- Belgium

- /

- Trade Distributors

- /

- ENXTBR:AZE

Azelis Group (ENXTBR:AZE): Examining Valuation After Extended Share Price Weakness

Reviewed by Simply Wall St

Most Popular Narrative: 36.5% Undervalued

Based on the most widely followed narrative, Azelis Group shares are currently seen as significantly undervalued, trading far below their calculated fair value.

Azelis Group's organic growth turned positive in Q3 and Q4 of 2024, suggesting improving business conditions and momentum that could lift future revenue and earnings if the trend continues. The company completed 8 acquisitions during 2024 with a strong focus on its strategic markets and indicated a promising M&A pipeline. This could contribute to future revenue growth and potentially expand net margins as synergies are realized.

Curious about the bold financial projections justifying this massive undervaluation? There is one major forecasting assumption driving analyst optimism, and its implications reach far beyond just future profits. Wonder what the analysts are really banking on to support their price target? Unlock the details behind this striking value gap.

Result: Fair Value of €19.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent geopolitical uncertainty and ongoing cost pressures could present significant challenges to the optimistic outlook for Azelis, potentially limiting future revenue and profit growth.

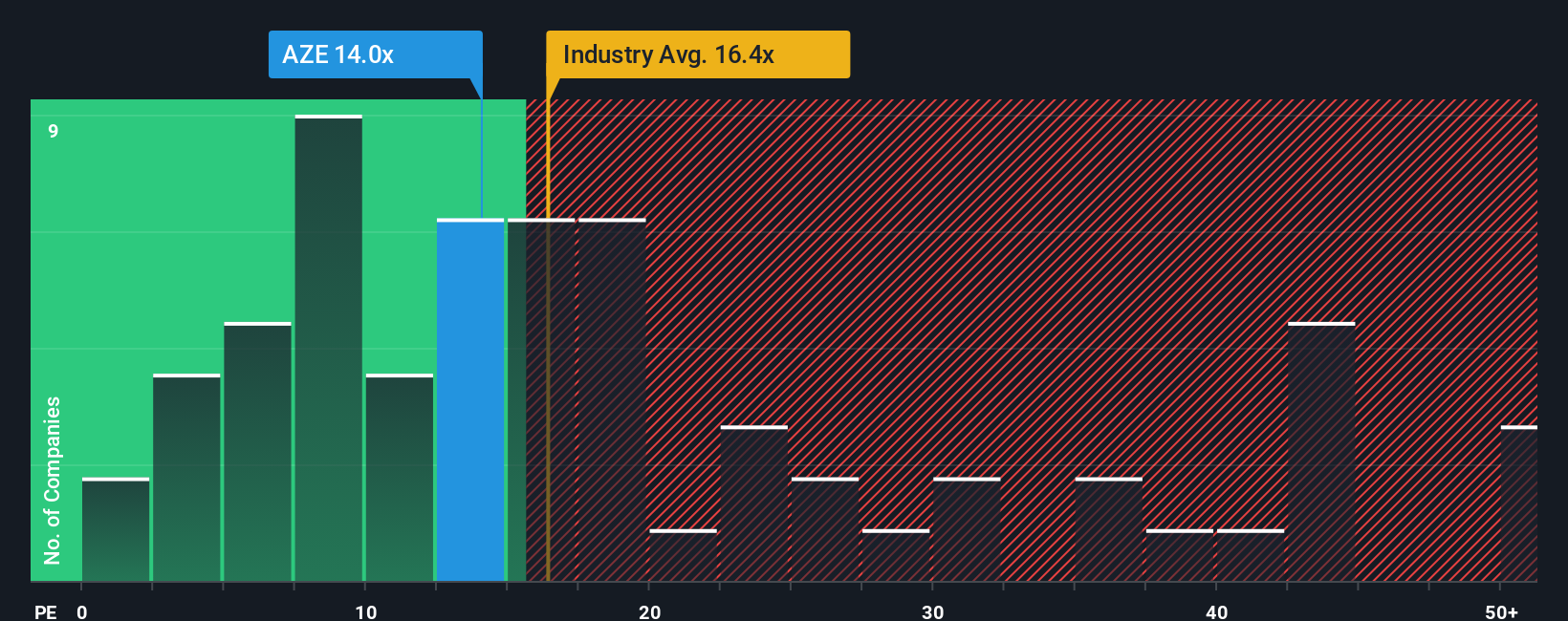

Find out about the key risks to this Azelis Group narrative.Another View: What Do Valuation Multiples Suggest?

Looking at things from a different angle, the current share price appears less attractive when we compare it to others in the industry using standard valuation ratios. This method suggests the stock could be expensive today.

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Azelis Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Azelis Group Narrative

If you see things differently or want to dig into the numbers yourself, you can put together your own view in just a few minutes. Do it your way

A great starting point for your Azelis Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Unlock your advantage this year by stepping up your research with some of the market’s most compelling, unconventional stock ideas. Don’t let great prospects pass you by. The next breakout investment could be just a click away.

- Capture the momentum from undervalued businesses the market has overlooked through our latest selection of undervalued stocks based on cash flows.

- Boost your search with companies pioneering affordable growth and strong balance sheets in our collection of penny stocks with strong financials.

- Tap into game-changing trends in medicine by screening for innovators driving healthcare forward with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:AZE

Azelis Group

Engages in the distribution and sale of specialty chemicals and food ingredients.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives