Undiscovered European Gems With Promising Potential In September 2025

Reviewed by Simply Wall St

In recent weeks, the European market has seen mixed performance across major indices, with the pan-European STOXX Europe 600 Index ending slightly lower as investors processed various monetary policy decisions. Amid this backdrop of cautious optimism and economic recalibration, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking opportunities in smaller-cap segments.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Moury Construct | 1.73% | 11.11% | 23.28% | ★★★★★☆ |

| Dekpol | 64.28% | 10.52% | 14.34% | ★★★★★☆ |

| Sparta | NA | -9.54% | -15.40% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Moury Construct (ENXTBR:MOUR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Moury Construct SA operates in the construction and renovation sector, focusing on both residential and non-residential buildings for private and public markets in Belgium, with a market capitalization of €237.55 million.

Operations: Moury Construct generates revenue primarily from construction and renovation projects in Belgium's residential and non-residential sectors. The company's financial performance is reflected in its market capitalization of €237.55 million.

Moury Construct, a smaller player in the construction sector, recently reported half-year sales of €124.91 million, up from €97.97 million the previous year. Despite this growth in revenue to €125.92 million from €98.97 million and net income rising to €15.26 million from €14.2 million, earnings growth over the past year was negative at -3.4%, contrasting with the industry's 19% average increase. The company is trading at 34% below its estimated fair value and maintains high-quality earnings with positive free cash flow of approximately €38.9 as of June 2024, suggesting potential for value appreciation despite challenges in outpacing industry peers.

- Navigate through the intricacies of Moury Construct with our comprehensive health report here.

Gain insights into Moury Construct's past trends and performance with our Past report.

Linedata Services (ENXTPA:LIN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Linedata Services S.A. is a company that develops, publishes, and distributes financial software across Southern Europe, Northern Europe, North America, and Asia with a market capitalization of €286.81 million.

Operations: Linedata Services generates revenue primarily from the development, publication, and distribution of financial software across various regions. The company's market capitalization stands at €286.81 million.

