenue growth projection at 5% per year may trail the broader Belgian market trend of 7%, yet it underscores a steady upward trajectory bolstered by positive free cash flow dynamics, laying groundwork for sustained financial health and shareholder value creation.

- Navigate through the intricacies of Kinepolis Group with our comprehensive health report here.

Explore historical data to track Kinepolis Group's performance over time in our Past section.

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★★★

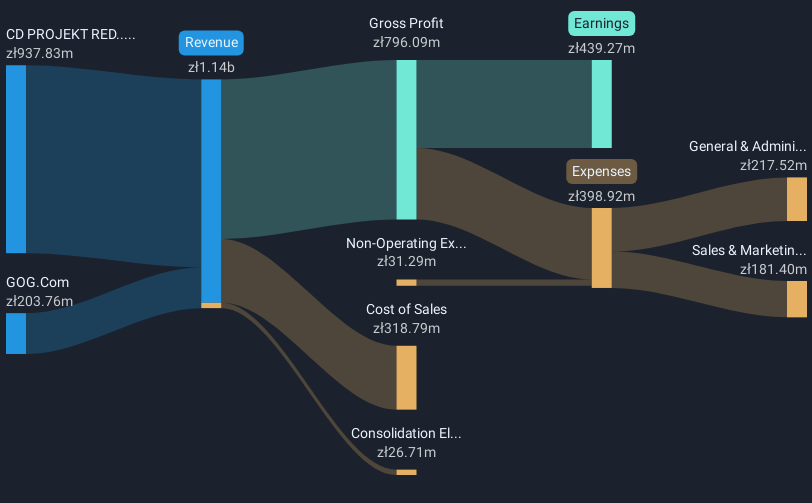

Overview: CD Projekt S.A., along with its subsidiaries, focuses on developing, publishing, and digitally distributing video games for PCs and consoles in Poland, with a market cap of PLN22.08 billion.

Operations: The company generates revenue primarily through its CD PROJEKT RED segment, contributing PLN937.83 million, and GOG.com segment, which adds PLN203.76 million. The business involves the creation and distribution of video games for PCs and consoles in Poland.

CD Projekt, a standout in the European tech landscape, is charting a robust growth trajectory with its revenue expected to surge by 27.1% annually, significantly outpacing the Polish market's growth of 5.1%. This performance is underpinned by an aggressive R&D strategy, where recent figures show an investment increase to $120 million this year alone—accounting for nearly 15% of their total revenue. With earnings also projected to climb at an impressive rate of 39.4% per year, CD Projekt not only eclipses local market averages but also positions itself as a leader in innovation and market expansion. Recent presentations at major technology conferences across Europe further underscore their active engagement with industry trends and commitment to maintaining a competitive edge in high-growth sectors.

- Click here to discover the nuances of CD Projekt with our detailed analytical health report.

Gain insights into CD Projekt's past trends and performance with our Past report.

Nemetschek (XTRA:NEM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nemetschek SE offers software solutions for architecture, engineering, construction, media, and entertainment sectors globally and has a market capitalization of approximately €13.19 billion.

Operations: Nemetschek SE generates revenue primarily from its software solutions across four segments: Design (€449.12 million), Build (€302.33 million), Media (€117.81 million), and Manage (€59.77 million). The Design segment is the largest contributor to its revenue stream, highlighting its strong presence in architecture and engineering software solutions.

Nemetschek SE, a prominent figure in the European tech arena, recently showcased its strategic agility at multiple industry conferences, signaling robust engagement with market trends and customer needs. With an annual revenue growth forecast at 13.5%, Nemetschek outpaces the German market's 5.7% expansion rate. The firm is also set to enhance shareholder value through a tactical share repurchase program initiated in February 2025, reflecting a strong financial posture with €11.1 million allocated to buy back shares. Moreover, under new executive leadership, Nemetschek is poised to further its technological edge and market presence, particularly through innovations driven by significant R&D investments which underscore its commitment to maintaining competitiveness in a rapidly evolving sector.

- Get an in-depth perspective on Nemetschek's performance by reading our health report here.

Understand Nemetschek's track record by examining our Past report.

Make It Happen

- Discover the full array of 248 European High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CDR

CD Projekt

Together its subsidiaries, engages in the development, publishing, and digital distribution of video games for personal computers and video game consoles in Poland.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives