Virgin Australia Holdings (ASX:VGN): Exploring Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

The recent movement in Virgin Australia Holdings (ASX:VGN) shares might have caught the attention of investors on the lookout for signals about the company’s direction. While there is no single major headline driving the action, these kinds of shifts often spark fresh questions for anyone deciding whether to buy, hold, or sell. Sometimes, even quieter trading periods can open the door to opportunities hiding in plain sight.

Looking back over the month, Virgin Australia Holdings shares have gained nearly 6%, outperforming their pace in the past three months. This shows a steady increase. Annualized revenue is still moving higher, although net income has nudged a bit lower. This combination of modest financial growth and recent share price momentum in a company that has already experienced its share of ups and downs raises interesting questions about whether sentiment is shifting or if these moves are more technical in nature.

After this most recent upswing, is there a genuine bargain hidden in plain sight, or is the market already factoring in all the company’s future prospects?

Price-to-Earnings of 5.2x: Is it justified?

Virgin Australia Holdings is trading at a Price-to-Earnings (P/E) ratio of 5.2x, noticeably lower than both the global airlines industry average of 9.8x and the peer group average of 16.3x. On the surface, this suggests the stock could be undervalued by the market.

The P/E ratio is a commonly used valuation metric that compares a company’s current share price to its earnings per share. For airlines, it is an important indicator because it reflects how much investors are willing to pay for each dollar of profit, taking into account both current financial results and future growth prospects.

This low P/E could indicate an opportunity for investors if Virgin Australia’s earnings are sustainable, but it might also reflect market concern about the airline’s future profit trajectory. In either case, compared to its industry peers, the valuation appears attractive for those comfortable with potential risks.

Result: Fair Value of $3.36 (UNDERVALUED)

See our latest analysis for Virgin Australia Holdings.However, ongoing concerns about declining net income and uncertain profit outlook could quickly change investor sentiment. These factors act as potential risks to the current valuation story.

Find out about the key risks to this Virgin Australia Holdings narrative.Another View: What Does Our DCF Model Say?

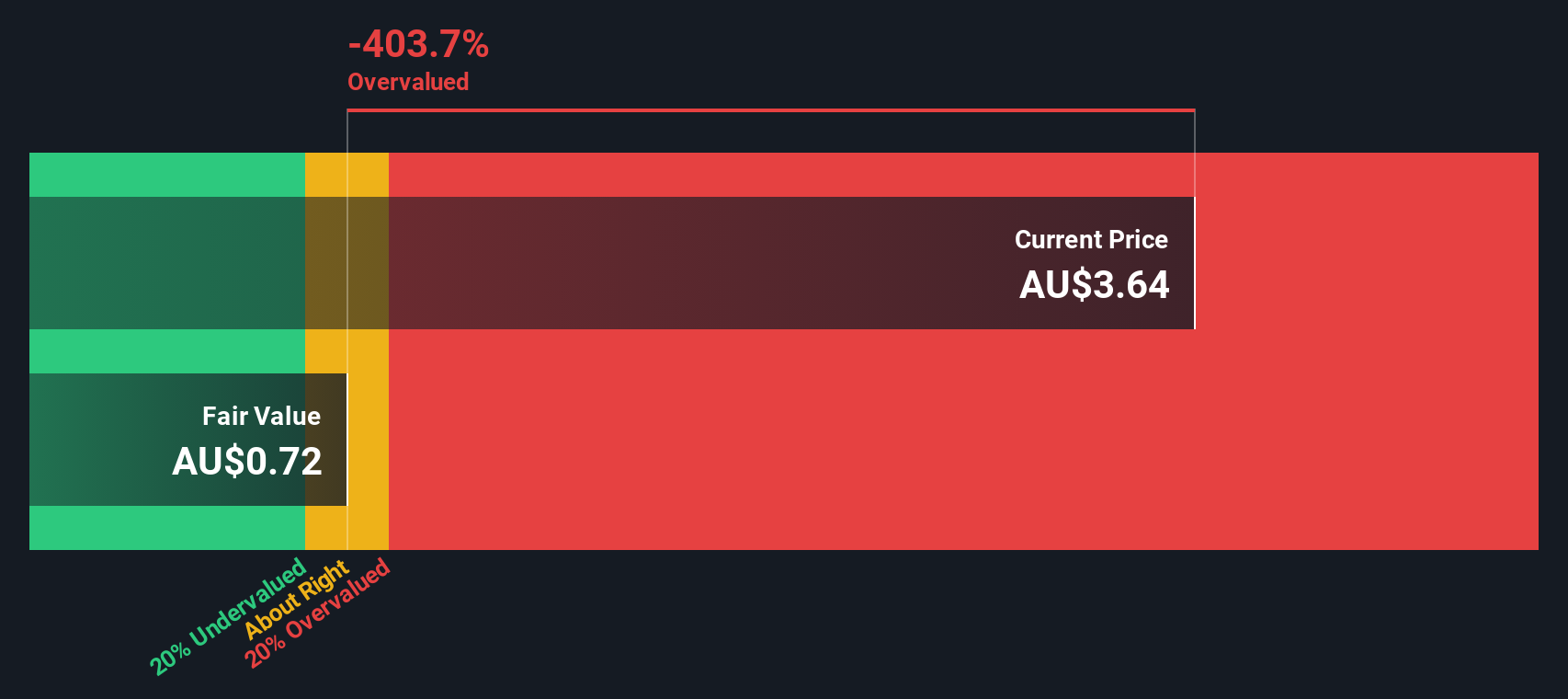

The SWS DCF model takes a different approach by focusing on future cash flows rather than current earnings multiples. This method suggests Virgin Australia Holdings could be overvalued, which raises questions about whether the market's optimism is justified or misplaced.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Virgin Australia Holdings Narrative

If you want to dig deeper or have a different perspective, you can explore the figures yourself and craft your own storyline in just a few minutes. Do it your way

A great starting point for your Virgin Australia Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their options open. If you’re eager to strengthen your portfolio, don’t let these high-potential ideas slip by. Now is the time to act.

- Catch the next wave in tech by searching for AI penny stocks making headlines in artificial intelligence breakthroughs and disruptive innovations.

- Find reliable income streams and maximize yield with dividend stocks with yields > 3% to uncover thriving companies paying attractive dividends above 3%.

- Tap into tomorrow’s markets by scoping out cryptocurrency and blockchain stocks at the intersection of cryptocurrency and blockchain, where finance meets the future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VGN

Virgin Australia Holdings

Provides domestic and international travel services to leisure, corporate and government, regional and charter travel, and air freight customers in Australia.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives