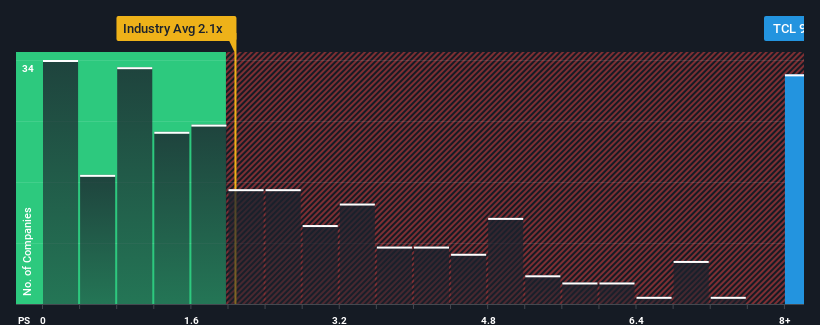

When you see that almost half of the companies in the Infrastructure industry in Australia have price-to-sales ratios (or "P/S") below 2x, Transurban Group (ASX:TCL) looks to be giving off strong sell signals with its 9.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Transurban Group

How Transurban Group Has Been Performing

Recent revenue growth for Transurban Group has been in line with the industry. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Transurban Group.How Is Transurban Group's Revenue Growth Trending?

In order to justify its P/S ratio, Transurban Group would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. Pleasingly, revenue has also lifted 31% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 2.5% per year as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 8.1% each year, which is noticeably more attractive.

With this information, we find it concerning that Transurban Group is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Transurban Group's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Transurban Group, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you take the next step, you should know about the 3 warning signs for Transurban Group (2 are a bit unpleasant!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Transurban Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TCL

Transurban Group

Engages in the development, operation, management, and maintenance of toll road networks in Australia and North America.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026