- Belgium

- /

- Construction

- /

- ENXTBR:MOUR

Is It Smart To Buy Moury Construct SA (EBR:MOUR) Before It Goes Ex-Dividend?

Moury Construct SA (EBR:MOUR) is about to trade ex-dividend in the next 3 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. This means that investors who purchase Moury Construct's shares on or after the 13th of June will not receive the dividend, which will be paid on the 17th of June.

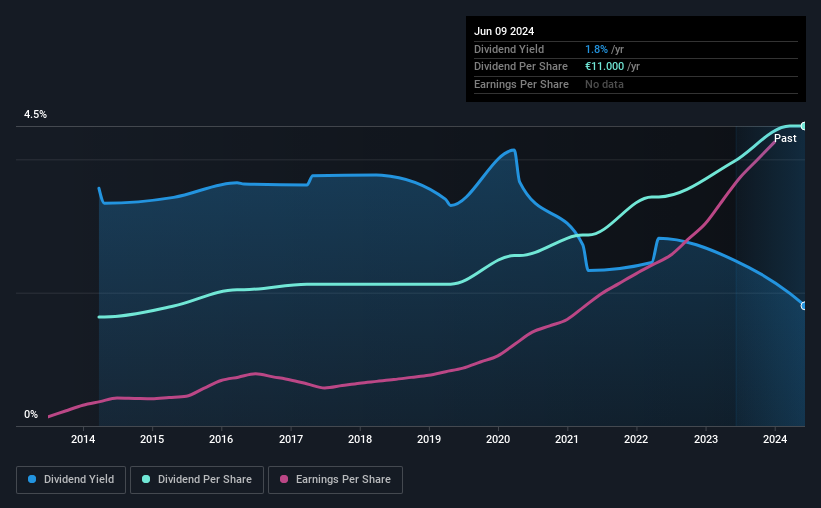

The company's next dividend payment will be €7.70 per share, on the back of last year when the company paid a total of €11.00 to shareholders. Based on the last year's worth of payments, Moury Construct has a trailing yield of 1.8% on the current stock price of €610.00. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Moury Construct

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Moury Construct is paying out just 18% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out 9.0% of its free cash flow as dividends last year, which is conservatively low.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit Moury Construct paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's comforting to see Moury Construct's earnings have been skyrocketing, up 41% per annum for the past five years. With earnings per share growing rapidly and the company sensibly reinvesting almost all of its profits within the business, Moury Construct looks like a promising growth company.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past 10 years, Moury Construct has increased its dividend at approximately 11% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

The Bottom Line

Is Moury Construct an attractive dividend stock, or better left on the shelf? Moury Construct has been growing earnings at a rapid rate, and has a conservatively low payout ratio, implying that it is reinvesting heavily in its business; a sterling combination. Moury Construct looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

In light of that, while Moury Construct has an appealing dividend, it's worth knowing the risks involved with this stock. For example, we've found 1 warning sign for Moury Construct that we recommend you consider before investing in the business.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

If you're looking to trade Moury Construct, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:MOUR

Moury Construct

Engages in the construction and renovation of residential and non-residential buildings for private and public markets in Belgium.

Excellent balance sheet and good value.

Market Insights

Community Narratives