- Australia

- /

- Infrastructure

- /

- ASX:TCL

Is Rising September Quarter Traffic Altering the Investment Case for Transurban Group (ASX:TCL)?

Reviewed by Sasha Jovanovic

- Transurban Group announced on October 8, 2025, that it recorded growth in average daily traffic across its portfolio for the September quarter.

- This operational update serves as a positive indicator for long-term performance, reflecting increased mobility and sustained demand for toll road infrastructure.

- To understand how reported traffic growth in the September quarter shapes the investment outlook, we now examine its impact on Transurban’s narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Transurban Group Investment Narrative Recap

To be a Transurban Group shareholder, an investor needs to believe that population growth, urbanization, and a resilient preference for private vehicle travel will keep demand for toll roads strong. The latest news of average daily traffic growth is supportive of this view, but it does not appear to materially change the most influential short-term catalyst, the ramp-up of new projects like the West Gate Tunnel, or address the ongoing regulatory risks in New South Wales. A recent announcement directly relevant to the traffic growth news is the August operating results showing an increase in Average Daily Traffic to 2.52 million for the quarter, up 2.2% year-on-year. This continued uptick in usage comes as Transurban advances major project completions and prepares for new asset openings, factors closely tied to both revenue growth potential and the company's ability to offset rising maintenance costs. However, despite steady traffic, investors should also consider that persistent regulatory uncertainty remains a risk for future toll increases, especially if…

Read the full narrative on Transurban Group (it's free!)

Transurban Group's outlook anticipates A$4.1 billion in revenue and A$959.6 million in earnings by 2028. This scenario assumes a 3.2% annual revenue growth rate and an increase in earnings of A$826.6 million from the current A$133.0 million level.

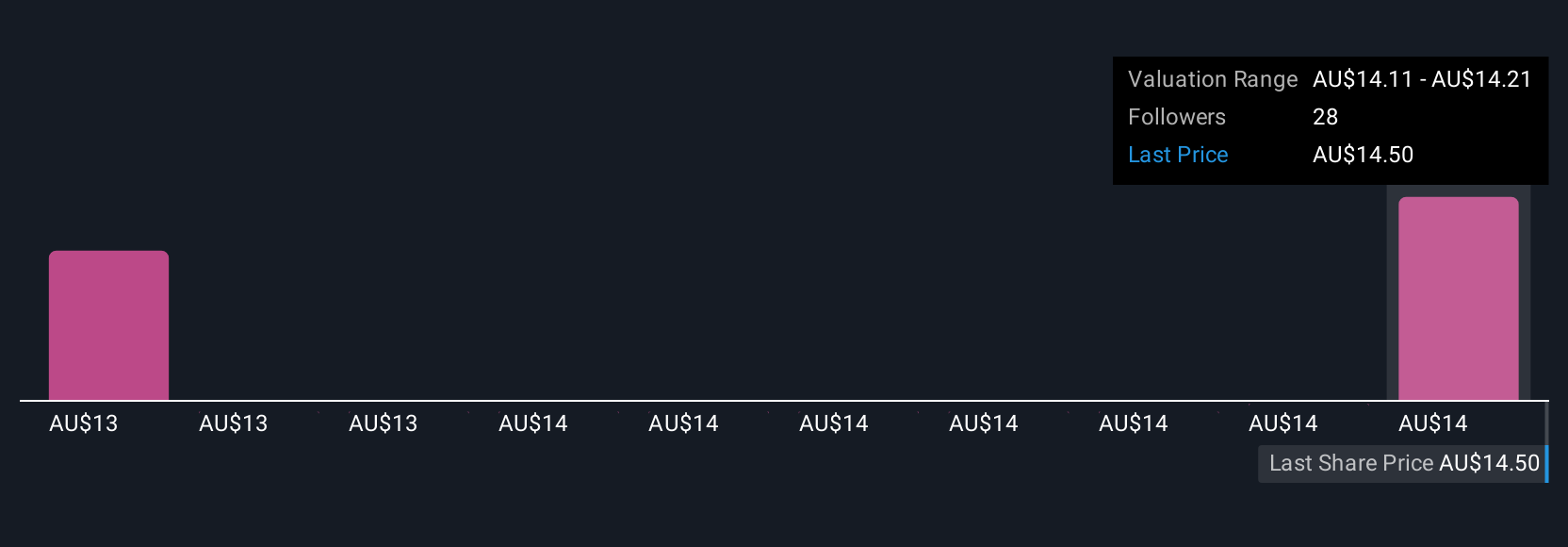

Uncover how Transurban Group's forecasts yield a A$14.21 fair value, in line with its current price.

Exploring Other Perspectives

Three individual fair value estimates from the Simply Wall St Community range tightly from A$13.70 to A$14.21 per share. While recent traffic growth supports optimism, regulatory risks still play a central role in future outlook, readers can review these diverse opinions for deeper insight.

Explore 3 other fair value estimates on Transurban Group - why the stock might be worth as much as A$14.21!

Build Your Own Transurban Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Transurban Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Transurban Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Transurban Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Transurban Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TCL

Transurban Group

Engages in the development, operation, management, and maintenance of toll road networks in Australia and North America.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.