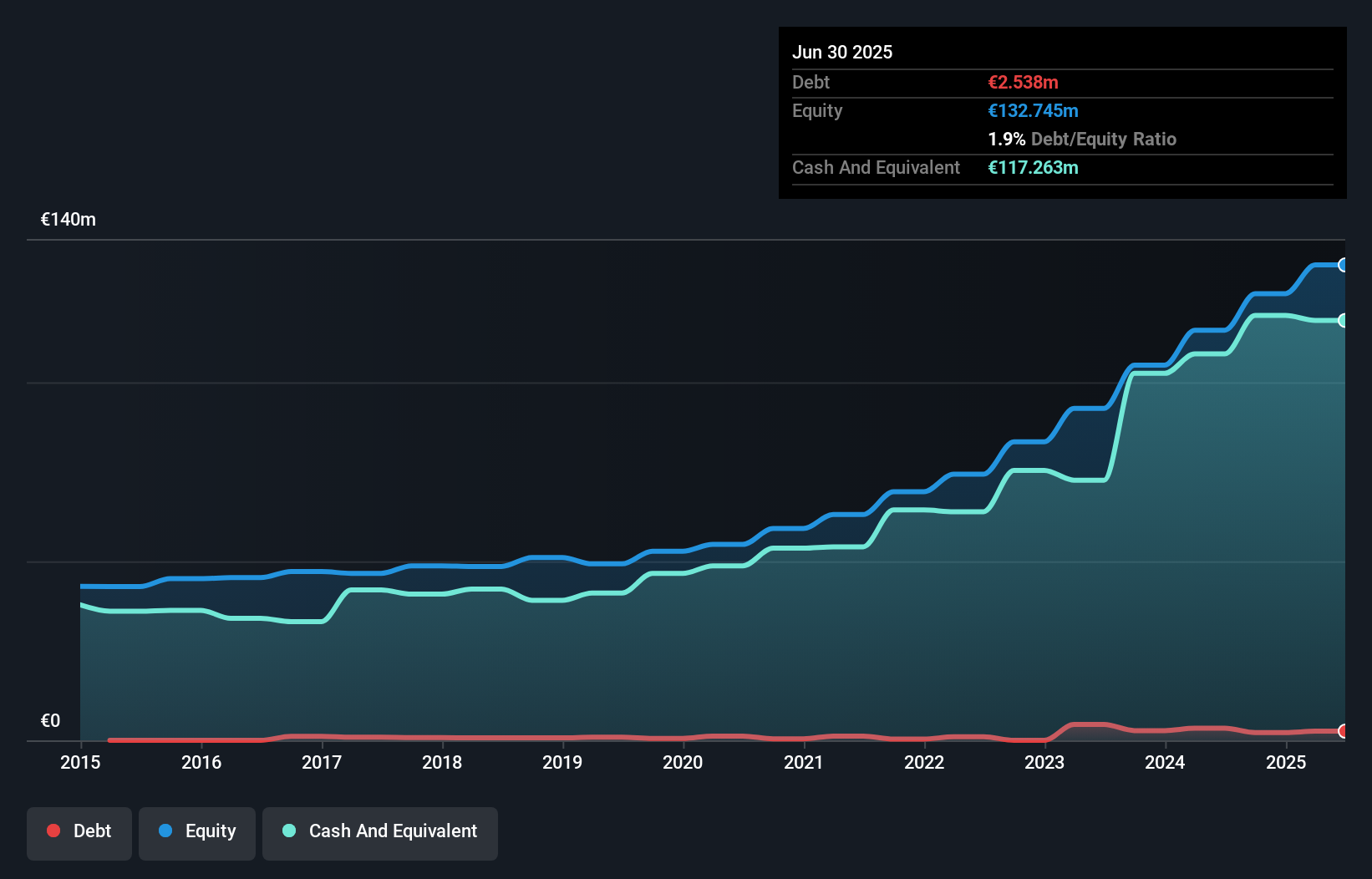

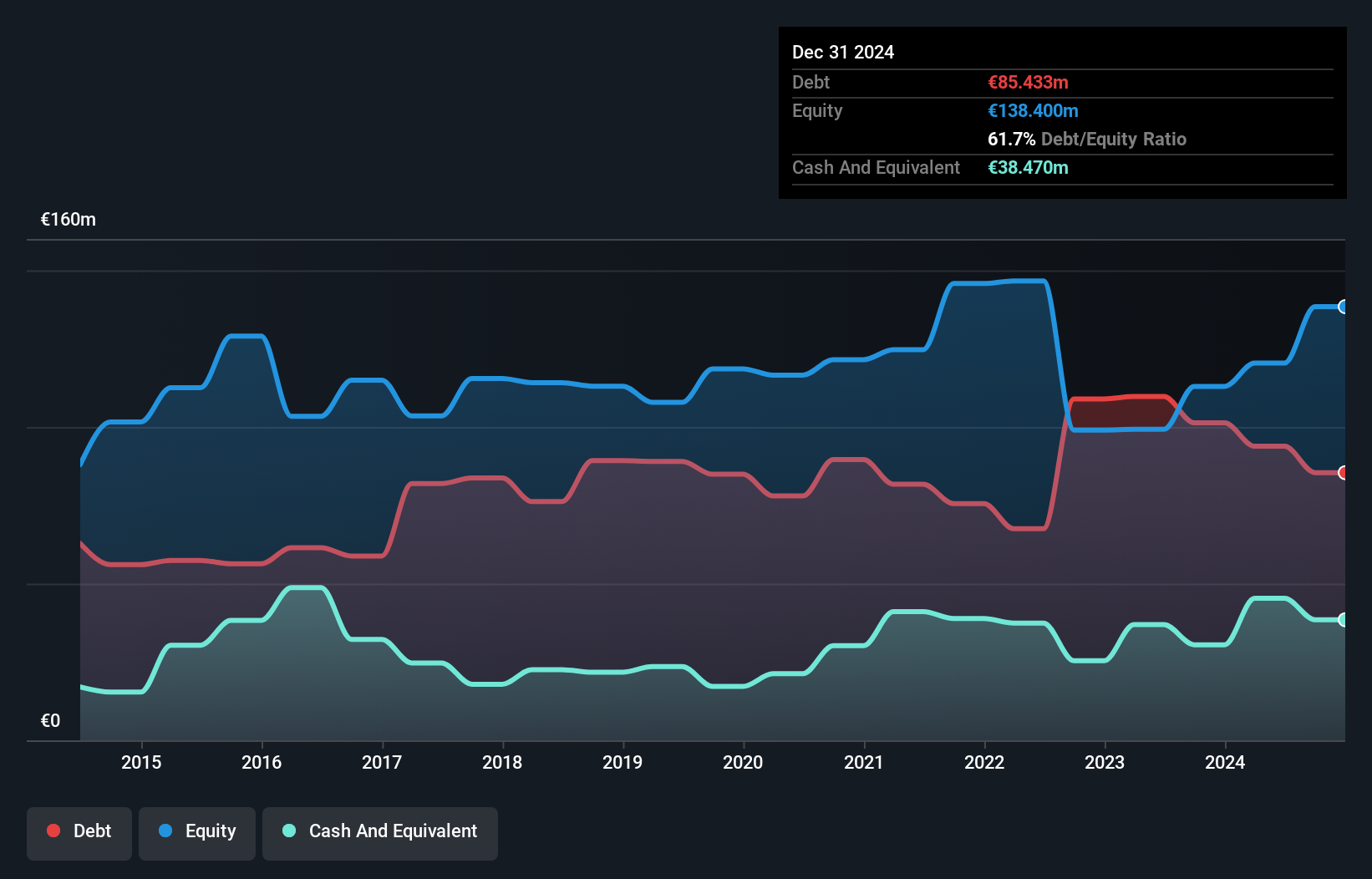

Linedata Services, a notable player in the European software landscape, recently joined the CAC Small and All-Tradable indices. Despite a dip in revenue to €86.6 million from €89.7 million and net income dropping to €8 million from €10.6 million for the half-year ending June 2025, it remains on solid financial ground with free cash flow positivity and high-quality earnings. The company's net debt to equity ratio of 43% is considered elevated but manageable given its EBIT covers interest payments by 9.2 times. Trading at nearly 28% below estimated fair value suggests potential upside as earnings are expected to grow annually by 5.7%.

- Get an in-depth perspective on Linedata Services' performance by reading our health report here.

Assess Linedata Services' past performance with our detailed historical performance reports.

Fabryka Farb i Lakierów Sniezka (WSE:SKA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fabryka Farb i Lakierów Sniezka SA is a company that manufactures and sells decorative paints across Poland, Hungary, Ukraine, Belarus, and other international markets with a market cap of PLN1.06 billion.

Operations: Sniezka generates revenue primarily from its paint and related products, amounting to PLN776.12 million.

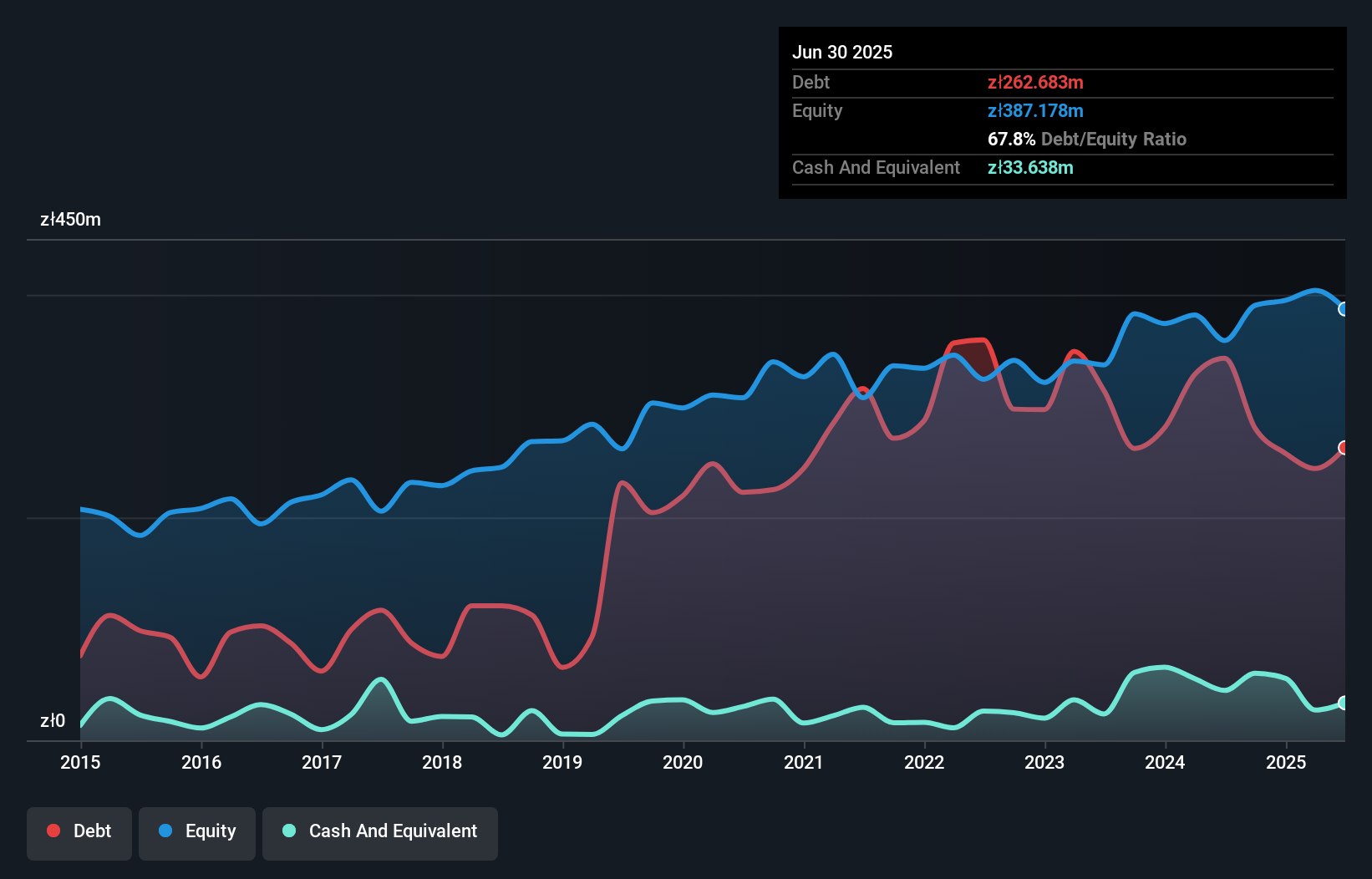

Sniezka, a notable player in the European paint industry, shows promise with its earnings growth of 0.03%, outpacing the broader Chemicals sector's -3.3%. Trading at 35.5% below estimated fair value, it offers potential upside for investors seeking undervalued opportunities. Despite a high net debt to equity ratio of 55.9%, interest payments are well-covered by EBIT at 5.9x, reflecting financial resilience amid challenges. The company's debt to equity ratio has improved from 72.4% to 62.6% over five years, indicating prudent financial management while revenue is projected to grow annually by 8.73%, suggesting robust future prospects in its niche market.

Key Takeaways

- Access the full spectrum of 331 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LIN

Linedata Services

Develops, publishes, and distributes financial software in Southern Europe, Northern Europe, North America, and Asia.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives