- Australia

- /

- Infrastructure

- /

- ASX:ALX

Three Things You Should Check Before Buying Atlas Arteria Limited (ASX:ALX) For Its Dividend

Could Atlas Arteria Limited (ASX:ALX) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

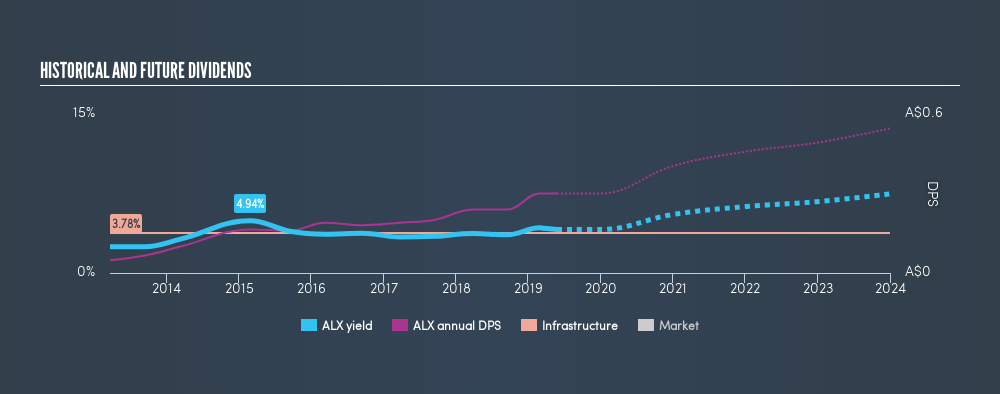

In this case, Atlas Arteria likely looks attractive to dividend investors, given its 4.1% dividend yield and six-year payment history. We'd agree the yield does look enticing. The company also bought back stock during the year, equivalent to approximately 1.5% of the company's market capitalisation at the time. Some simple analysis can reduce the risk of holding Atlas Arteria for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Atlas Arteria paid out 20% of its profit as dividends. With a low payout ratio, it looks like the dividend is comprehensively covered by earnings.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. With a cash payout ratio of 386%, Atlas Arteria's dividend payments are poorly covered by cash flow. Paying out more than 100% of your free cash flow in dividends is generally not a long-term, sustainable state of affairs, so we think shareholders should watch this metric closely. While Atlas Arteria's dividends were covered by the company's reported profits, free cash flow is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were Atlas Arteria to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Consider getting our latest analysis on Atlas Arteria's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Atlas Arteria has been paying a dividend for the past six years. Its dividend has not fluctuated much that time, which we like, but we're conscious that the company might not yet have a track record of maintaining dividends in all economic conditions. During the past six-year period, the first annual payment was AU$0.048 in 2013, compared to AU$0.30 last year. This works out to be a compound annual growth rate (CAGR) of approximately 36% a year over that time.

The dividend has been growing pretty quickly, which could be enough to get us interested even though the dividend history is relatively short. Further research may be warranted.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. Atlas Arteria has grown its earnings per share at 3.3% per annum over the past five years. So, we know earnings growth has been thin on the ground. On the plus side, the dividend payout ratio is low and dividends could grow faster than earnings, if the company decides to increase its payout ratio.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Atlas Arteria has a low payout ratio, which we like, although it paid out virtually all of its generated cash. Second, earnings growth has been ordinary, and its history of dividend payments is shorter than we'd like. In sum, we find it hard to get excited about Atlas Arteria from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 5 analysts we track are forecasting for Atlas Arteria for free with public analyst estimates for the company.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:ALX

Atlas Arteria

Owns, develops, and operates toll roads in France, Germany, and the United States.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives