3 Stocks That May Be Trading Below Estimated Value In December 2024

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and major indices experiencing both gains and losses during the holiday-shortened week, investors are keenly observing potential opportunities in undervalued stocks. In such a climate, identifying stocks that may be trading below their estimated value can provide a strategic edge, particularly when market volatility presents chances to acquire assets at potentially attractive prices.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$631.28 | MX$1257.07 | 49.8% |

| Round One (TSE:4680) | ¥1310.00 | ¥2617.57 | 50% |

| SKS Technologies Group (ASX:SKS) | A$1.935 | A$3.86 | 49.8% |

| S Foods (TSE:2292) | ¥2745.00 | ¥5472.35 | 49.8% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 49.9% |

| Medley (TSE:4480) | ¥3835.00 | ¥7615.98 | 49.6% |

| Surgical Science Sweden (OM:SUS) | SEK159.60 | SEK317.20 | 49.7% |

| Beijing LeiKe Defense Technology (SZSE:002413) | CN¥4.53 | CN¥9.01 | 49.7% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.90 | 49.9% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.53 | CN¥126.46 | 49.8% |

Let's explore several standout options from the results in the screener.

Solvay (ENXTBR:SOLB)

Overview: Solvay SA is a global provider of advanced materials and specialty chemicals, with a market cap of approximately €3.22 billion.

Operations: The company's revenue is primarily derived from Basic Chemicals (€3.23 billion), Performance Chemicals (€2.02 billion), and Corporate & Business Services (€130 million).

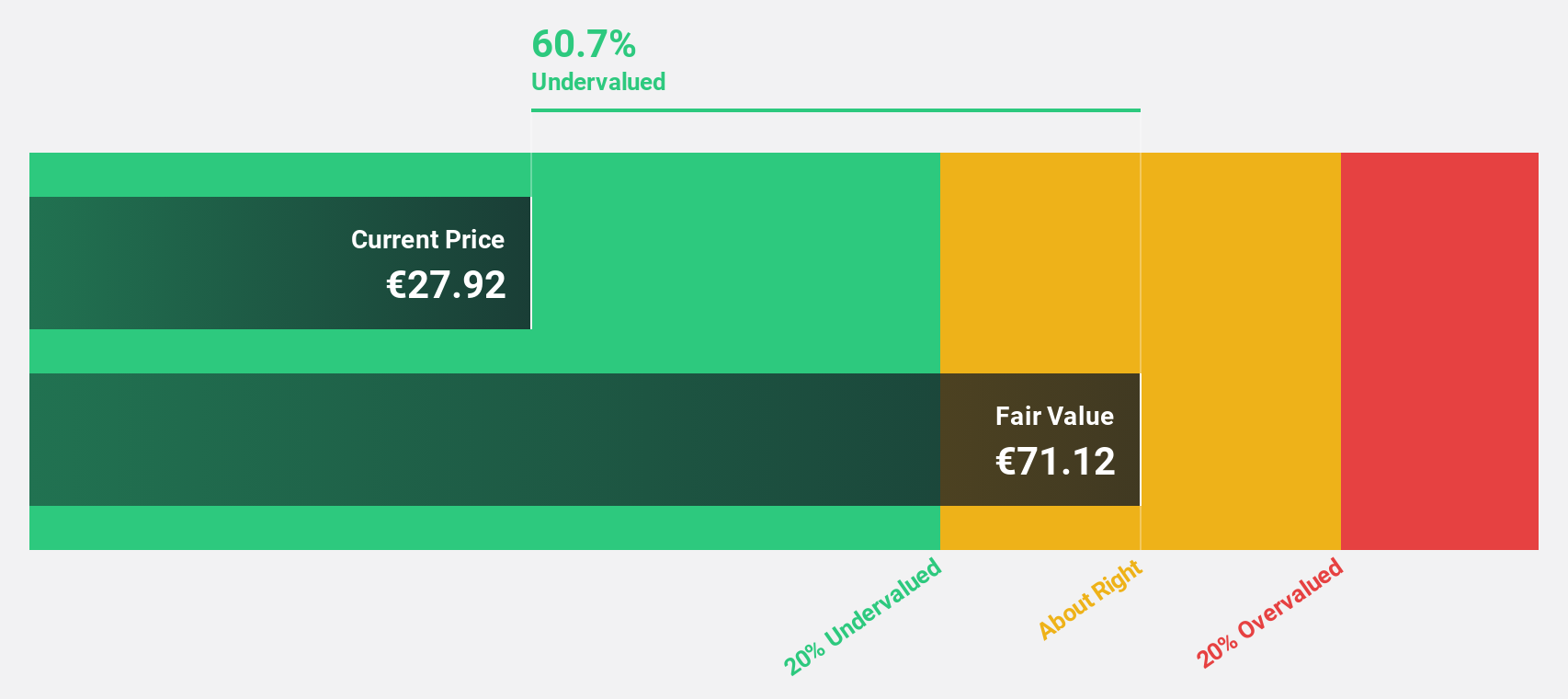

Estimated Discount To Fair Value: 43.4%

Solvay is trading at €30.82, significantly below its estimated fair value of €54.41, indicating it may be undervalued based on cash flows. Despite high debt and a dividend not well covered by earnings or free cash flows, Solvay's earnings are forecast to grow 44.48% annually, surpassing market expectations over the next three years. Recent results show decreased revenue and net income compared to last year but highlight potential for profitability improvement.

- Our earnings growth report unveils the potential for significant increases in Solvay's future results.

- Click here to discover the nuances of Solvay with our detailed financial health report.

Sri Trang Agro-Industry (SET:STA)

Overview: Sri Trang Agro-Industry Public Company Limited, along with its subsidiaries, is engaged in the manufacturing and distribution of natural rubber products across Thailand, China, the United States, Singapore, Japan, and other international markets with a market cap of THB27.03 billion.

Operations: The company's revenue primarily comes from its Natural Rubbers segment, generating THB86.85 billion, followed by the Gloves segment with THB23.30 billion.

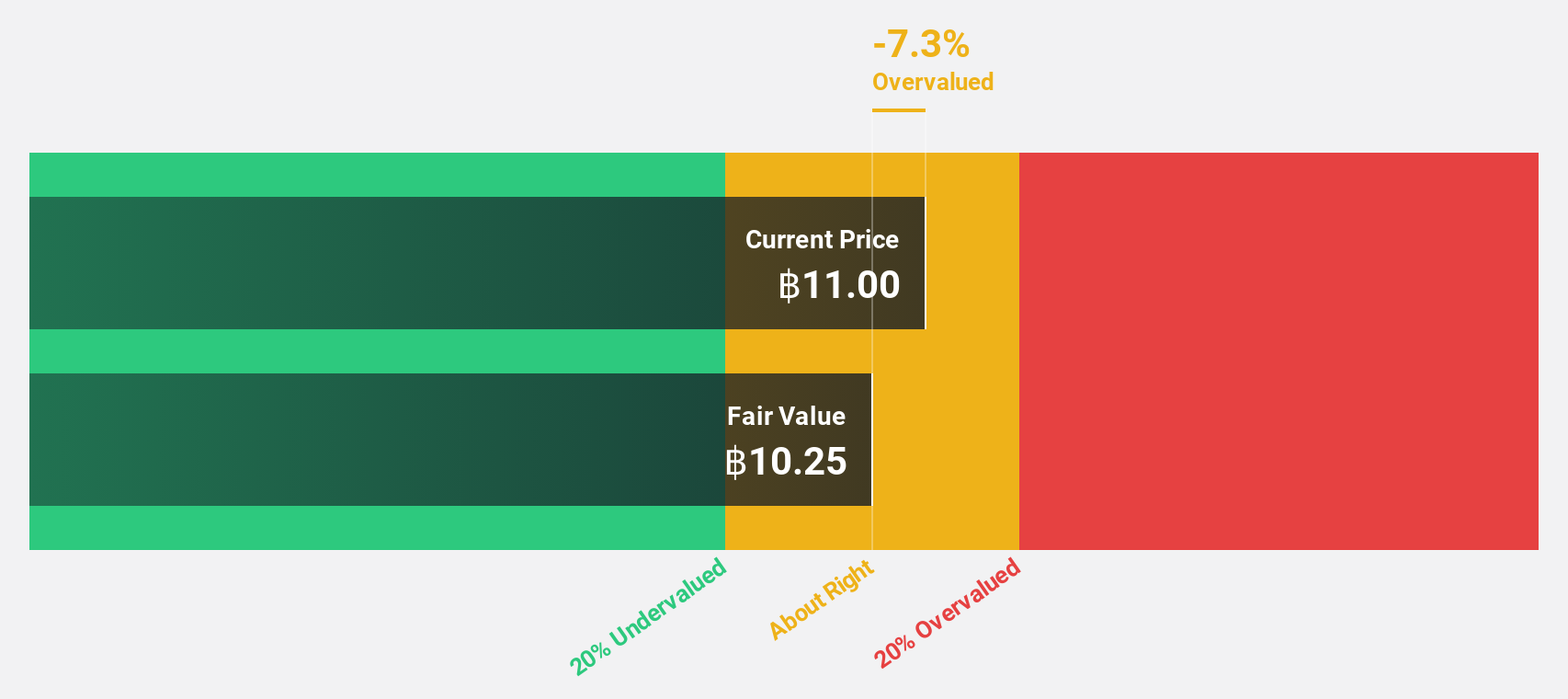

Estimated Discount To Fair Value: 36.2%

Sri Trang Agro-Industry is trading at THB18.1, well below its estimated fair value of THB28.38, reflecting potential undervaluation based on cash flows. The company reported a turnaround with net income of THB 517.29 million for the third quarter, contrasting a loss last year. However, profit margins have decreased to 0.4%. While earnings are expected to grow significantly at 54.2% annually, interest payments remain inadequately covered by earnings and dividends are not well supported by cash flows.

- Our expertly prepared growth report on Sri Trang Agro-Industry implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Sri Trang Agro-Industry with our comprehensive financial health report here.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. is a company involved in the development and commercialization of biopharmaceutical products, with a market cap of CN¥16.58 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, amounting to CN¥488.45 million.

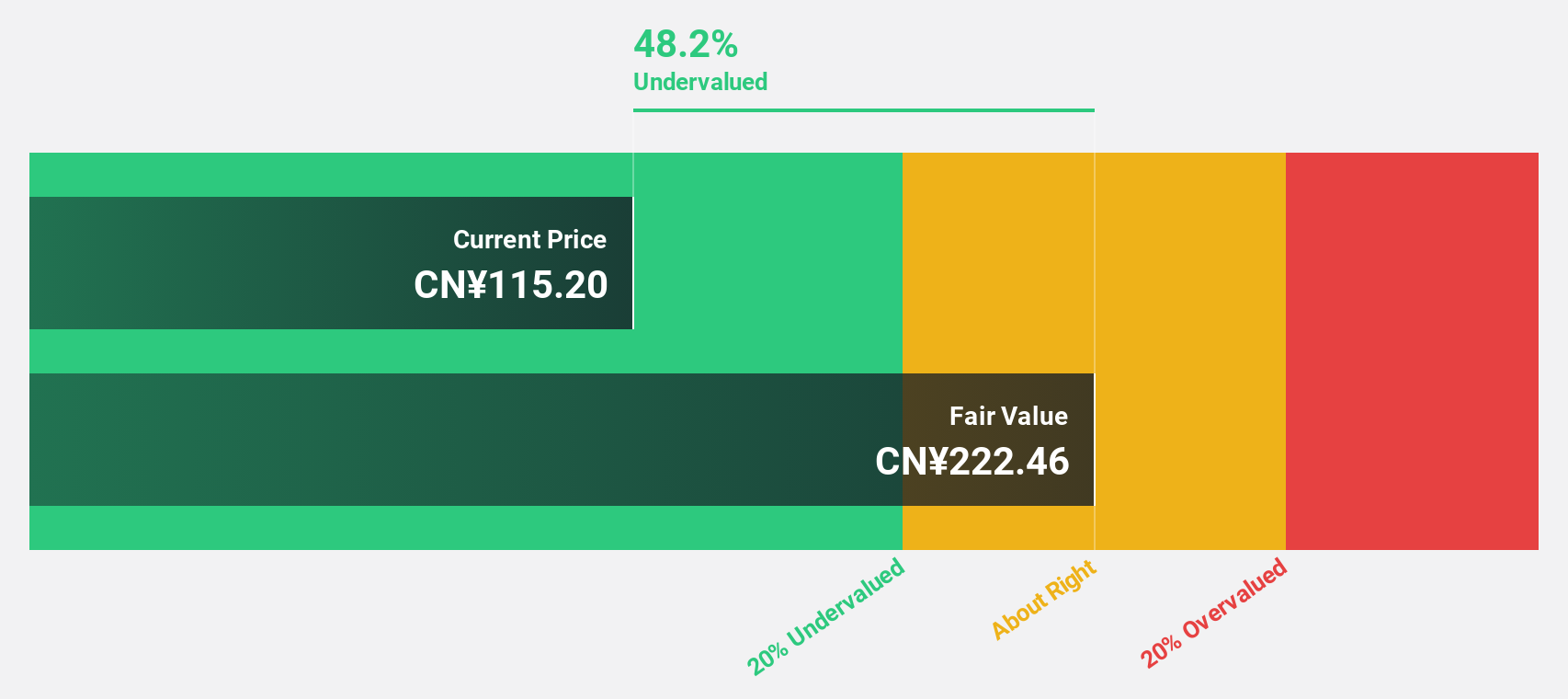

Estimated Discount To Fair Value: 49.8%

Suzhou Zelgen Biopharmaceuticals is trading at CN¥63.53, significantly below its estimated fair value of CN¥126.46, highlighting its undervaluation based on cash flows. The company reported sales of CN¥384.12 million for the first nine months of 2024, up from CN¥282.1 million a year ago, with net losses narrowing to CN¥97.9 million from CN¥202.09 million previously. Revenue growth is projected to outpace the market significantly at 59.6% annually over the next three years.

- The growth report we've compiled suggests that Suzhou Zelgen BiopharmaceuticalsLtd's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Suzhou Zelgen BiopharmaceuticalsLtd's balance sheet health report.

Summing It All Up

- Gain an insight into the universe of 874 Undervalued Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:SOLB

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives