Solvay (ENXTBR:SOLB) Valuation in Focus After Quarterly Results Highlight Cost Savings and Strategic Projects

Reviewed by Kshitija Bhandaru

Solvay (ENXTBR:SOLB) has drawn fresh attention after releasing its latest quarterly results, which revealed lower sales and EBITDA. The company is addressing these challenges through cost-saving initiatives and ongoing investments in key projects.

See our latest analysis for Solvay.

Solvay’s recent quarterly results arrived alongside a notable jump in the share price, with a single-day gain of over 5%. Still, its year-to-date share price return sits at -7.4%, and the one-year total shareholder return is down 21%, highlighting how tough the last year has been for investors. Over the long run, however, total shareholder returns of 126% across five years serve as a reminder that there can be significant upside when momentum eventually returns.

If Solvay’s rebound after earnings sparked your curiosity, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares rebounding but fundamentals still under some pressure, the key question is whether Solvay is trading below its true value or if the market is already factoring in any future improvements, which could leave little room for upside.

Most Popular Narrative: 1.2% Undervalued

With the narrative's fair value at €29.03 and Solvay's last close at €28.68, there is a marginal gap between where analysts see fair worth and where the stock currently trades. The storyline centers on Solvay's strategic initiatives and how they could impact future value.

Advancement of digitalization initiatives (IoT, drones, process automation) is delivering consistent structural cost savings across Solvay's plants, which are expected to exceed interim targets and drive higher operating margins and earnings over the medium term. Solvay's strategic focus on energy transition and sustainability, including reducing greenhouse gas emissions by 10% year-on-year and ongoing investments in green chemistry, is enabling the company to future-proof its portfolio, align with regulatory shifts, and benefit from premium pricing, positively impacting long-term margins and growth.

What supports this valuation? Only those who read on will uncover the bold margin expansion forecast, ambitious earnings leaps, and the underlying discount rate powering this fair value story. The true drivers just might surprise you.

Result: Fair Value of €29.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued pricing pressure in key product lines and persistent operational inefficiencies could easily undermine this outlook if market conditions do not improve.

Find out about the key risks to this Solvay narrative.

Another View: What Do Valuation Ratios Say?

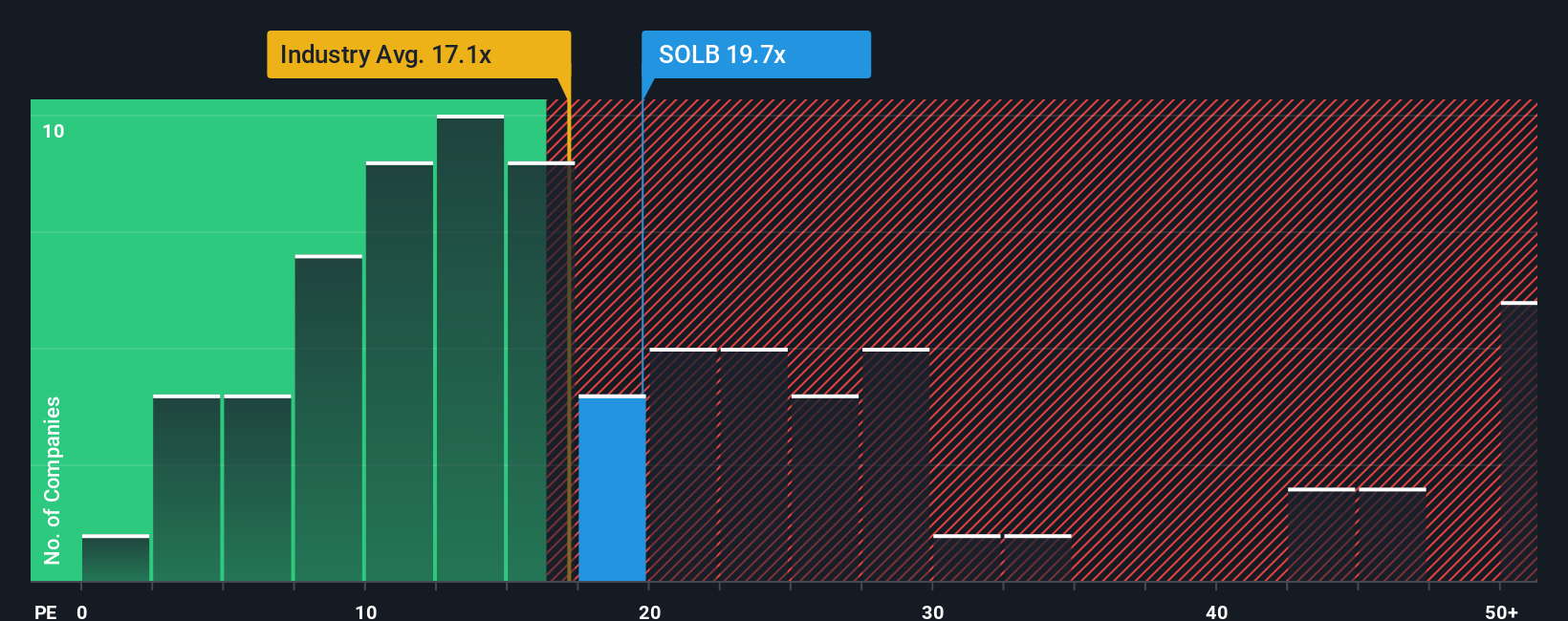

While the fair value narrative points to Solvay being slightly undervalued, an examination of its price-to-earnings ratio tells a different story. At 21.6x, Solvay trades above both its peer average (16.5x) and the European sector average (17.1x), as well as the estimated fair ratio of 19.2x. This premium suggests investors may be paying up for expected growth that is not being realized yet. The question remains: is the market overestimating Solvay’s immediate prospects, or does it anticipate a rebound?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solvay Narrative

Don't forget, if this view does not align with your own, you can review the figures yourself and develop a personalized assessment in just a few minutes. Do it your way

A great starting point for your Solvay research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now to seize fresh opportunities and fuel your portfolio with stocks positioned for growth, innovation, or solid income. There is no reason to settle for ordinary returns.

- Spot untapped growth opportunities by checking out these 3565 penny stocks with strong financials making headlines for financial resilience and overlooked potential.

- Boost your portfolio’s income by targeting these 18 dividend stocks with yields > 3% that consistently deliver yields above 3%.

- Join the AI revolution early by backing these 25 AI penny stocks that are shaping tomorrow’s technology landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:SOLB

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives