Shareholders May Be More Conservative With Lotus Bakeries NV's (EBR:LOTB) CEO Compensation For Now

Key Insights

- Lotus Bakeries to hold its Annual General Meeting on 14th of May

- Salary of €1.17m is part of CEO Jan Marcel Matthieu Boone's total remuneration

- The total compensation is 54% higher than the average for the industry

- Lotus Bakeries' total shareholder return over the past three years was 107% while its EPS grew by 16% over the past three years

Performance at Lotus Bakeries NV (EBR:LOTB) has been reasonably good and CEO Jan Marcel Matthieu Boone has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 14th of May. However, some shareholders will still be cautious of paying the CEO excessively.

Check out our latest analysis for Lotus Bakeries

How Does Total Compensation For Jan Marcel Matthieu Boone Compare With Other Companies In The Industry?

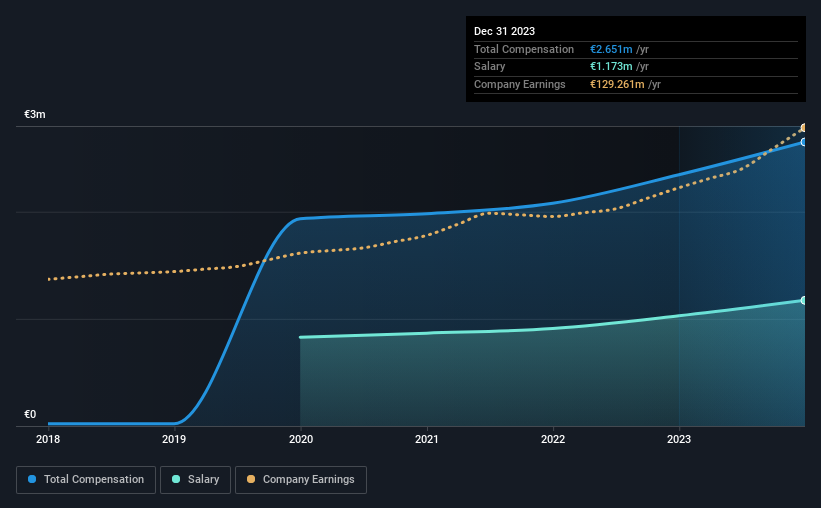

According to our data, Lotus Bakeries NV has a market capitalization of €7.6b, and paid its CEO total annual compensation worth €2.7m over the year to December 2023. That's a notable increase of 13% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at €1.2m.

For comparison, other companies in the Belgian Food industry with market capitalizations ranging between €3.7b and €11b had a median total CEO compensation of €1.7m. Accordingly, our analysis reveals that Lotus Bakeries NV pays Jan Marcel Matthieu Boone north of the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €1.2m | €1.0m | 44% |

| Other | €1.5m | €1.3m | 56% |

| Total Compensation | €2.7m | €2.3m | 100% |

Talking in terms of the broader industry, salary and other compensation roughly make up 50% each, of the total compensation. Lotus Bakeries pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Lotus Bakeries NV's Growth Numbers

Lotus Bakeries NV's earnings per share (EPS) grew 16% per year over the last three years. It achieved revenue growth of 21% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Lotus Bakeries NV Been A Good Investment?

We think that the total shareholder return of 107%, over three years, would leave most Lotus Bakeries NV shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

So you may want to check if insiders are buying Lotus Bakeries shares with their own money (free access).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:LOTB

Lotus Bakeries

Provides various snack products in Belgium and internationally.

Outstanding track record with flawless balance sheet.