As the pan-European STOXX Europe 600 Index rose by 1.40% amid optimism over potential U.S. rate cuts, European markets have shown resilience, with key indices like Italy's FTSE MIB and the UK's FTSE 100 reaching new highs. In this context of renewed investor confidence and expanding business activity in the eurozone, identifying promising small-cap stocks can be particularly rewarding for those looking to uncover hidden opportunities in Europe's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Exmar (ENXTBR:EXM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Exmar NV provides shipping and floating infrastructure solutions globally, with a market capitalization of €592.70 million.

Operations: Exmar NV generates revenue primarily from its Infrastructure segment at $212.16 million and Shipping segment at $142.83 million, complemented by Supporting Services contributing $90.18 million. The company experiences eliminations of -$10.28 million in its revenue streams.

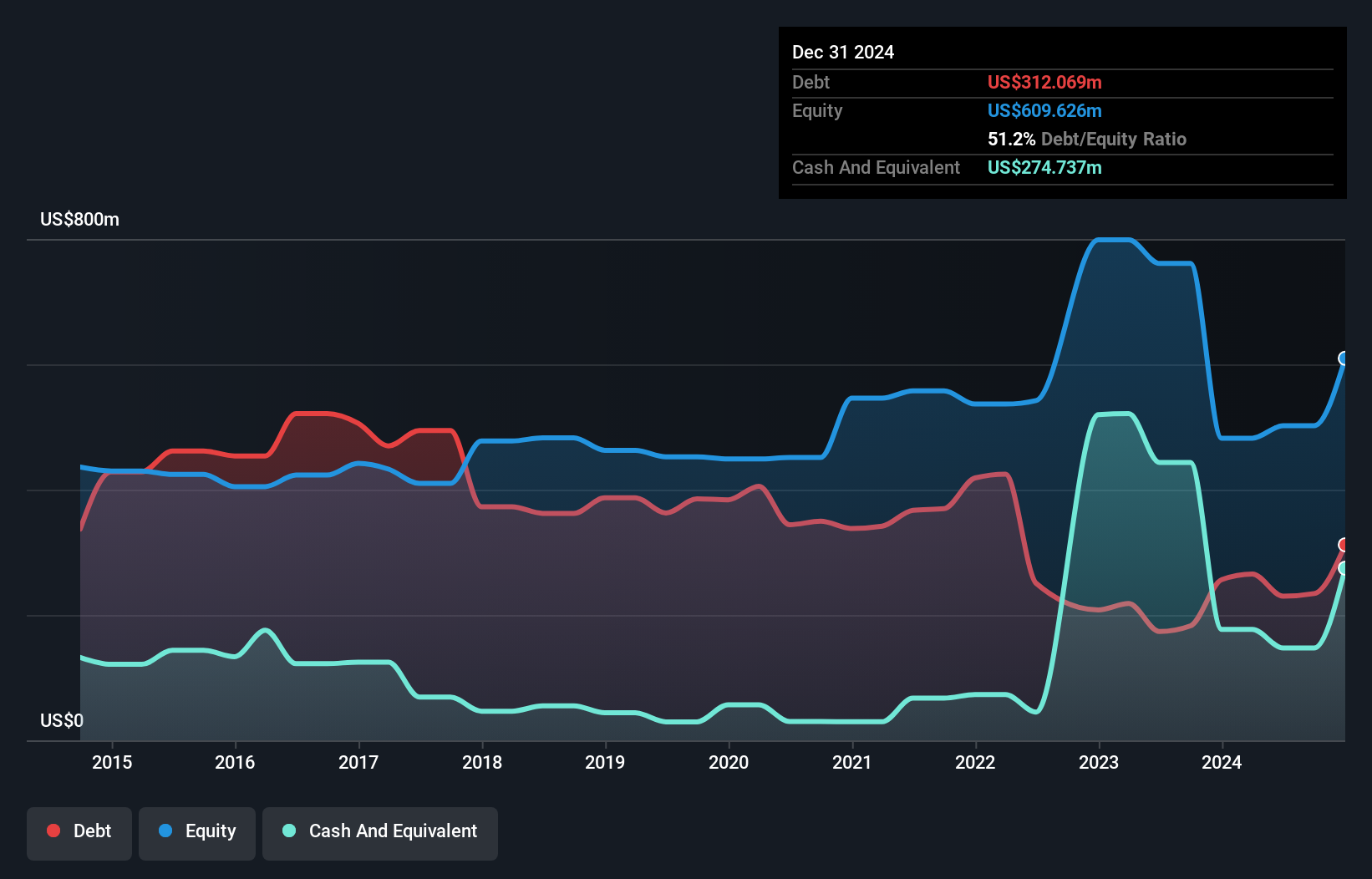

Exmar, a nimble player in the oil and gas sector, has shown impressive earnings growth of 151.5% over the past year, outpacing the industry's -30.3%. Trading at 36% below its estimated fair value, it presents an intriguing opportunity for those eyeing undervalued stocks. The company's debt management seems prudent with a net debt to equity ratio of 6.1%, deemed satisfactory as it is well below industry norms. Despite recent share price volatility, Exmar's interest payments are comfortably covered by EBIT at seven times over, and its high level of non-cash earnings suggests robust financial health moving forward.

Toyota Caetano Portugal (ENXTLS:SCT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Toyota Caetano Portugal, S.A. imports, assembles, and commercializes light and heavy vehicles with a market capitalization of €222.25 million.

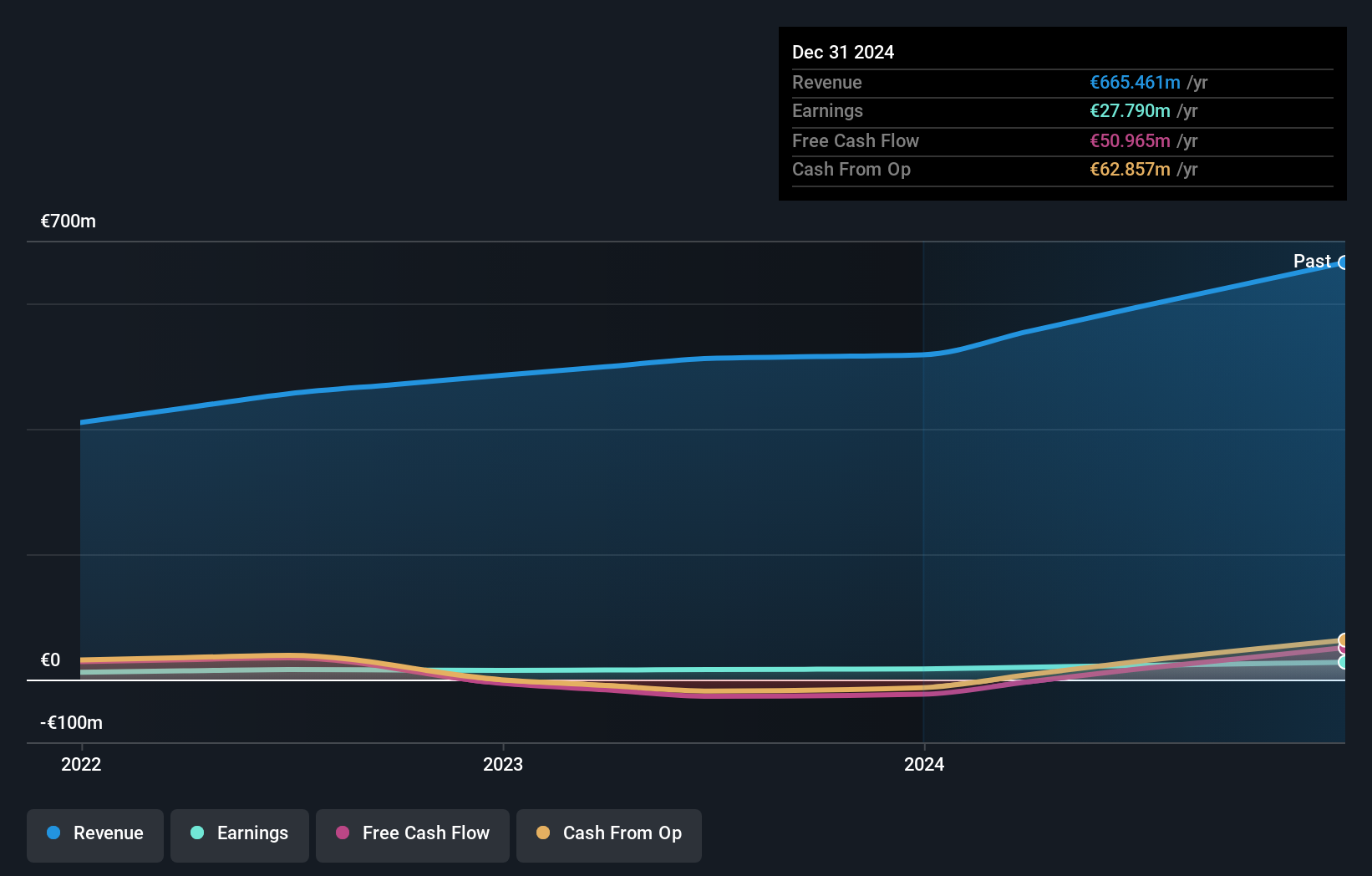

Operations: Toyota Caetano Portugal generates significant revenue from the domestic commercialization of motor vehicles, amounting to €824.71 million, followed by external motor vehicle industry sales at €70.01 million. The company also derives income from services and rentals in both the motor vehicles and industrial equipment segments.

Toyota Caetano Portugal, a smaller player in the automotive sector, demonstrates robust financial health with its net debt to equity ratio at 12.4%, which is considered satisfactory. The company has seen impressive earnings growth of 62% over the past year, outpacing the broader auto industry's negative trajectory of -45%. This growth is supported by high-quality earnings and strong interest coverage at 6.9 times EBIT. Although its debt to equity ratio increased from 15.9% to 25.5% over five years, it remains profitable with positive free cash flow and recently declared a €0.35 dividend per share for June 2025 distribution.

Sidetrade (ENXTPA:ALBFR)

Simply Wall St Value Rating: ★★★★★☆

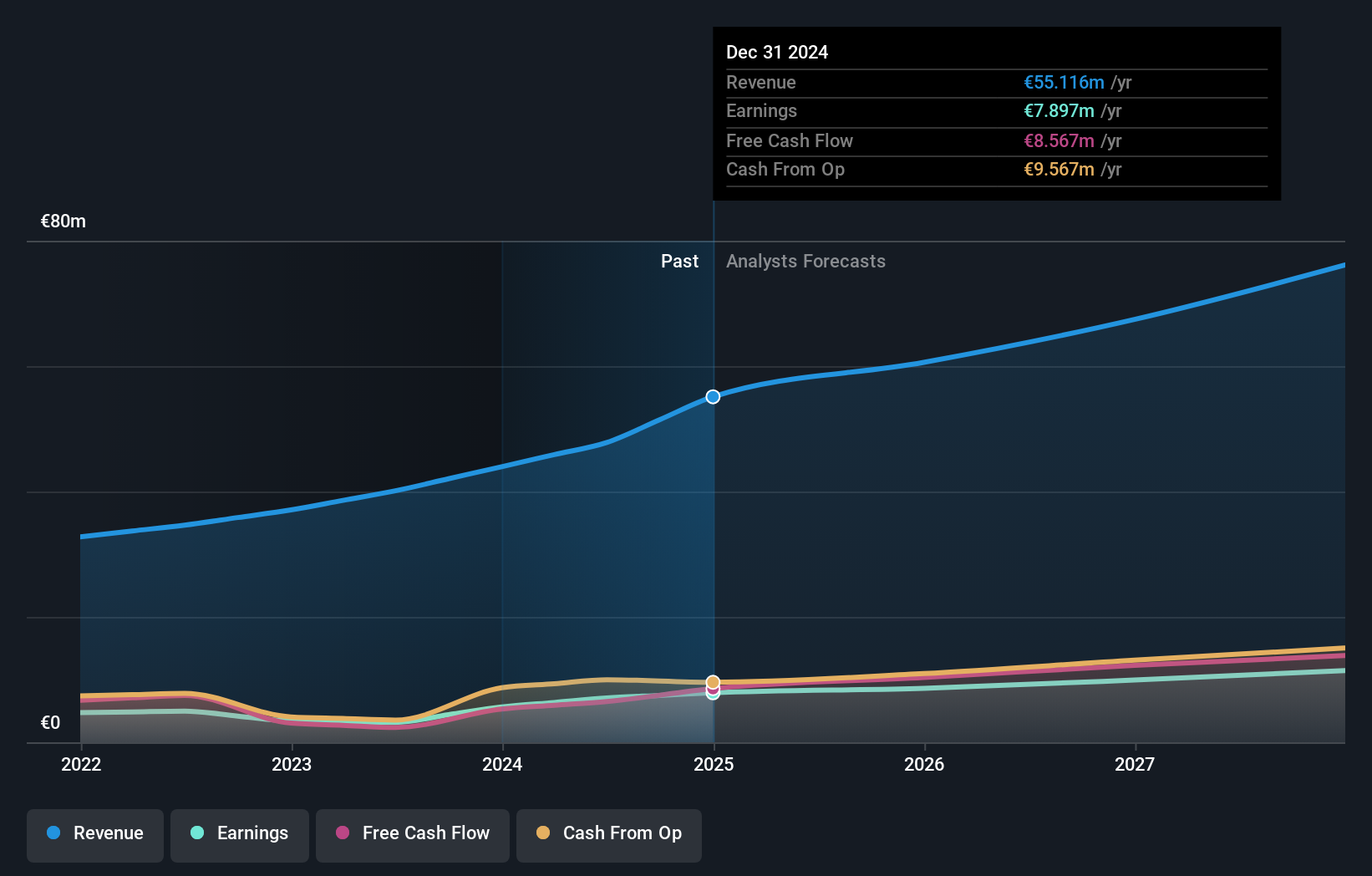

Overview: Sidetrade SA is a SaaS company operating in France and internationally, with a market cap of €306.38 million.

Operations: Sidetrade SA generates revenue primarily from its Software & Programming segment, totaling €55.12 million.

Sidetrade, a noteworthy player in the European tech landscape, has been making waves with its robust financial performance. Over the past year, earnings surged by 40%, outpacing the software industry's 15% growth. The company boasts high-quality earnings and a solid financial structure with cash exceeding total debt. Its interest payments are comfortably covered by EBIT at 168 times over. Despite an increase in debt to equity from 1.9% to 20% over five years, Sidetrade remains free cash flow positive and is forecasted for continued annual earnings growth of around 13%. This paints a promising picture for future prospects in this sector.

- Unlock comprehensive insights into our analysis of Sidetrade stock in this health report.

Review our historical performance report to gain insights into Sidetrade's's past performance.

Key Takeaways

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 326 more companies for you to explore.Click here to unveil our expertly curated list of 329 European Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Toyota Caetano Portugal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:SCT

Toyota Caetano Portugal

Imports, assembles, and commercializes light and heavy vehicles.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)