It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like K&S (ASX:KSC). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for K&S

How Fast Is K&S Growing Its Earnings Per Share?

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's easy to see why many investors focus in on EPS growth. K&S boosted its trailing twelve month EPS from AU$0.19 to AU$0.22, in the last year. There's little doubt shareholders would be happy with that 14% gain.

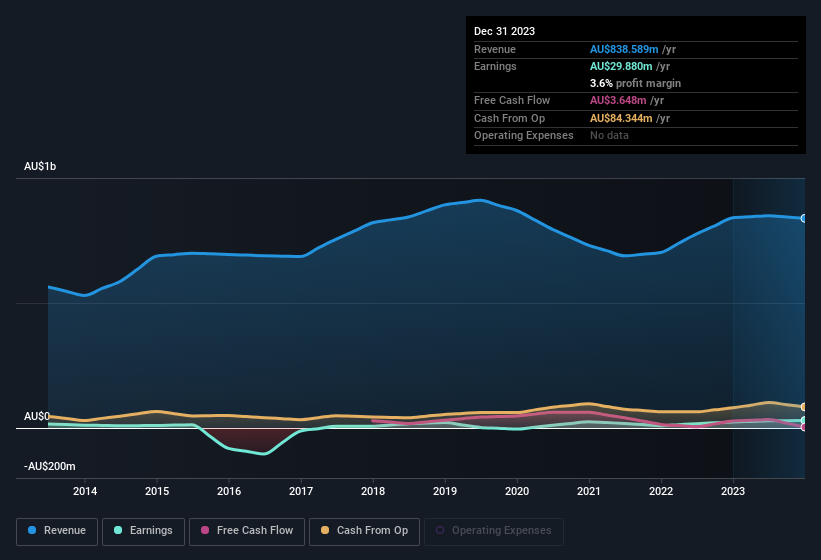

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. K&S reported flat revenue and EBIT margins over the last year. That's not a major concern but nor does it point to the long term growth we like to see.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since K&S is no giant, with a market capitalisation of AU$421m, you should definitely check its cash and debt before getting too excited about its prospects.

Are K&S Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's nice to see that there have been no reports of any insiders selling shares in K&S in the previous 12 months. With that in mind, it's heartening that Paul Sarant, the CEO, MD & Executive Director of the company, paid AU$25k for shares at around AU$2.40 each. It seems that at least one insider is prepared to show the market there is potential within K&S.

Is K&S Worth Keeping An Eye On?

As previously touched on, K&S is a growing business, which is encouraging. Not every business can grow its EPS, but K&S certainly can. The icing on the cake is that an insider bought shares during the year; a point of interest for people who will want to keep a watchful eye on this stock. Before you take the next step you should know about the 1 warning sign for K&S that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, K&S isn't the only one. You can see a a curated list of Australian companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if K&S might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:KSC

K&S

Engages in the transportation and logistics, warehousing, and fuel distribution businesses in Australia and New Zealand.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.