Will US Expansion and Michelob ULTRA Investment Shift Anheuser-Busch InBev's (ENXTBR:ABI) Growth Narrative?

Reviewed by Sasha Jovanovic

- In late September 2025, Anheuser-Busch announced a US$7.4 million investment to upgrade brewing and packaging equipment at its Los Angeles brewery to boost Michelob ULTRA production in response to demand for new can sizes and formats as part of its wider “Brewing Futures” initiative, with over US$300 million earmarked for U.S. operations.

- This investment, along with a US$9 million expansion for Beyond Beer products in New York, highlights AB InBev’s focus on supporting manufacturing jobs, expanding capacity for high-growth brands, and increasing portfolio diversification ahead of major sporting events in Los Angeles.

- We'll now explore how these US production upgrades and product expansions may influence Anheuser-Busch InBev’s long-term growth narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Anheuser-Busch InBev Investment Narrative Recap

To be a shareholder in Anheuser-Busch InBev, you need to believe in the company’s ability to leverage global premiumization trends, expand into new beverage categories, and maintain strong cash flows despite economic uncertainty in key markets. The recent US$7.4 million investment in Los Angeles and related capacity expansions are aligned with growth catalysts but are not material enough to outweigh the near-term headwinds posed by volume declines in emerging markets or shifts in consumer preferences, which remain the most important short-term catalyst and risk, respectively.

The August 2025 announcement of a US$9 million investment in New York to expand production of Beyond Beer products stands out here, reinforcing AB InBev’s efforts to diversify its portfolio and participate in higher growth, non-traditional segments, a catalyst that could help counterbalance risks linked to declining core mainstream lager volumes and evolving consumer tastes.

By contrast, one risk investors should be aware of is the company’s high leverage and net debt levels, which if macro volatility persists...

Read the full narrative on Anheuser-Busch InBev (it's free!)

Anheuser-Busch InBev is projected to reach $67.7 billion in revenue and $9.7 billion in earnings by 2028. This outlook is based on an assumed 5.0% annual revenue growth rate and a $2.6 billion increase in earnings from $7.1 billion currently, reflecting analyst expectations over the next three years.

Uncover how Anheuser-Busch InBev's forecasts yield a €67.44 fair value, a 32% upside to its current price.

Exploring Other Perspectives

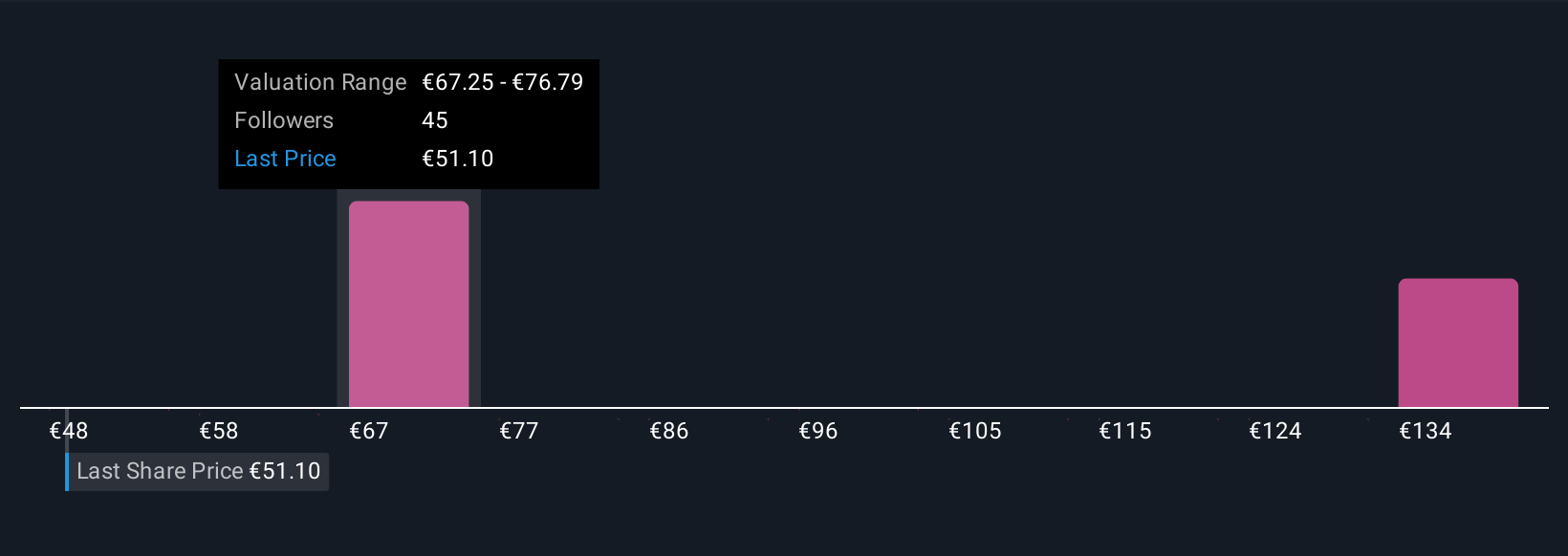

Simply Wall St Community members shared 11 distinct fair value estimates for ABI, ranging from €48.18 to €143.54 per share. These broad views accompany ongoing margin improvement, yet consensus spotlights slower-than-market revenue growth, so consider several perspectives to assess the bigger picture.

Explore 11 other fair value estimates on Anheuser-Busch InBev - why the stock might be worth 6% less than the current price!

Build Your Own Anheuser-Busch InBev Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Anheuser-Busch InBev research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Anheuser-Busch InBev research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Anheuser-Busch InBev's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:ABI

Anheuser-Busch InBev

Produces, distributes, exports, markets, and sells beer in North America, Middle Americas, South America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)