- Australia

- /

- Infrastructure

- /

- ASX:TCL

Transurban Group (ASX:TCL) delivers shareholders notable 6.3% CAGR over 5 years, surging 5.6% in the last week alone

If you buy and hold a stock for many years, you'd hope to be making a profit. Furthermore, you'd generally like to see the share price rise faster than the market. Unfortunately for shareholders, while the Transurban Group (ASX:TCL) share price is up 11% in the last five years, that's less than the market return. Over the last twelve months the stock price has risen a very respectable 9.2%.

The past week has proven to be lucrative for Transurban Group investors, so let's see if fundamentals drove the company's five-year performance.

While Transurban Group made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, Transurban Group can boast revenue growth at a rate of 8.0% per year. That's a fairly respectable growth rate. The annual gain of 2% over five years is better than nothing, but falls short of the market. You could even argue that the share price was over optimistic, previously.

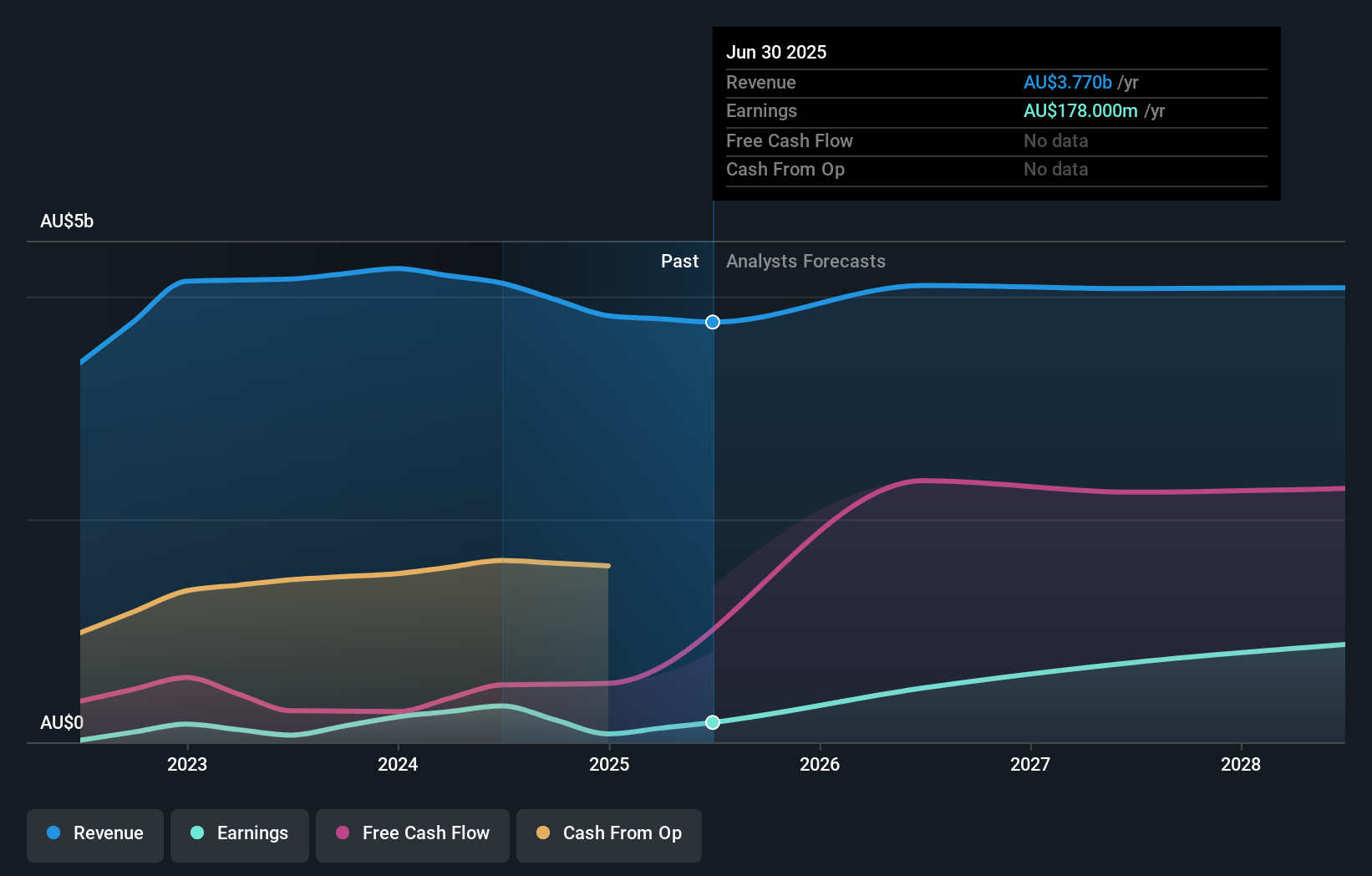

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Transurban Group has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Transurban Group stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Transurban Group, it has a TSR of 36% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Transurban Group shareholders gained a total return of 15% during the year. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 6% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Transurban Group has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Transurban Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TCL

Transurban Group

Engages in the development, operation, management, and maintenance of toll road networks in Australia and North America.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives