- Australia

- /

- Infrastructure

- /

- ASX:TCL

Here's Why We Think Transurban Group (ASX:TCL) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Transurban Group (ASX:TCL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Transurban Group

Transurban Group's Improving Profits

Over the last three years, Transurban Group has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. To the delight of shareholders, Transurban Group's EPS soared from AU$0.053 to AU$0.073, over the last year. That's a commendable gain of 38%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Transurban Group shareholders is that EBIT margins have grown from 22% to 26% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

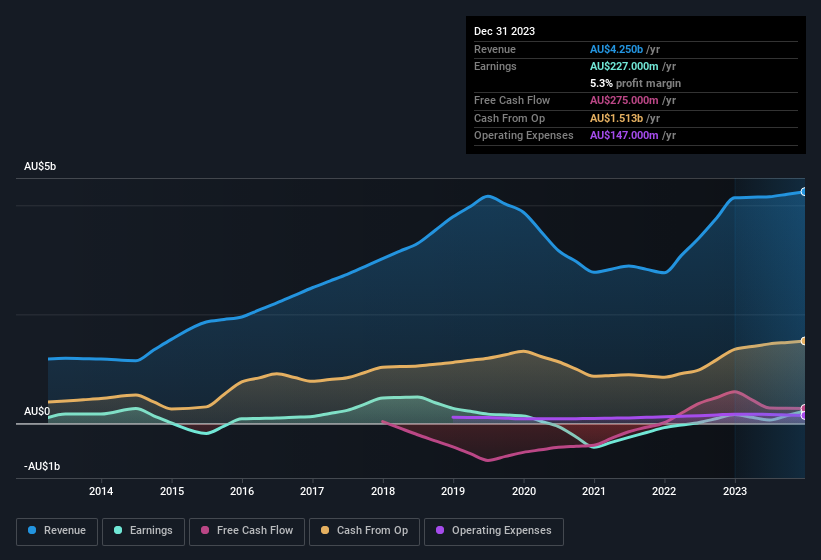

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Transurban Group?

Are Transurban Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Transurban Group insiders refrain from selling stock during the year, but they also spent AU$228k buying it. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by Independent Chairman Craig Drummond for AU$127k worth of shares, at about AU$12.70 per share.

The good news, alongside the insider buying, for Transurban Group bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold AU$24m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.06% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Transurban Group's CEO, Michelle Jablko, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Transurban Group, with market caps over AU$12b, is about AU$6.1m.

Transurban Group's CEO took home a total compensation package worth AU$3.1m in the year leading up to June 2023. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Transurban Group Deserve A Spot On Your Watchlist?

For growth investors, Transurban Group's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. These things considered, this is one stock worth watching. What about risks? Every company has them, and we've spotted 2 warning signs for Transurban Group you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Transurban Group, you'll probably love this curated collection of companies in AU that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Transurban Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TCL

Transurban Group

Engages in the development, operation, management, and maintenance of toll road networks in Australia and North America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives