- Belgium

- /

- Oil and Gas

- /

- ENXTBR:CMBT

Cmb.Tech (ENXTBR:CMBT): Valuation in Focus After Board Changes and Interim Dividend Announcement

Reviewed by Simply Wall St

Cmb.Tech (ENXTBR:CMBT) is grabbing the spotlight as a series of material updates hit the wires: the company just announced the resignation of its chairman Marc Saverys from the Supervisory Board, with Patrick de Brabandere stepping in, along with the appointment of Gudrun Janssens as an independent member. In addition to these board changes, Cmb.Tech also affirmed an interim dividend payout of USD 0.05 per share, sharpening focus on its shareholder return strategy. For investors deciding what to do next, these consecutive governance and capital return signals are worth parsing.

This combination of leadership transition and steady cash return comes after a challenging period for Cmb.Tech’s share price. While the confirmed dividend may offer some reassurance, the stock has trended downward this year, shedding 44% over the past twelve months and continuing to slide in recent months. Even so, with revenue and net income showing annual growth and new faces at the board table, questions are swirling about whether momentum is set to shift or if risks remain front and center.

With Cmb.Tech’s valuation now under scrutiny, is the market overlooking hidden value, or are these latest moves simply what is already expected from the company’s next phase?

Price-to-Earnings of 10.7x: Is it justified?

At a Price-to-Earnings (PE) ratio of 10.7x, Cmb.Tech is currently trading below both the European Oil and Gas industry average of 11.5x and the peer group average of 10.9x. This indicates that the stock appears undervalued compared to sector benchmarks.

The PE ratio measures how much investors are willing to pay for each euro of earnings. It is a common way to assess value in capital-intensive, profit-driven sectors like oil and gas. For Cmb.Tech, a lower PE compared to peers suggests that the market may be overlooking the company’s earnings potential or has a more cautious outlook on future profits.

This discrepancy could point to an opportunity for value-oriented investors, particularly given the company’s positive profit forecasts. However, it also raises questions about whether recent challenges or risks are causing sustained skepticism in the market.

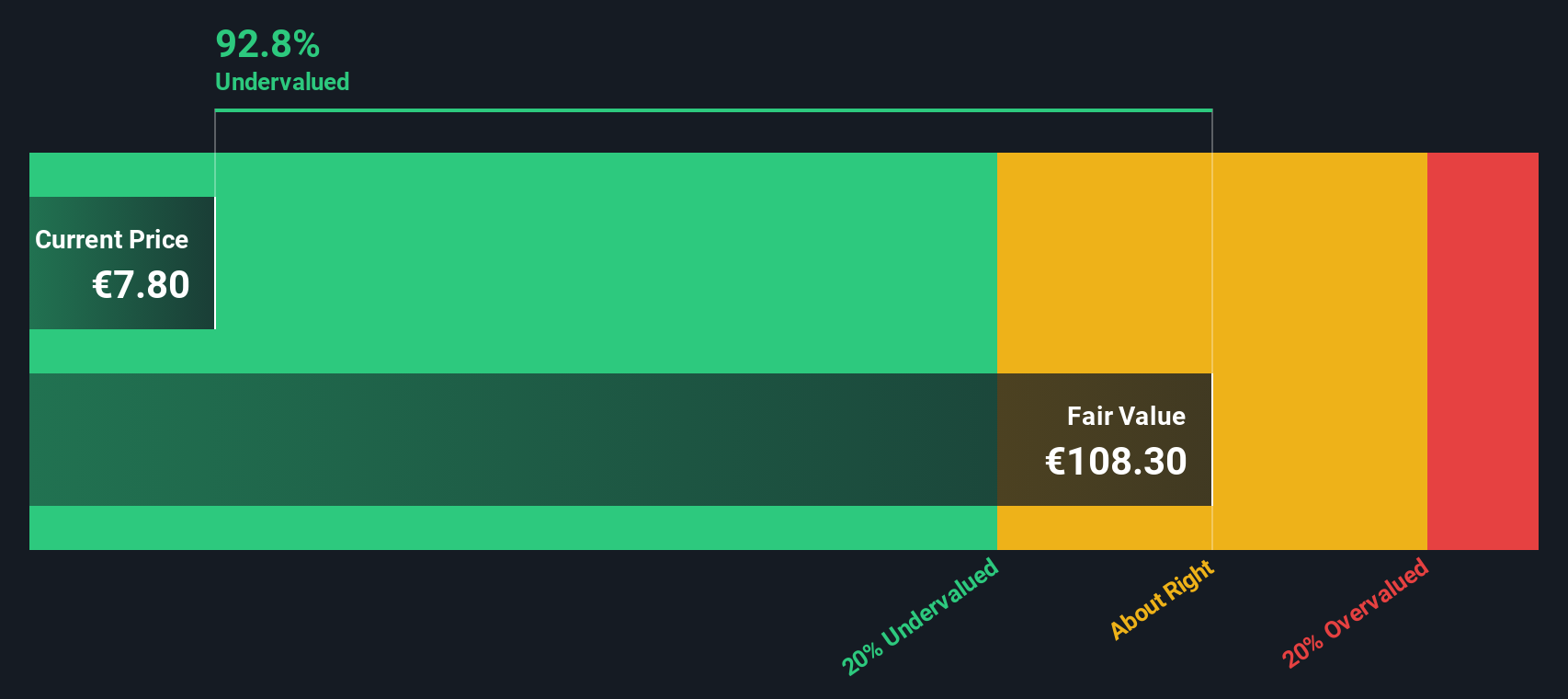

Result: Fair Value of €7.68 (UNDERVALUED)

See our latest analysis for Cmb.Tech.However, recent share price declines and lingering market skepticism about long-term profitability remain meaningful risks that could challenge the case for a turnaround.

Find out about the key risks to this Cmb.Tech narrative.Another View: What Does the DCF Say?

Looking beyond the standard valuation multiple, our DCF model paints a much larger discount than what earnings suggest. This approach uses future cash flows to estimate value and offers a fresh perspective. Could this point to deeper upside, or are there hidden risks that the market sees?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cmb.Tech Narrative

If you see things differently or want to explore the numbers in your own way, you can shape your personal investment view in just minutes. Do it your way

A great starting point for your Cmb.Tech research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

If you want an edge in today's market, check out smarter ways to find growth, value, or future trends. Missing these opportunities could mean leaving potential gains on the table.

- Uncover big yield potential by scanning for companies offering strong payouts and steady income through our dividend stocks with yields > 3%.

- Tap into future-defining trends by selecting innovators advancing medicine and patient care via healthcare AI stocks.

- Catch the next wave of growth by targeting undervalued businesses showing powerful cash flow signals using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTBR:CMBT

Exceptional growth potential with medium-low risk and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026