Unsurprisingly, Fountain S.A.'s (EBR:FOU) stock price was strong on the back of its healthy earnings report. However, we think that shareholders may be missing some concerning details in the numbers.

Check out our latest analysis for Fountain

A Closer Look At Fountain's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

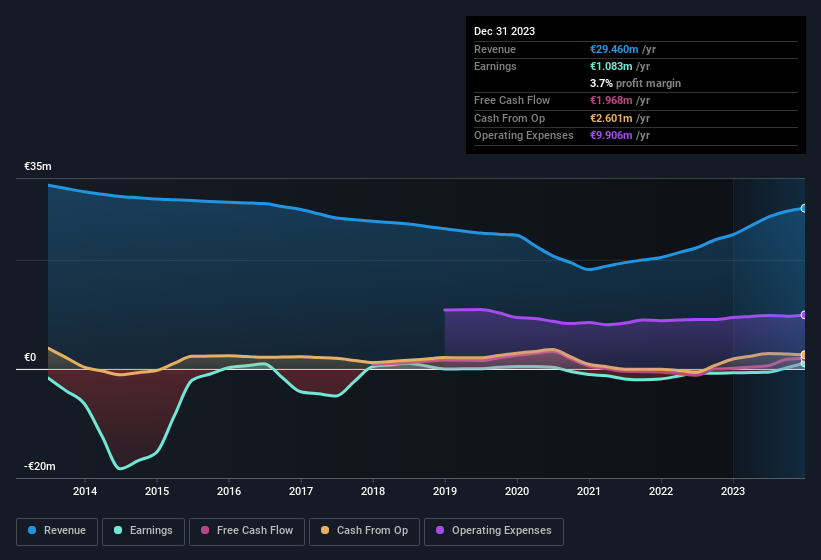

Fountain has an accrual ratio of -0.12 for the year to December 2023. That indicates that its free cash flow was a fair bit more than its statutory profit. To wit, it produced free cash flow of €2.0m during the period, dwarfing its reported profit of €1.08m. Fountain shareholders are no doubt pleased that free cash flow improved over the last twelve months. Importantly, we note an unusual tax situation, which we discuss below, has impacted the accruals ratio.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Fountain.

An Unusual Tax Situation

Moving on from the accrual ratio, we note that Fountain profited from a tax benefit which contributed €349k to profit. This is meaningful because companies usually pay tax rather than receive tax benefits. We're sure the company was pleased with its tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On Fountain's Profit Performance

While Fountain's accrual ratio stands testament to its strong cashflow, and indicates good quality earnings, the fact that it received a tax benefit suggests that this year's profit may not be a great guide to its sustainable profit run-rate. Having considered these factors, we don't think Fountain's statutory profits give an overly harsh view of the business. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Our analysis shows 3 warning signs for Fountain (2 don't sit too well with us!) and we strongly recommend you look at these bad boys before investing.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you're looking to trade Fountain, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:FOU

Fountain

Engages in the sale, rental, and provision of machines for cold and hot drinks made from freeze-dried or grain products in in France, Belgium, the Netherlands, and rest of European Countries.

Solid track record and good value.

Market Insights

Community Narratives